Bitcoin ETF Outflows Amid US Turmoil Continue For Fourth Day

Ongoing Withdrawals From Spot Bitcoin and Ethereum ETFs

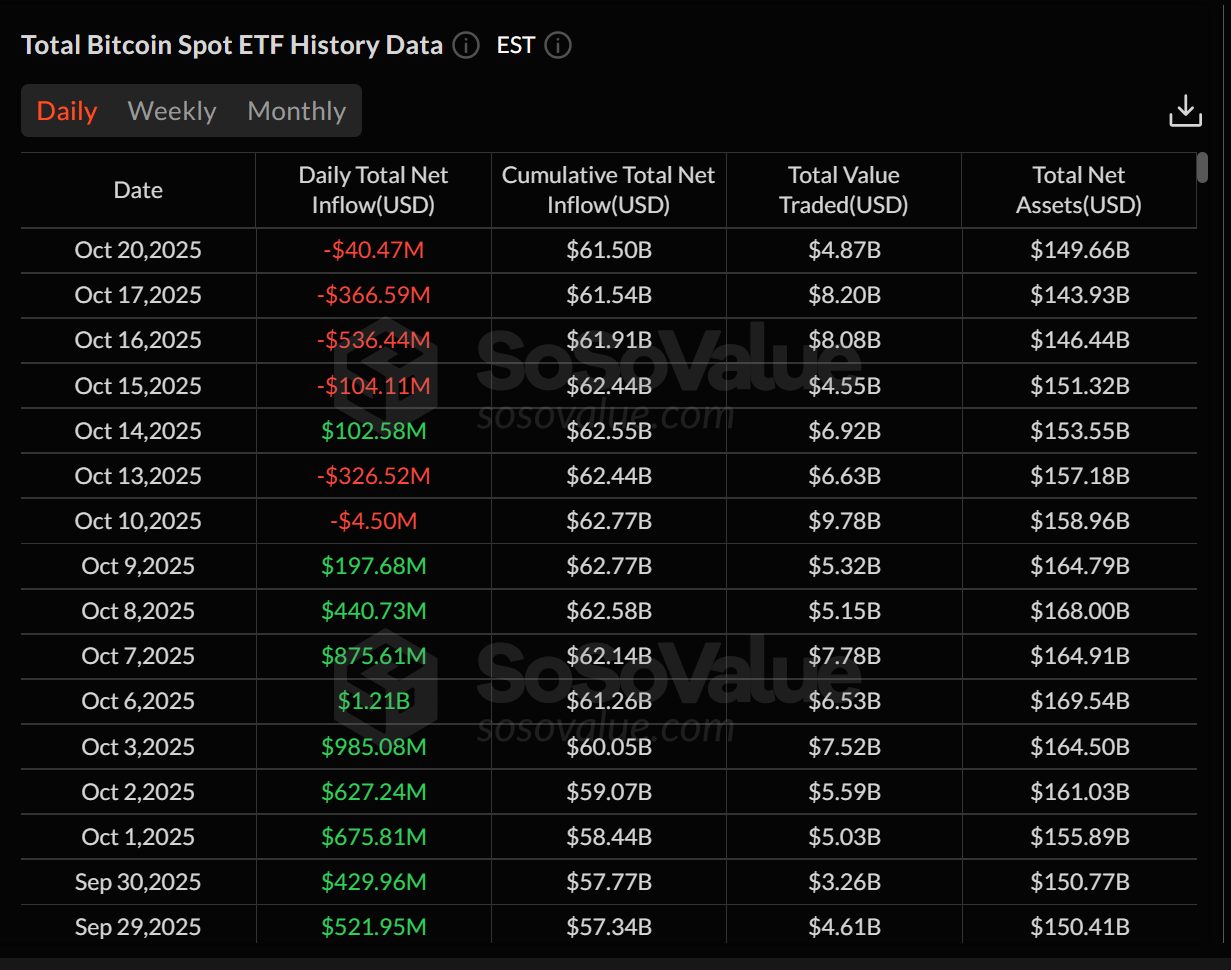

Spot Bitcoin ETF outflows continued Monday, marking the fourth consecutive session of withdrawals among US-listed funds as investor sentiment weakened. Data from SoSoValue shows Bitcoin ETF outflows reached $40.47 million on the day, with BlackRock’s IBIT leading the detractions at $100.65 million. In contrast, Fidelity’s FBTC and Bitwise’s BITB saw net inflows of $9.67 million and $12.05 million, respectively.

Overall, cumulative net inflows for spot Bitcoin ETFs have reached $61.50 billion. However, total net assets slipped to $149.66 billion, accounting for approximately 6.76% of Bitcoin’s overall market capitalization.

Spot Ethereum ETFs mirrored this pattern, registering daily net outflows of $145.68 million. This marked the third consecutive day of losses for these funds. BlackRock’s ETHA lost $117.86 million, while Fidelity’s FETH recorded $27.82 million in outflows.

Political Unrest and Economic Concerns Drive Investor Retreat

The extended series of ETF outflows follows intensified political turbulence in the US. According to Politico, nationwide protests labeled “No Kings” erupted as the government shutdown reached its 18th day. Demonstrations in cities including New York, Portland, and Los Angeles protested perceived threats to US democratic norms.

Bitunix analysts told Cointelegraph the current “political turmoil is not merely a clash between public sentiment and authority but a stress test of institutional confidence.” They warned the US government shutdown could “extend from liquidity to structural trust in the US system” if divisions persist. The performance of Bitcoin ETF outflows amid US turmoil may hinge on whether policymakers can “restore consensus amid deep division,” they added.

Vincent Liu, chief investment officer at Kronos Research, stated to Cointelegraph that the persistent outflows “reflect a broader de-risking phase. Investors are locking in profits and sidelining fresh capital; both ETFs are seeing reduced risk appetite and thinner bid depth across the board.” Liu further noted, “The erosion of trust in policy stability is pushing capital toward defensive plays.”

Market Response and Outlook

Amid ongoing Bitcoin ETF outflows amid US turmoil, investors are closely watching for signs of restored stability. Liu said market volatility is likely to remain elevated until a clearer policy direction emerges or US political tensions ease. “A more defined macro path or easing US political tension could restore confidence, reviving risk appetite and turning ETF flows back to positive,” he suggested.

As the situation develops, analysts are focusing on the interplay between political developments and investor flows in crypto ETFs. The broader market remains sensitive to the ongoing instability in the US, which continues to affect risk-taking and liquidity in digital assets.

For more insights on cryptocurrency markets, visit our cryptocurrency section.

Sources

Reporting via Cointelegraph, Politico