US Government Shutdown Delays Crypto ETF Approvals

The ongoing US government shutdown has now entered its third week, directly impacting the approval process for as many as 16 exchange-traded funds (ETFs), including several in the crypto sector. With federal operations at a near standstill since October 1, critical agencies such as the Securities and Exchange Commission (SEC) are limited to conducting only essential duties, causing significant delays in pending ETF applications.

Background: How the Shutdown Affects Crypto ETFs

As the government shutdown stretches on, the SEC has been forced to put numerous ETF decisions on hold. The agency was expected to rule on at least 16 crypto ETF applications in October, but those deadlines have now lapsed with no action taken (Reporting via Cointelegraph). Additionally, 21 new ETF applications were filed in the first eight days of the month, further adding to the growing backlog.

The political deadlock between Republicans and Democrats over federal funding is at the center of the shutdown. Republicans have called for spending cuts to address the national debt, which now stands at $37.8 trillion—about $111,000 per person in the US—while seeking more resources for border enforcement. Democrats, meanwhile, resist cuts to healthcare and are pressing for extensions to expiring tax credits affecting health insurance affordability.

Current Status of ETF Approvals and Legislative Stalemate

With no immediate path toward resolution, both chambers of Congress have paused legislative activity, leaving agencies like the SEC with minimal staff. The Senate is not set for votes until Tuesday, and the House remains out of session, making it unlikely the shutdown will end in the immediate term. To reopen the government, Congress must pass a series of 12 annual funding bills or another temporary spending measure.

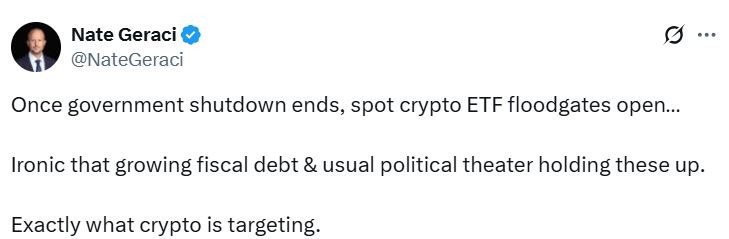

ETFs, particularly crypto ETFs, remain in limbo. According to Nate Geraci, president of NovaDius Wealth Management, “Once government shutdown ends, spot crypto ETF floodgates open,” indicating that multiple approvals could follow as soon as a deal is reached (Cointelegraph).

This situation has drawn attention within the crypto market, as ETF launches are seen as gateways for broader investor participation. Bitfinex analysts previously suggested that mass ETF approvals could initiate an altcoin season, offering diversified exposure with lower risk.

Market Reaction and What’s Next for Crypto ETF Approvals

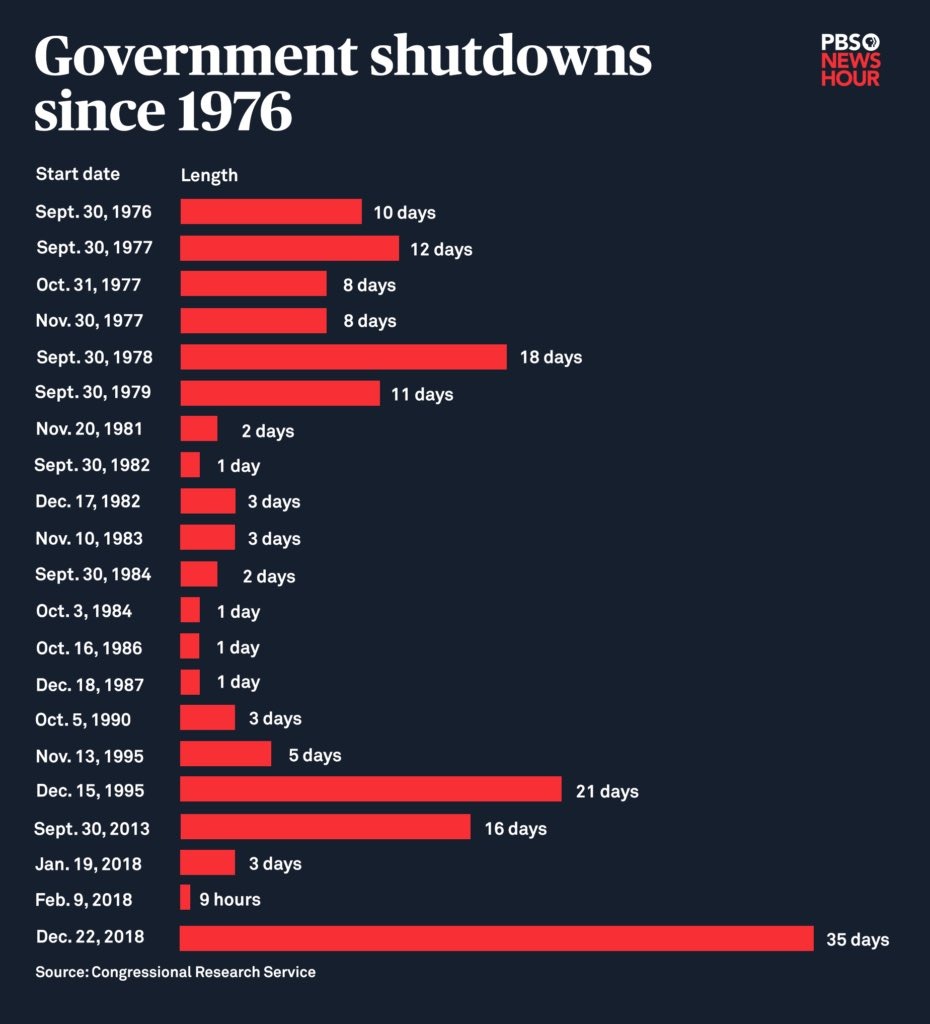

The SEC is responsible for evaluating and approving ETF applications, but is unable to proceed with reviews or approvals until normal government operations resume. The previous federal government shutdown, from December 2018 to January 2019, lasted 35 days—the longest on record—raising concerns that crypto ETF approvals could be delayed for weeks if the current impasse continues.

The political standoff underscores a crucial issue for the financial markets, especially the cryptocurrency industry. As political negotiation continues, the fate of crypto ETFs remains uncertain. Investors and analysts alike are closely watching congressional developments for signs that a resolution might soon allow the SEC to address the ETF backlog.

For broader discussions on crypto regulation during government shutdowns, see more on cryptocurrency regulation.

Conclusion

The US government shutdown has effectively paused the SEC’s review of crypto ETF applications, impacting potential market expansion and investor opportunities. The resolution depends on bipartisan agreement in Congress, making the timeline for regulatory clarity and crypto ETF approvals uncertain.

Sources: Cointelegraph