Gold $2.5 Trillion Sell-Off Surpasses Bitcoin’s Value

Background: Historic Correction Rocks Gold Market

Gold, traditionally seen as a reliable store of value, experienced a steep decline as it suffered a $2.5 trillion sell-off within just 24 hours this week. According to a report from Cointelegraph, citing data from The Kobeissi Letter, the gold market’s value tumbled on Tuesday and Wednesday, marking its largest two-day correction since 2013.

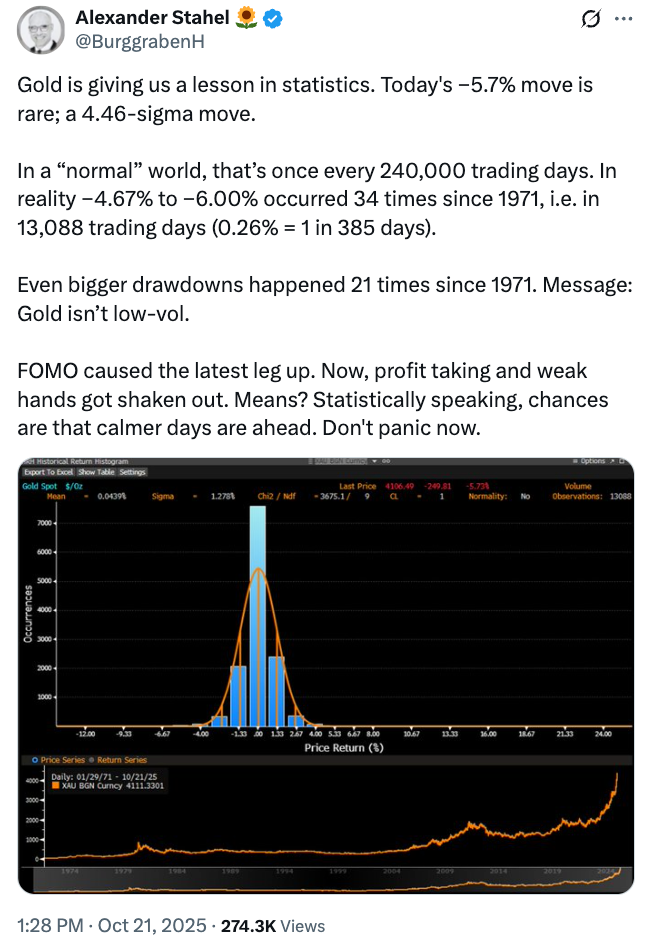

This 8% drop came after a notable 60% surge in gold’s price earlier in 2022. The scale of the sharp downturn is considered highly unusual, with Swiss investor Alexander Stahel noting in a post on X that such a correction should occur “once every 240,000 trading days.”

Stahel added: “Gold is giving us a lesson in statistics,” referencing the asset class’s historical volatility since 1971, with such corrections counted 21 times to date.

Market Impact and Comparisons to Bitcoin

The gold $2.5 trillion sell-off surpasses the entire market capitalization of Bitcoin, which is valued at about $2.2 trillion. Veteran trader Peter Brandt highlighted the size of the drop, noting that “this decline in gold today is equal to 55% of the value of every cryptocurrency in existence” (Cointelegraph).

Despite gold’s reputation for stability, this event signals that even traditional safe-haven assets are susceptible to severe market corrections. For comparison, Bitcoin—a digital asset often referred to as “digital gold”—fell 5.2% from its intraday high of $114,000 but registered a daily loss of just 0.8% at the time, per Coinbase data.

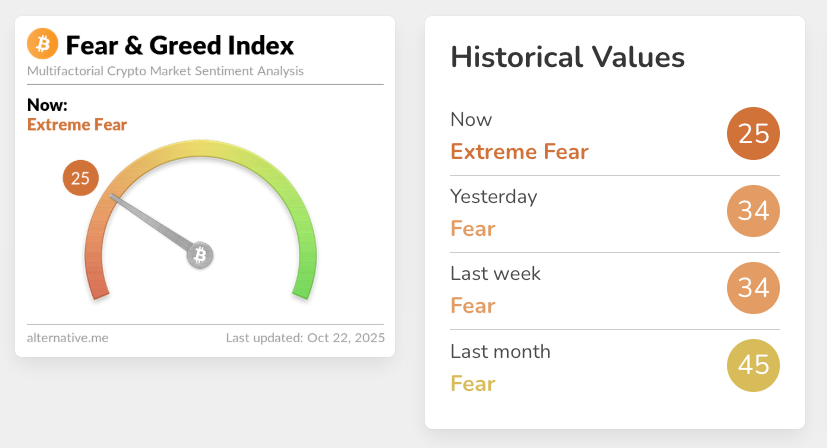

While Bitcoin spot exchange-traded funds (ETFs) attracted $142 million in inflows on the day, the broader cryptocurrency market entered a phase of “Extreme Fear.” The Crypto Fear & Greed Index dropped to levels previously seen in December 2022.

Causes of the Gold Downturn and Future Outlook

Analysts suggested multiple factors behind the gold $2.5 trillion sell-off. Stahel observed that a wave of investor FOMO (fear of missing out) had driven a ‘gold frenzy’ in recent months, leading to increased exposure in gold equities, physical holdings, and tokenized gold products. As the price corrected, profit-taking and panic-selling contributed to the rapid downturn.

According to Stahel, “FOMO caused the latest leg up. Now, profit taking and weak hands got shaken out.” He suggests that there is statistical precedent for calmer days ahead, based on the market’s historical corrections.

The gold sell-off follows recent observations from Deutsche Bank strategist Marion Laboure, who noted increasing parallels between gold and Bitcoin as hedges against inflation and market volatility. Deutsche Bank also pointed out that while gold reached new nominal highs this year, it only recently surpassed its inflation-adjusted all-time highs set in early October.

What’s Next for Gold and Digital Assets?

The record-setting gold $2.5 trillion sell-off has sparked new debate about the resilience of traditional safe-haven assets. Market analysts will be watching closely to see if the correction marks a turning point for gold, or if investor confidence will return after the rapid shakeout. Meanwhile, the cryptocurrency sector, including Bitcoin, continues to play a growing role in the conversation about stores of value.

For more updates on digital assets and market trends, visit our cryptocurrency news section.