Bitcoin ETF Outflows Top $1.2B as Schwab Sees Rising Interest

US Spot Bitcoin ETFs Record Major Outflows

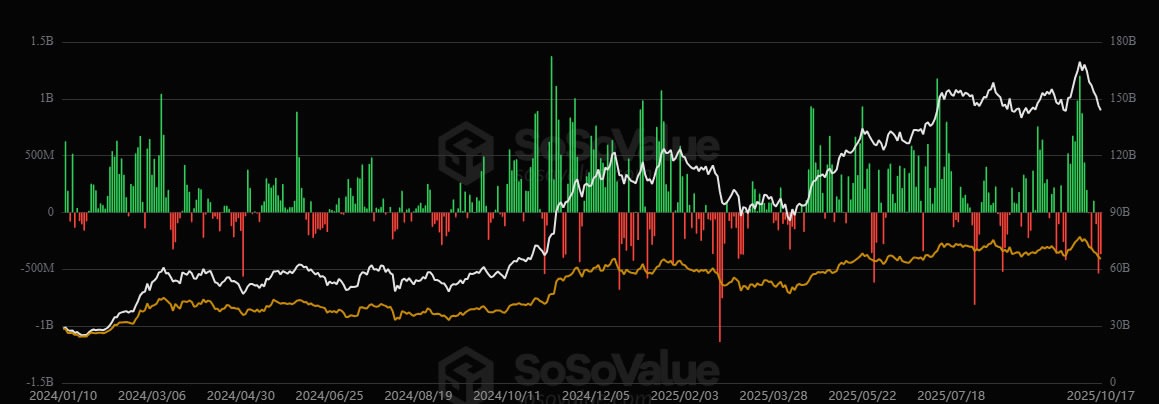

The United States spot Bitcoin ETF market saw substantial outflows this week, with investors pulling over $1.2 billion, according to recent market data. Friday alone witnessed $366.6 million in outflows, capping a challenging week for both the spot Bitcoin ETFs and related institutional products. Data from SoSoValue shows that BlackRock’s iShares Bitcoin Trust faced the largest single-day loss, with $268.6 million in investor withdrawals. Fidelity’s ETF followed with $67.2 million in outflows, and Grayscale’s GBTC shed $25 million. Other funds, such as Valkyrie, also registered minor outflows, while the remainder saw zero flows on the day. The total weekly outflow amounted to $1.22 billion, influenced by a significant Bitcoin price drop.

Market Turbulence Hits Bitcoin and ETFs Alike

The sharp decline in Bitcoin’s price contributed heavily to the ETF outflows. Early in the week, Bitcoin traded above $115,000 before falling to just below $104,000 by Friday, reaching a four-month low. This 6% monthly loss interrupted what had previously been ten positive Octobers in the last twelve years, as reported by CoinGlass. The crash caused investor sentiment to waver, resulting in only a single day of inflows during the week. Despite the downturn, analysts remain optimistic for a potential rebound later this month, especially if the Federal Reserve implements anticipated interest rate cuts.

Charles Schwab Reports Rising Client Engagement

Amid broader withdrawals, Charles Schwab has reported growing interest in crypto investment products among its clientele. Charles Schwab CEO Rick Wurster stated in a CNBC interview on Friday, “Clients have been very active in crypto ETPs,” and noted that visits to Schwab’s crypto platform have increased by 90% over the past year. Schwab clients currently hold about 20% of all crypto ETPs in the United States. The brokerage, which already offers crypto ETFs and Bitcoin futures, has announced plans to roll out spot crypto trading for clients in 2026. ETF analyst Nate Geraci highlighted Schwab’s significant presence, describing it as one of the nation’s largest brokerages.

What’s Next for Bitcoin ETFs?

Despite the sharp drop in Bitcoin ETF outflows, some market participants expect a rebound if broader economic conditions improve. October, often a historically strong month for Bitcoin, has underperformed so far this year. Industry observers are monitoring potential Federal Reserve interest rate decisions and upcoming product launches to assess any turnaround possibilities. Meanwhile, Charles Schwab’s positive outlook and increased client engagement suggest that traditional investment firms remain engaged with the evolving crypto investment landscape.

Related reading: Cryptocurrency insights at Vizi