BlackRock iShares ETFs See Bitcoin-Driven Institutional Inflows

Record Inflows Power Strong Quarterly Results

BlackRock’s iShares exchange-traded funds (ETFs), including both traditional and crypto-related products, reported record-breaking net inflows of $205 billion in the third quarter of 2025, according to the company’s latest financial statement. This surge, led by growing institutional demand for digital assets, contributed to a 10% rise in organic base fee growth during the quarter and 8% over the past year. BlackRock Chairman and CEO Larry Fink credited the momentum to the firm’s readiness to embrace technology and digital assets, reinforcing BlackRock’s position as an industry leader.

Crypto-Related Funds Drive Asset Growth

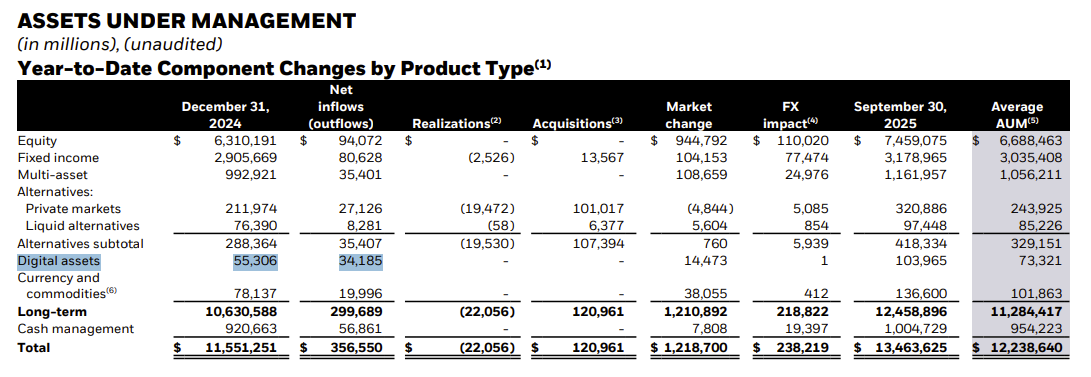

Digital asset ETFs have been central to BlackRock’s recent performance. These ETFs, including the flagship iShares Bitcoin Trust (IBIT), brought in $17 billion in net inflows during Q3 alone, with year-to-date net inflows reaching $34 billion. By September 2025, BlackRock managed nearly $104 billion in cryptocurrency assets, accounting for around 1% of its $13.46 trillion total assets under management (AUM). Both earnings and revenue for the period exceeded analyst forecasts, with AUM rising 17% from the previous year.

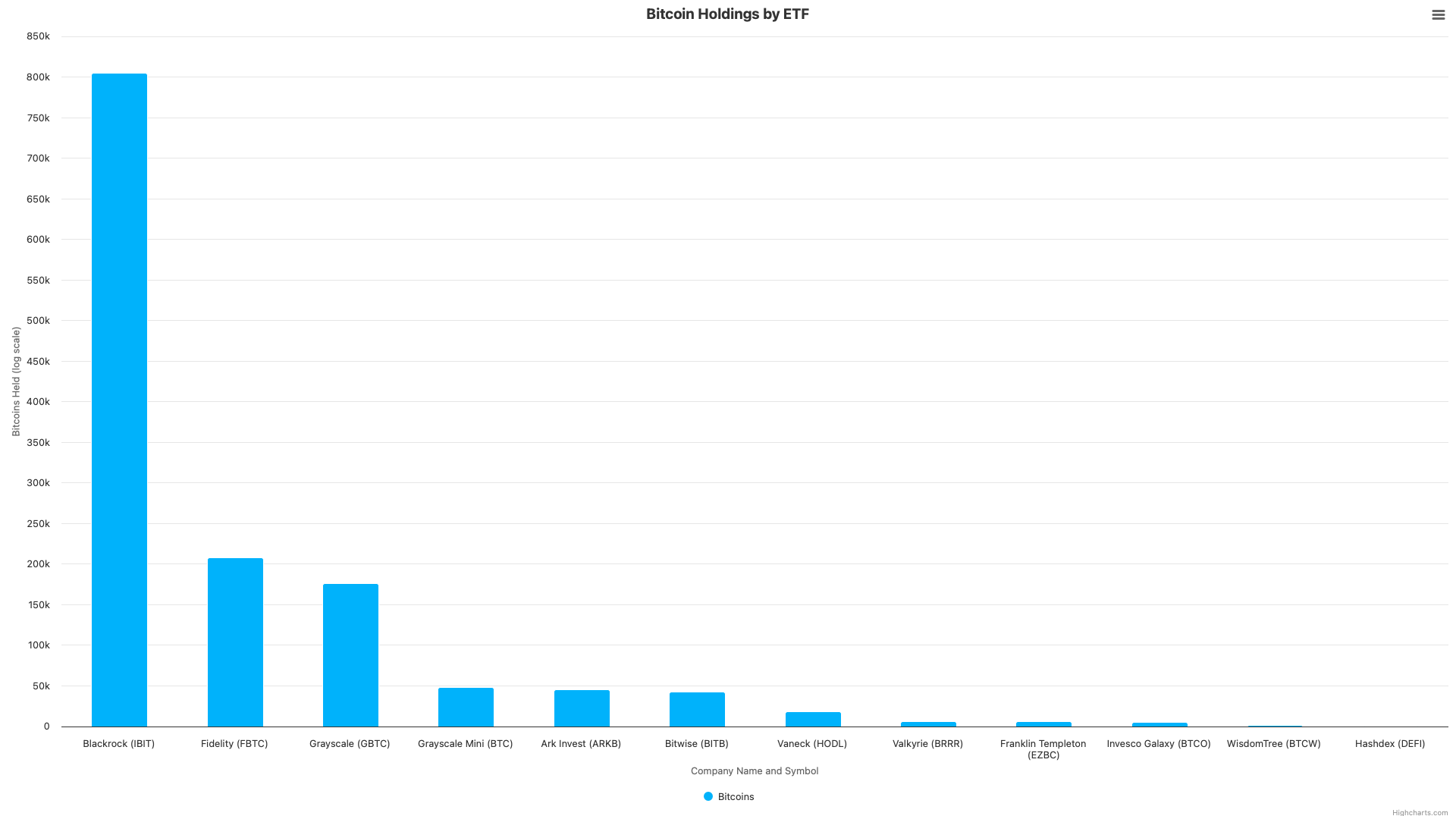

The iShares Bitcoin Trust (IBIT), introduced in early 2024 following U.S. SEC approval for spot Bitcoin ETFs, rapidly became BlackRock’s most successful ETF. By early October 2025, IBIT was approaching $100 billion in net assets and had generated $25 million more in fees than the company’s next best-performing fund. Industry data suggests IBIT holds more than 800,000 BTC, far outpacing other Bitcoin ETFs on the market.

BlackRock also launched the iShares Ethereum Trust (ETHA) later in 2024. After a slow start, ETHA gained momentum during 2025 and is now the third-fastest fund ever to reach $10 billion in assets.

Institutional Appetite for Digital Assets Grows

The robust inflows to BlackRock iShares ETFs, particularly those tied to digital assets, highlight rising institutional interest in the crypto sector. Institutions are increasingly turning to ETFs for exposure to Bitcoin and other cryptocurrencies, attracted by regulatory transparency, custodial safeguards, and straightforward accounting procedures. These features offer a solution for organizations seeking direct digital asset exposure while avoiding the complexities of traditional custody arrangements.

This institutional activity has contributed to Bitcoin’s extended rally since the start of 2024, with prices reaching a new all-time high above $126,000 in early 2025. Some analysts attribute part of this momentum to what is referred to as the “debasement trade,” as investors move assets away from the U.S. dollar amid rising fiscal deficits, inflation, and economic uncertainty. Cointelegraph reports that Bitcoin’s correlation with gold has intensified, positioning the cryptocurrency as both a store of value and an inflation hedge alongside traditional safe-haven assets.

What’s Next for BlackRock and Crypto ETFs?

BlackRock expects continued growth in its iShares ETF platform, with a focus on expanding offerings in emerging sectors like digital assets, technology, and data analytics. Ongoing institutional adoption and regulatory developments in the U.S. are likely to further fuel inflows to crypto-related ETFs.

For more developments on digital assets and ETFs, visit the Vizi Cryptocurrency category.

Sources

Reporting via Cointelegraph