Strategy STRE Shares: Company Raises €600M for Bitcoin

Background: Launch of STRE Shares to Expand Bitcoin Holdings

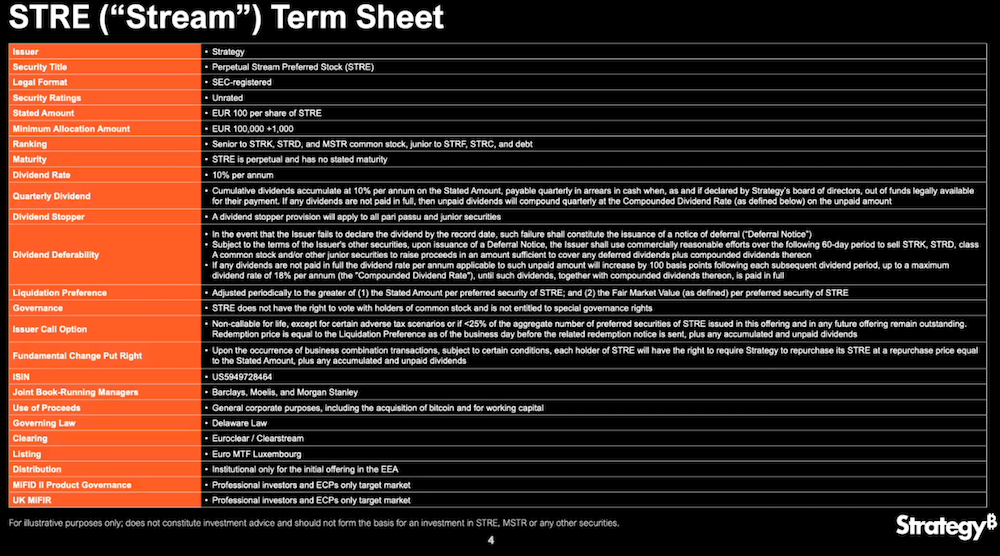

Crypto treasury company Strategy has announced the pricing of its new euro-denominated Series A Perpetual Stream Preferred Stock (STRE), with the primary objective of expanding its Bitcoin holdings. As of Friday, the STRE shares are set to debut at 80 euros (approximately $92.50) per share. This offering is expected to generate an estimated 608.8 million euros in net proceeds. The company confirmed that the capital will be used for additional Bitcoin (BTC) purchases and general corporate purposes. The settlement date for this stock issuance is scheduled for November 13, according to Cointelegraph.

Details of the STRE Offering and Credit Ratings

The newly introduced STRE shares will be senior to Strategy’s Perpetual Strike (STRK), Perpetual Stride (STRD), and common stock, but subordinate to both the company’s Perpetual Strife (STRF) and Variable Rate Perpetual Stretch (STRC) stocks, as well as any outstanding debt. Notably, this share offering will not be made available to retail investors in either the European Union or the United Kingdom, focusing instead on institutional investors.

The launch of the STRE shares follows a period of slowed acquisition activity in October, prompted by a general downturn in the sector and lower prices across the broader crypto market. Strategy reported revenue of $2.8 billion in Q3, a significant decrease compared to $10 billion the previous quarter. In the same period, the company’s stock price has experienced a downward trend since July.

Ratings agency S&P Global Ratings assigned Strategy a B- credit rating in October 2023, indicating “speculative characteristics” and designating the company as non-investment grade. S&P cautioned that the firm’s heavy concentration in Bitcoin holdings and narrow focus presented additional risks to investors.

Market Reaction and Future Outlook

Despite the concerns highlighted by the credit rating agency—particularly related to the risks of concentrating Treasury reserves in Bitcoin—some analysts believe that Strategy is not likely to liquidate BTC holdings during a future crypto bear market. Citing the company’s manageable debt maturities, on-chain analyst and investor Willy Woo stated, “The likelihood of a forced liquidation to meet debt obligations is low” (Cointelegraph).

The company’s approach to debt management and its ongoing commitment to Bitcoin as a reserve asset continue to draw market attention, especially in a period of increasing institutional participation in cryptocurrency markets. Industry observers are watching how the injection of new funds via the STRE shares will impact Strategy’s balance sheet and whether it can help reverse the recent decrease in revenue and stock price performance.

Further updates on Bitcoin investment strategies and corporate treasury movements can be found on our cryptocurrency news section.

What’s Next for Strategy and Bitcoin Holdings?

Strategy’s successful capital raise underscores its ongoing commitment to holding and potentially expanding its Bitcoin investments, despite broader market volatility and a speculative credit rating. As the STRE stock offering settles on November 13, institutional investors and stakeholders will monitor how these funds are deployed, as well as the company’s exposure and risk management regarding Bitcoin.

The broader market will also be watching for any additional commentary from S&P Global Ratings and industry analysts as Strategy persists in its focus on digital assets. The outcome of this funding round could influence similar moves by other crypto treasury companies planning to increase their cryptocurrency reserves.

Sources: