Background: Fidelity Adds Solana Trading to Its Platform

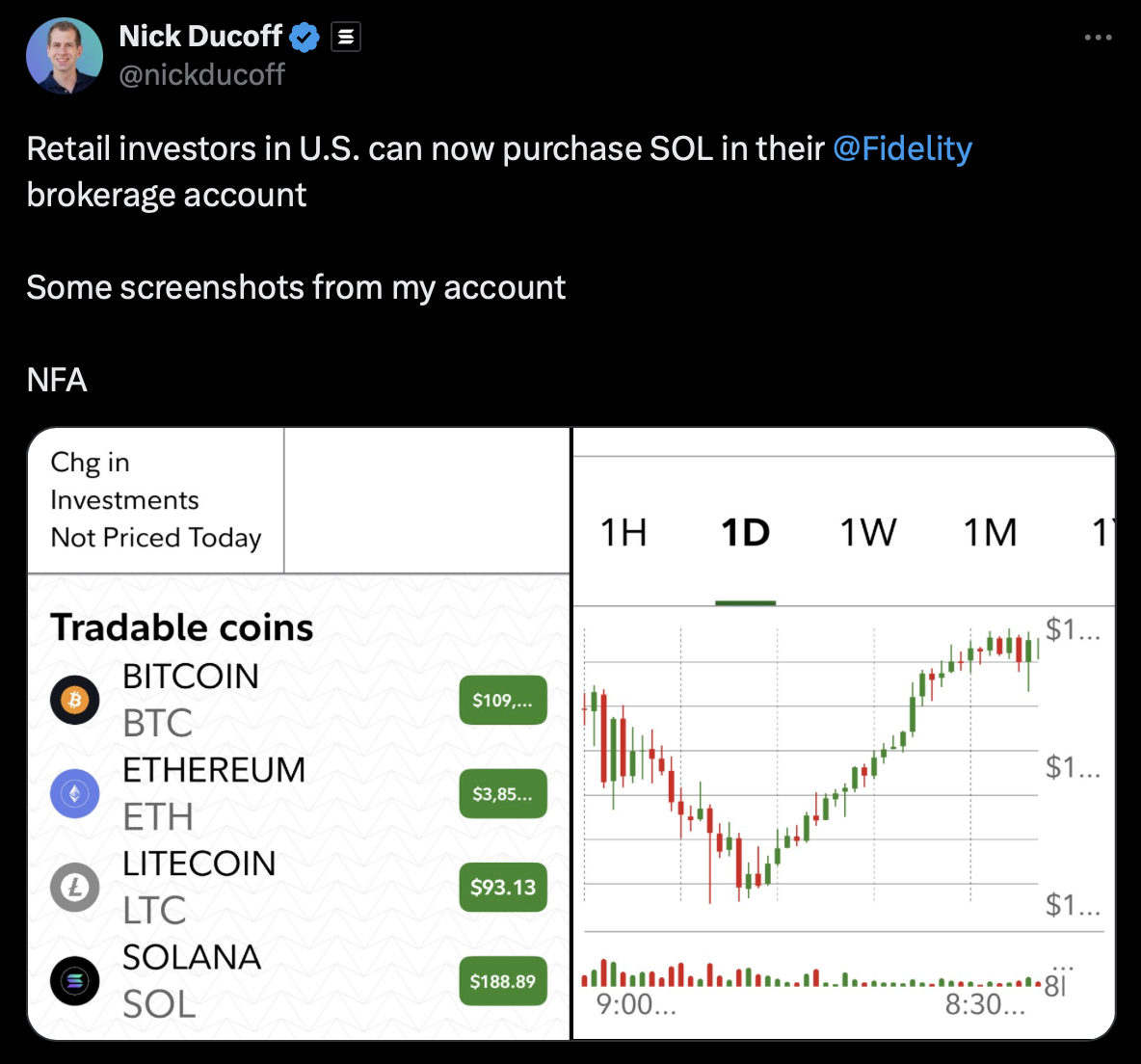

Fidelity Investments has expanded its cryptocurrency offerings by introducing Solana (SOL) trading to its crypto platforms. This move grants both institutional and retail clients access to buy, sell, and trade Solana via Fidelity Crypto, Fidelity Crypto for IRAs, Fidelity Crypto for Wealth Managers, and the Fidelity Digital Assets platform. A Fidelity spokesperson confirmed this update to Cointelegraph on Thursday, emphasizing that “the added support for SOL signals that cryptocurrencies are maturing as an asset class, further reducing the gap between legacy and digital finance,” as reported by Cointelegraph.

Solana’s Position and Potential Impact

The integration comes as Solana (SOL) holds a market capitalization exceeding $104 billion, ranking it as the sixth-largest cryptocurrency globally according to CoinMarketCap. Key Solana developers have stated their ambition to turn the network into a hub for tokenized real-world assets (RWAs), including stocks, money market funds, stablecoins, and collectibles. They argue that making such tokenized assets accessible on the blockchain may democratize finance and “unlock liquidity trapped in traditionally illiquid asset classes.” Crosschain versions of Tether’s USDt (USDT) and Tether Gold (XAUT) launched on Solana in October, enhancing the network’s potential as a cross-chain stablecoin liquidity center.

These recent advancements could position Solana as a crucial piece of decentralized finance (DeFi) infrastructure. By enabling access to greater stablecoin liquidity, Solana aims to reduce risks like volatility, depegging, and slippage in trading.

Market Reaction and Regulatory Developments

Experts in the Solana community view Fidelity’s addition of Solana trading as further validation of both the blockchain’s growth and the expanding role of cryptocurrencies in mainstream finance. The move also comes on the heels of regulatory discussions in the United States surrounding potential reforms in trading hours. In September, representatives from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) noted that “further expanding trading hours could better align US markets with the evolving reality of a global, always-on economy.”

Meanwhile, the recent approval of the first spot Solana ETF in Hong Kong illustrates the growing international embrace of Solana as a legitimate asset in crypto markets. Both individual and institutional clients now have more avenues to interact with Solana, reinforcing its relevance within evolving financial infrastructures.

What’s Next for Solana and Fidelity

With Fidelity adding Solana trading across multiple platforms, the company is seen as strengthening the connection between traditional finance and the expanding crypto sector. The availability of tokenized real-world assets on Solana and the active development of interoperable assets are expected to further drive adoption and innovation. Market analysts and stakeholders will be observing potential shifts in liquidity, trading volumes, and the wider impacts on DeFi ecosystems as more highly regulated institutions like Fidelity incorporate leading crypto projects into their product suites.

For ongoing updates about cryptocurrencies, visit Vizi’s Cryptocurrency Section.

Sources

Reporting via Cointelegraph.