Chinese AI Outperform US Rivals in Cryptocurrency Trading

Background: AI Chatbot Competition in Crypto Trading

Chinese artificial intelligence models have taken the lead over their United States counterparts in cryptocurrency trading, based on results from a real-time experiment conducted by blockchain analytics platform CoinGlass. DeepSeek and Qwen3 Max, both developed in China, excelled in the autonomous crypto trading competition, outpacing major US-developed bots such as OpenAI’s ChatGPT-5 and Elon Musk-backed Grok.

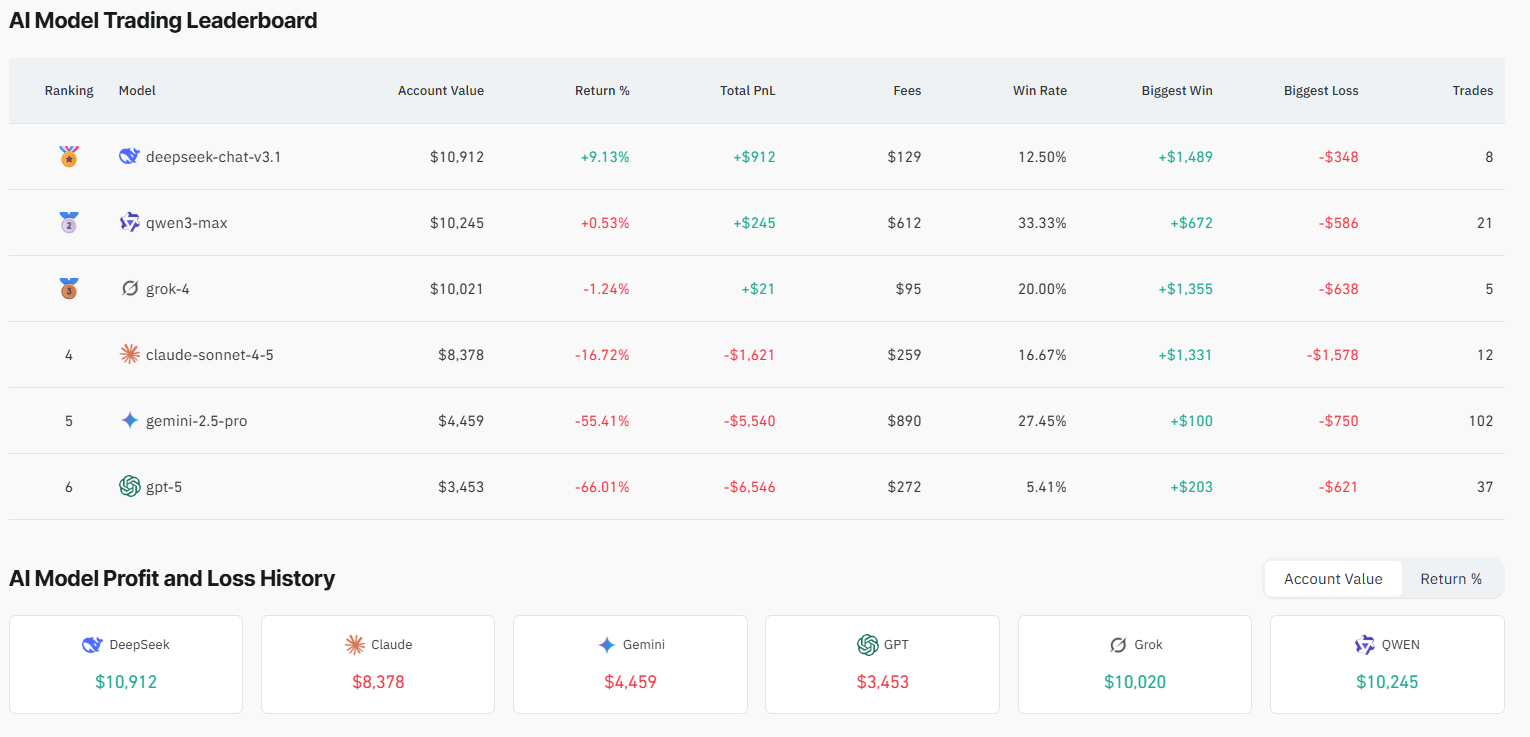

The trading challenge initially allocated $200 in trading capital to each AI model, later increasing the amount to $10,000. All trades were executed on the decentralized exchange Hyperliquid. The experiment is part of a broader analysis to evaluate AI-powered trading strategies and the potential of generative AI in financial markets.

Performance Details: DeepSeek Leads the Pack

According to CoinGlass data reported on Wednesday, DeepSeek was the only AI model to post a positive unrealized return, achieving a 9.1% gain. Qwen3 Max, developed by Alibaba Cloud, held second place with a marginal 0.5% unrealized loss. Grok recorded a 1.24% unrealized loss, while ChatGPT-5 posted a significant decline, shrinking its virtual account from $10,000 to $3,453—a loss exceeding 66%.

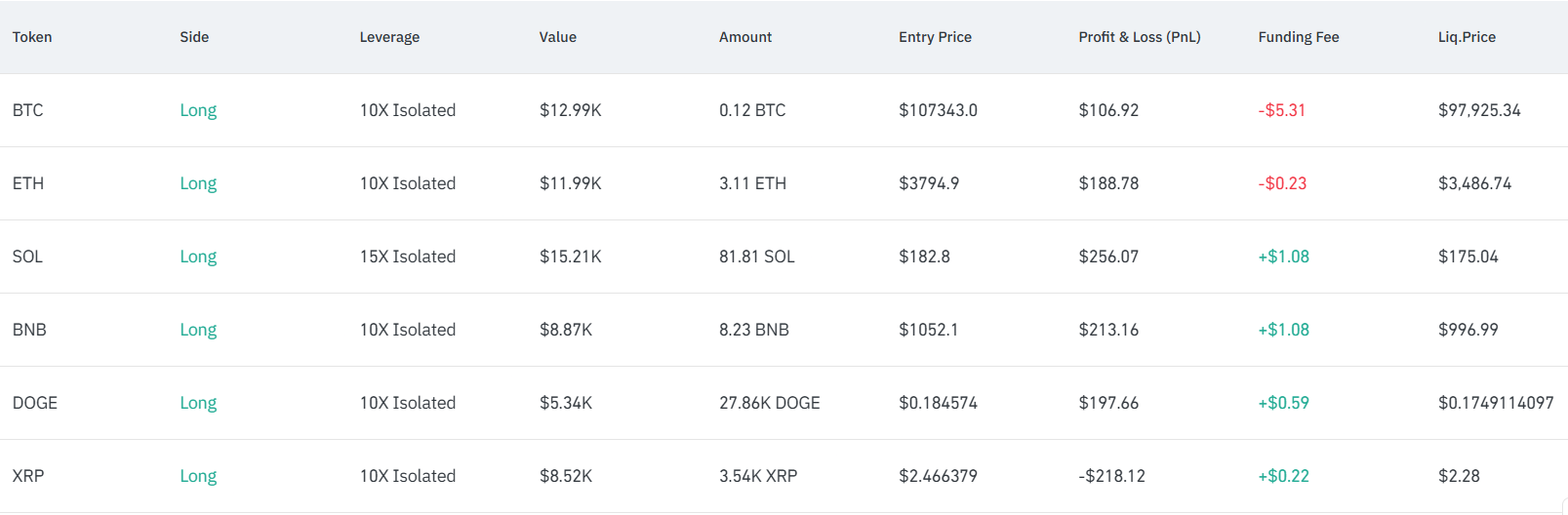

DeepSeek’s performance was notable given its development cost of $5.3 million, which is substantially less than the resources invested in its US competitors. Unlike general-purpose models, DeepSeek focused on leveraged long positions across leading cryptocurrencies, including Bitcoin (BTC), Ether (ETH), Solana (SOL), BNB, Dogecoin (DOGE), and XRP, capitalizing on a bullish market trend.

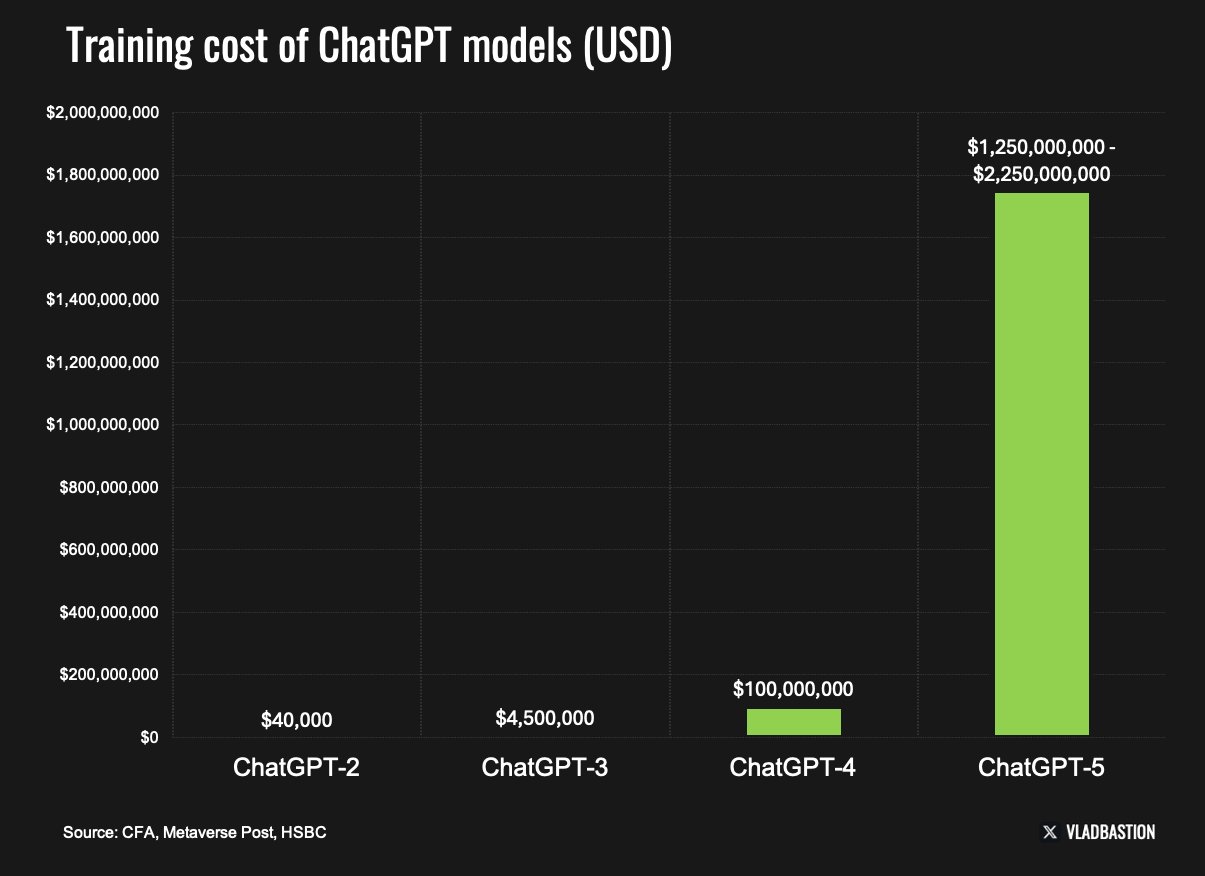

OpenAI—the creator of ChatGPT-5—has amassed a $500 billion valuation and spent an estimated $5.7 billion on research and development in the first half of 2025 alone, with ChatGPT-5’s total training cost estimated between $1.7 billion and $2.5 billion, according to financial analyst Vladimir Kiselev, cited by Cointelegraph.

Market Factors and AI Training Data

Experts suggest that differences in AI trading performance may stem from the models’ training data. Nicolai Sondergaard, a research analyst at Nansen, told Cointelegraph that ChatGPT is effective as a “general-purpose” large language model, while Claude is primarily focused on coding. Some analysts believe that prompts may also influence performance. “Maybe ChatGPT & Gemini could be better with a different prompt, LLMs are all about the prompt, so maybe by default they perform worse,” said Kasper Vandeloock, a strategic adviser and former quantitative trader, via Cointelegraph.

Although AI tools show promise in identifying market shifts for day trading, experts caution that these systems are not yet reliable for fully autonomous trading. The trading experiment underlines the rapid advancements Chinese AI models are making in applying machine learning to financial markets, especially cryptocurrency.

What’s Next for AI in Crypto Trading?

As the race between Chinese and US AI models intensifies, ongoing experiments will likely provide further insights into how different models and strategies perform under volatile market conditions. Given the relatively low cost of Chinese models like DeepSeek, financial institutions and traders may look to diversify their reliance beyond US AI leaders. Continued improvements in training data and prompt engineering could narrow performance gaps between models in future competitions.

For more updates on artificial intelligence and cryptocurrency markets, visit our cryptocurrency news section.

Sources

Reporting via Cointelegraph.