DefiLlama Aster Data Integrity Dispute: DEX Reinstated

Background on the DefiLlama and Aster Issue

Decentralized finance data aggregator DefiLlama has reinstated decentralized exchange (DEX) Aster to its analytics platform. This move comes weeks after Aster was quietly delisted due to inconsistencies in reported trading data, which raised questions about the platform’s data integrity. The issue first surfaced two weeks prior when DefiLlama detected anomalies in Aster’s onchain transaction metrics, sparking a broader debate within the DeFi community.

The delisting of Aster attracted attention from industry participants and users. Dragonfly managing partner Haseeb Qureshi highlighted the incident on social media, noting the lack of public announcements and pointing out “big gaps” in Aster’s historical data. In his post on X, Qureshi questioned the legitimacy of Aster’s reinstated numbers and sought clarification from DefiLlama’s founder, known online as 0xngmi.

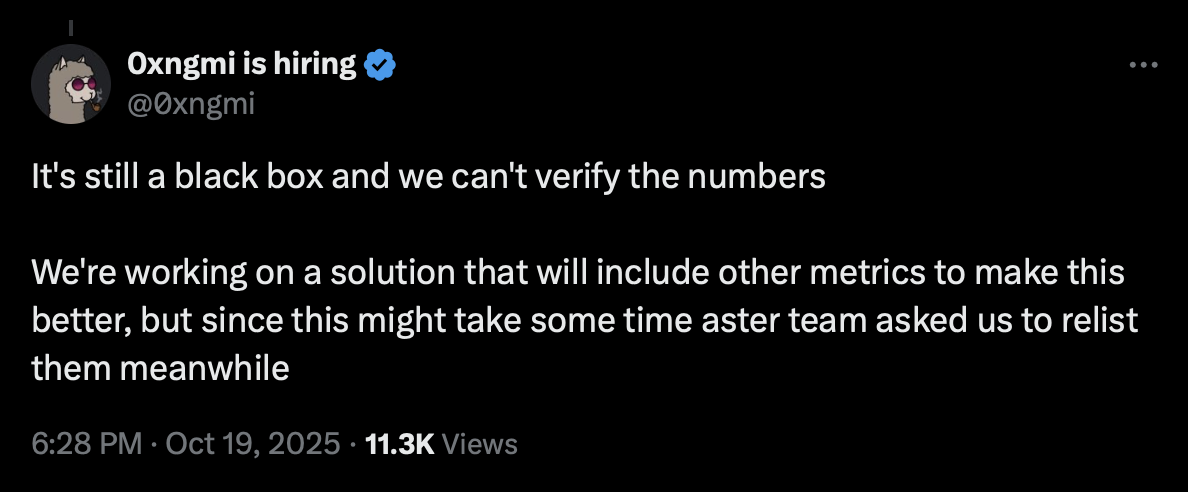

Ongoing Data Integrity Concerns

In response, DefiLlama’s founder 0xngmi acknowledged ongoing data verification issues. He described the situation as a “black box” and stated that, while they are developing a new analytic system to include additional metrics, the Aster team requested to be relisted on DefiLlama in the interim. “We’re working on a solution that will include other metrics to make this better, but since this might take some time aster team asked us to relist them meanwhile,” 0xngmi stated, reporting via Cointelegraph.

The underlying problem, according to a post from October 6, remains that Aster’s platform did not allow DefiLlama to distinguish between legitimate trades and potential wash trading. Without data indicating who is making and filling orders, separating valid trading activity from artificially inflated numbers remains a challenge. This led to fragmented historical data, resulting in incomplete leaderboard comparisons and unreliable cumulative metrics for market participants.

Market Impact and Industry Debate

The DefiLlama Aster data integrity incident intensified ongoing conversations about data provider centralization in decentralized markets. Some community members accused DefiLlama of acting in a centralized manner by unilaterally removing a project, while others questioned whether Aster’s apparent trading surge was authentic. The controversy underlined the risks and difficulties in ensuring data transparency and accuracy on public metrics platforms.

Despite the unresolved data integrity concerns, Aster now appears at the top of DefiLlama’s leaderboards for 24-hour and seven-day perpetual (perp) trading volumes, ahead of competitors like Hyperliquid and Lighter. However, because historical data gaps remain, longitudinal analyses, trader modeling, and historical comparisons are limited. For developers, researchers, and market participants relying on uninterrupted data, these gaps effectively reset Aster’s recorded market activity.

What’s Next for DefiLlama and Aster

The team behind DefiLlama is actively working on a new data system designed to address these verification challenges by incorporating more comprehensive metrics. Until this is implemented, Aster will remain listed, albeit with incomplete historical records. The situation highlights the evolving nature of DeFi analytics and the importance of robust data standards in an ecosystem where trust and transparency are crucial.

For further updates on decentralized exchanges, visit the Vizi cryptocurrency category.