ARK Invest Crypto Stock Purchases Surge in June 2024

Background: ARK Invest Steps Up Crypto Stock Accumulation

ARK Invest significantly boosted its crypto-related equity holdings during the first week of June 2024, making new investments across firms such as Bullish, BitMine, Circle, Robinhood, and several Bitcoin ETFs. The move comes as crypto stocks rebounded after recent declines. Reporting via Cointelegraph.

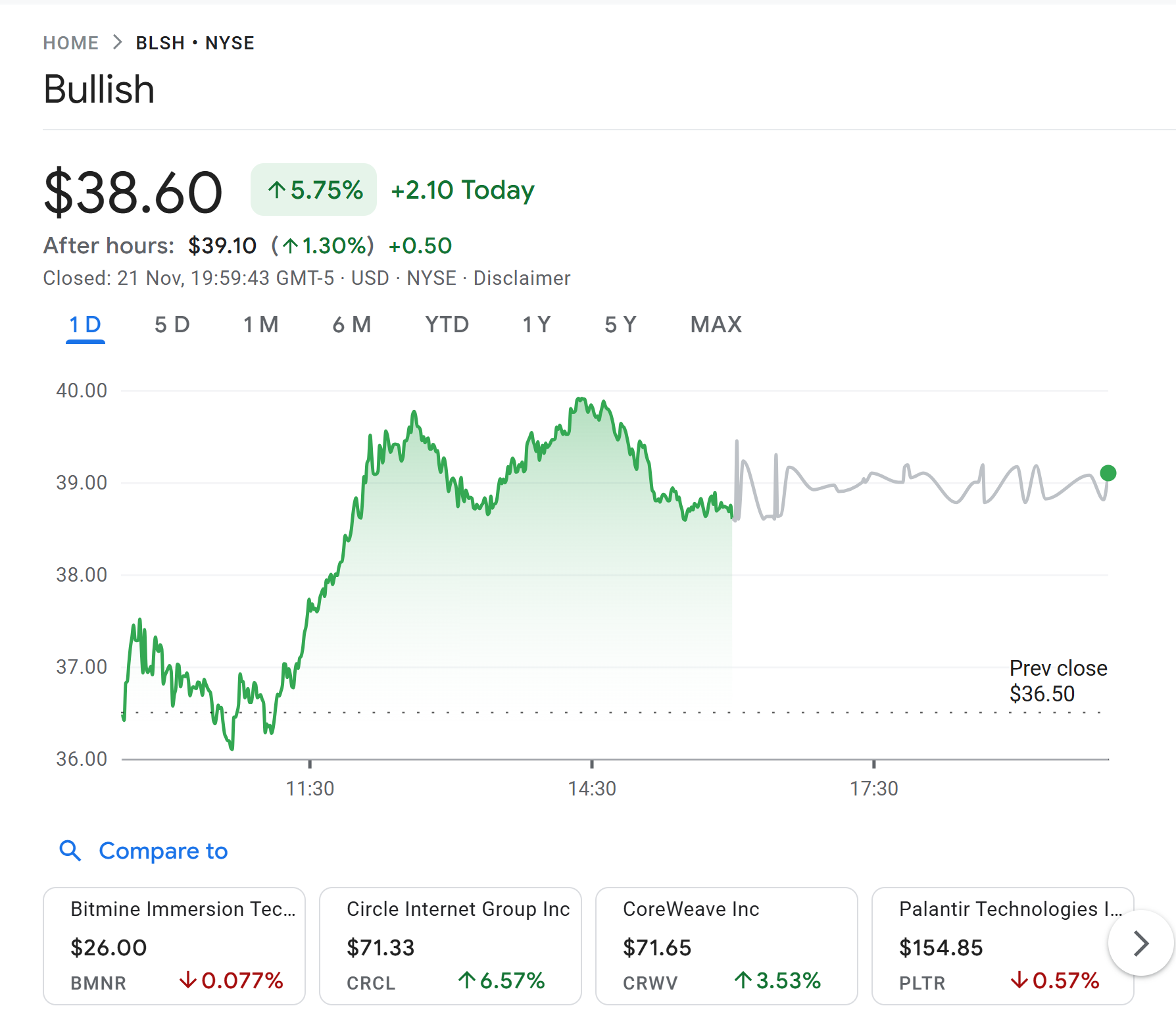

The firm’s flagship funds — ARK Innovation ETF (ARKK), ARK Fintech Innovation ETF (ARKF), and ARK Next Generation Internet ETF (ARKW) — led purchases of Bullish, totaling approximately $2 million. This action followed a 5.75% daily gain for Bullish shares on Friday.

Details of Latest Acquisitions

According to trade notifications released on Friday, ARK Invest picked up about $830,000 in BitMine shares across the ARKF, ARKK, and ARKW funds. BitMine, a bitcoin mining-related equity, traded near $26 at the time, slightly down on the day but holding steady within its recent range.

The investment firm also added new positions in Circle and Robinhood. ARK acquired 3,529 shares of Circle (valued at $250,000) as the stablecoin issuer’s stock increased by over 6%. Additionally, ARK invested about $200,000 in Robinhood shares.

On the same day, ARK increased its Bitcoin ETF exposure by nearly $600,000, focusing on the ARK 21Shares Bitcoin ETF (ARKB). The ARKF and ARKW funds contributed by acquiring more than 20,000 combined shares of the ETF.

Market Reaction and Broader Context

The purchases took place against the backdrop of substantial volatility in the US spot Bitcoin ETF market. The sector faced nearly $1 billion in net outflows on Thursday, marking the second-largest daily withdrawal since spot ETFs launched. Over the past month, total net outflows have accelerated, reaching around $4 billion, as Bitcoin’s price dropped roughly 30% from earlier highs.

Despite market headwinds, ARK Invest made several large daily acquisitions last week. On Thursday, the firm bought $10.1 million in Coinbase, $9.9 million in BitMine, $9 million in Circle, $9.65 million in Bullish, as well as $16.8 million in Nvidia and $6.8 million in Robinhood. The day before, additional purchases included $16.8 million in Bullish, approximately $15 million in Circle, and $7.6 million in BitMine through its flagship ETFs.

What’s Next for ARK Invest and Crypto Stocks?

ARK Invest’s active purchasing during a period of outflows and falling prices suggests a commitment to its long-term view on digital assets and related equities. The continued acquisitions in Bullish, BitMine, and Circle highlight confidence in the sector’s future potential, even amid short-term volatility.

As US spot Bitcoin ETFs experience their weakest week since February, how ARK’s strategy influences future market moves remains a subject of close industry scrutiny. The firm’s ongoing allocations may signal anticipated recovery or strategic positioning for future growth in cryptocurrency markets.

For further coverage of cryptocurrency stocks and investment trends, visit the Vizi cryptocurrency section.