US Treasury Surplus September 2025 Hits Record High

Largest-Ever September Surplus at the US Treasury

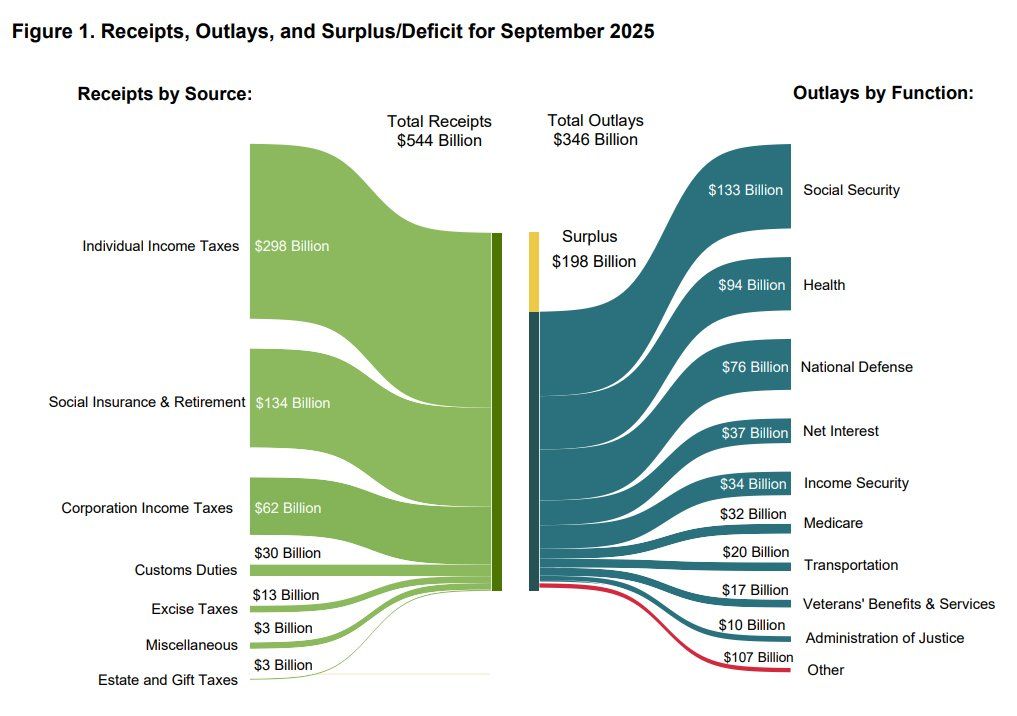

The United States Treasury posted a record-high surplus for September 2025, totaling $198 billion, according to Cryptonews.net. This figure marks the largest September surplus ever recorded and contributes significantly to a brighter fiscal outlook for the country. The US Treasury surplus for September 2025 has played a key role in reducing the annual federal budget deficit to $1.78 trillion, which is $41 billion—or 2.2%—lower than the previous year.

Factors Behind the Surplus: Tariffs and Tax Receipts

September often sees a government surplus due to quarterly tax payments. However, this year, additional revenue was generated by import duties—tariffs imposed by President Donald Trump in April 2025. These tariffs produced $30 billion in revenue during September alone, nearly half what had been forecast for the entire fiscal year. This increase in tariff income helped offset record-high annual interest payments on the national debt, which have now exceeded $1.2 trillion with net interest in September alone reaching $37 billion.

Other significant federal expenditures that month included Social Security at $133 billion, health-related spending at $94 billion, and national defense at $76 billion. The unexpectedly strong tariff revenues are seen as a driving factor behind the improved US Treasury surplus for September 2025, hinting at continued trade strategies in the months ahead.

Market Reactions and Policy Outlook

The increased reliance on tariffs, combined with ongoing fiscal challenges, has potential implications for financial markets. Previous increases in tariffs have been met with volatility, as seen during the so-called “tariff tantrum” in April 2025. Analysts note that continued trade tensions could prompt investors to shift away from riskier assets such as stocks and cryptocurrencies in favor of safer alternatives like bonds and gold.

Despite concerns that new tariffs could push inflation higher, the Federal Reserve has signaled that it views any impact as temporary. The central bank is expected to continue easing monetary policy, with benchmark interest rates currently set between 4.00% and 4.25%. According to the CME Fed Watch Tool, financial markets anticipate a total of 50 basis points worth of rate cuts by the end of 2025, which would lower the rate to a range of 3.50% to 3.75%.

What’s Next for US Fiscal Policy and Markets?

As the US Treasury surplus for September 2025 sets new records, market observers are watching closely to see how tariff strategies and monetary easing will impact risk assets such as bitcoin, stocks, and other cryptocurrencies (see more cryptocurrency news). Although lower interest rates generally boost risk sentiment, persistent trade tensions could limit market gains and drive further demand for safe-haven assets. The interplay of fiscal policy, tariff revenue, and monetary easing will remain in focus as investors react to changing conditions in both the US economy and global markets.

Sources

Reporting via Cryptonews.net