Trump $2,000 Tariff Dividend: Impact on Cryptocurrency Markets

Background on the $2,000 Tariff Dividend

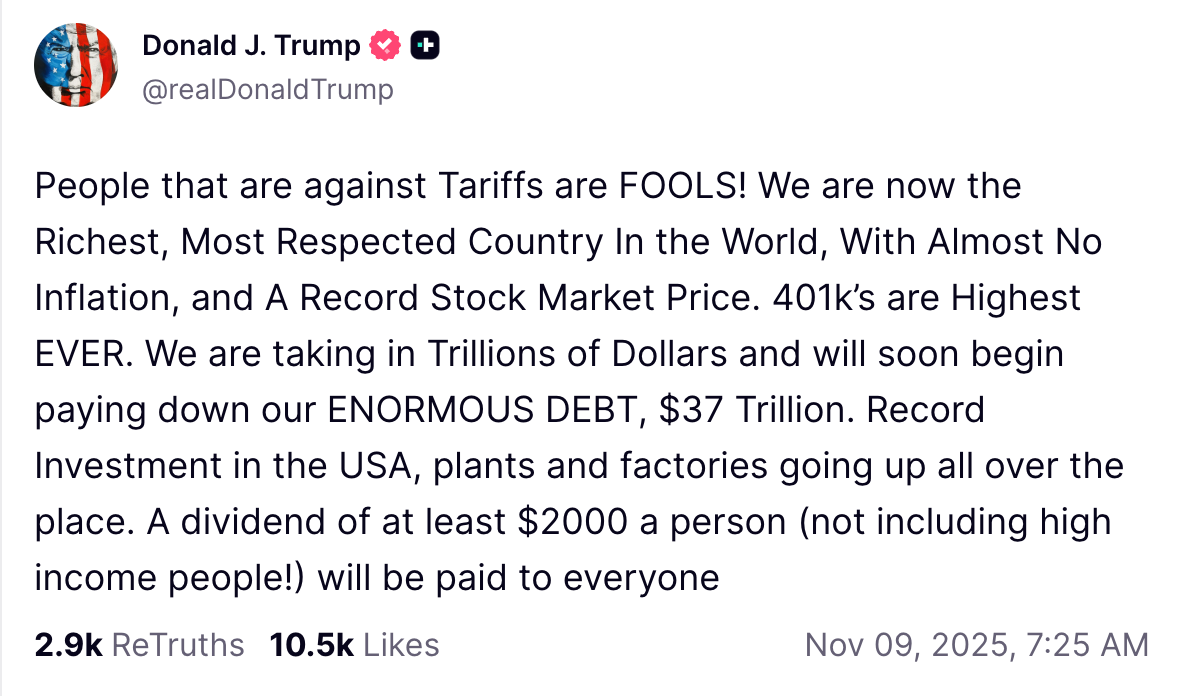

United States President Donald Trump announced on Truth Social that most Americans will receive a $2,000 tariff dividend, promising payments to “everyone” except high-income individuals. Trump stated the funds would come from tariff revenue as part of his ongoing efforts to implement wide-ranging tariff policies.

Trump emphasized, “A dividend of at least $2,000 a person, not including high-income people, will be paid to everyone,” according to his post. Reporting via Cointelegraph, these measures are intended to return tariff-generated revenue directly to U.S. citizens.

Meanwhile, the U.S. Supreme Court is reviewing the legality of the proposed tariffs, with oral arguments underway. Despite this, the likelihood of judicial approval remains low. As of the latest updates, prediction market platform Kalshi records odds of court approval at just 23%, while Polymarket traders set them at 21%.

Market Reaction: Cryptocurrency and Asset Prices

The announcement of the $2,000 tariff dividend spurred reactions across financial markets. Investors and analysts anticipate that the policy will act as an economic stimulus, benefiting both cryptocurrency and traditional asset prices. Some experts project that a significant portion of the stimulus could flow into the cryptocurrency market.

Investment analysts at The Kobeissi Letter estimated that approximately 85% of American adults would be eligible to receive the $2,000 stimulus checks. This figure is based on past distribution data from economic relief measures during the COVID-19 pandemic. According to The Kobeissi Letter, “While a portion of the stimulus will flow into markets and raise asset prices, the ultimate long-term effect… will be fiat currency inflation and the loss of purchasing power.”

Commenting on the announcement, Bitcoin author and analyst Simon Dixon warned, “If you don’t put the $2,000 in assets, it is going to be inflated away or just service some interest on debt and sent to banks.” Investor Anthony Pompliano added, “Stocks and Bitcoin only know to go higher in response to stimulus.” These remarks reflect widespread sentiment that the additional funds could drive cryptocurrency prices upward in the short term.

What’s Next: Legal & Economic Uncertainties

The Trump $2,000 tariff dividend remains contingent on the outcome of the Supreme Court case regarding the legality of his administration’s tariff initiatives. With market participants expressing skepticism about court approval, it is uncertain when or if the policy will take effect.

Should the stimulus proceed, experts forecast both a temporary market boost and potential long-term inflation risk. As investors monitor the Supreme Court’s decision, attention remains on how monetary stimulus might affect dollar stability, purchasing power, and cryptocurrency adoption.

For more analysis on how government stimulus packages impact cryptocurrency, visit our cryptocurrency news section.