Grayscale Dogecoin and XRP ETF Approval by NYSE

Grayscale Dogecoin and XRP ETF Approval at NYSE

The New York Stock Exchange (NYSE) has granted approval for the Grayscale Dogecoin and XRP Exchange-Traded Funds (ETFs) to begin trading. According to filings from NYSE Arca, both ETF products are scheduled to launch on Monday, following final approval issued on Friday. This marks a significant step in expanding access to cryptocurrency ETFs for investors in the United States.

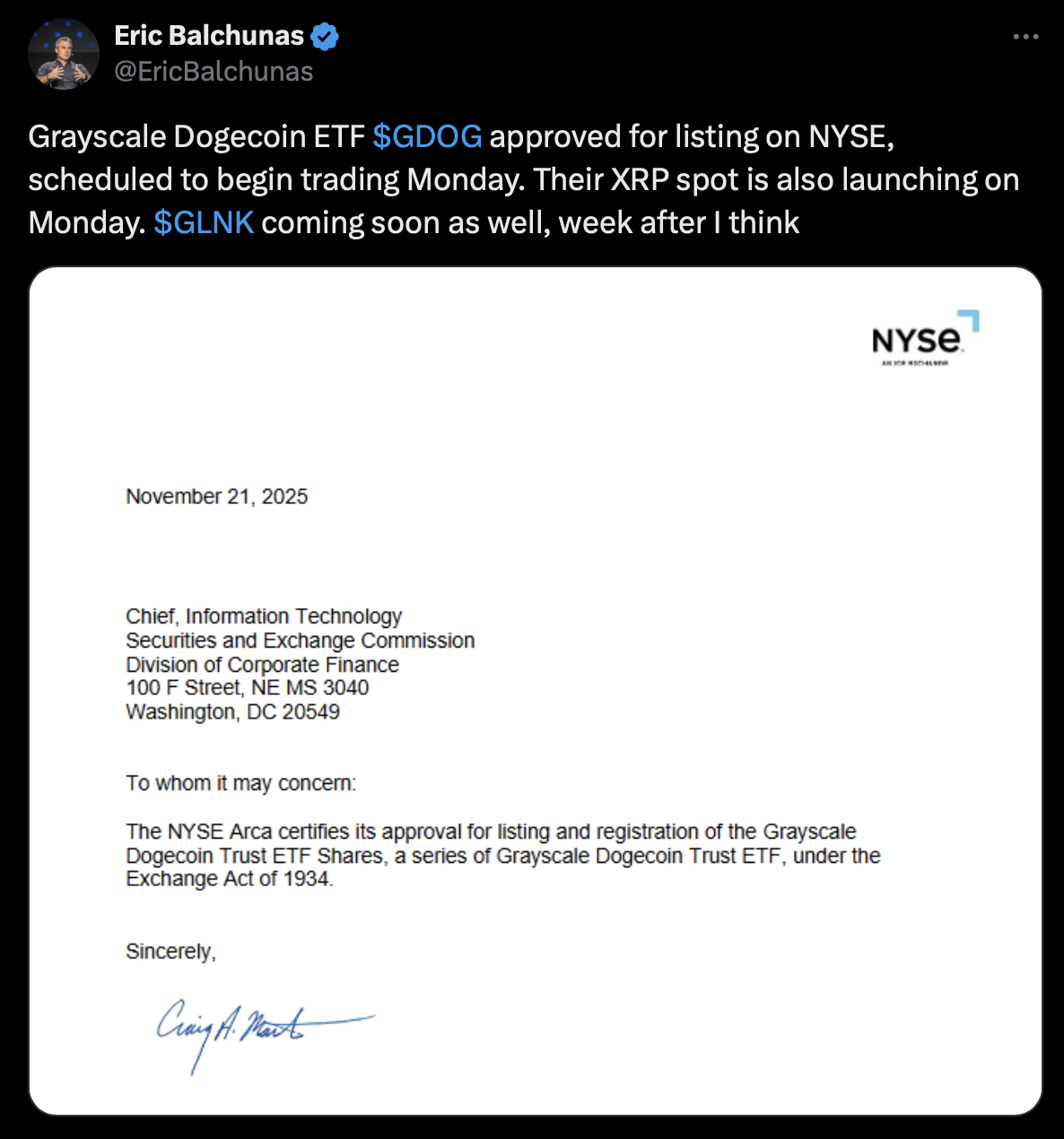

The Grayscale Dogecoin and XRP ETF approval follows increased interest and regulatory clarity for crypto-related products. According to Bloomberg ETF analyst Eric Balchunas, “Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday.” (Reporting via Cointelegraph)

Background: ETF Launches and Regulatory Developments

On Friday, NYSE Arca filed with the U.S. Securities and Exchange Commission to certify the listing and registration of the Grayscale XRP Trust ETF (GXRP) and the Grayscale Dogecoin Trust ETF (GDOG). The approval is the final requirement before public trading may begin. Grayscale’s Dogecoin ETF converts the firm’s existing DOGE trust into an ETF format, allowing investors to gain exposure to Dogecoin through traditional equity markets.

Grayscale’s XRP ETF is expected to begin trading alongside a competitive product from Franklin Templeton, while another XRP ETF from WisdomTree is pending launch. The market for XRP ETFs has grown rapidly, with several firms including Bitwise, 21Shares, and CoinShares introducing their own XRP-based products in recent weeks. The launches follow regulatory easing after the end of the US government shutdown and signals from the SEC allowing more crypto ETFs to come to market.

Market Reaction and Looking Forward

Analyst Eric Balchunas expects Grayscale’s DOGE ETF to attract approximately $11 million in trading volume on its first day. The entry of new ETFs adds to growing competition in the U.S. cryptocurrency ETF space. Recently, the first spot XRP ETF in the country, launched by Canary Capital (XRPC) on November 13, reported inflows of over $250 million on its debut day, indicating strong investor demand.

Despite new ETF launches, XRP’s price has dropped about 18% since the start of November, according to CoinGecko. This trend suggests that immediate ETF launches do not necessarily trigger price increases for the underlying asset. Meanwhile, a Chainlink (LINK) ETF from Grayscale is also expected to receive NYSE approval and commence trading next week, broadening the range of listed crypto ETFs.

Grayscale Dogecoin and XRP ETF approval by the NYSE marks a significant milestone for both securities and is likely to impact not only investor access but also competitive dynamics among asset managers offering crypto ETF products.

What’s Next for Crypto ETFs?

With Grayscale’s Dogecoin and XRP ETFs set to begin trading, the crypto ETF market in the U.S. continues to develop. More products, including a potential Grayscale Chainlink ETF, are anticipated to launch soon. This phase of regulatory approval is expected to lead to further innovations and investor options for digital asset exposure. Investors seeking to follow ETF developments and broader cryptocurrency news can visit the Vizi cryptocurrency section.

Sources

Reporting via Cointelegraph