BNB All-Time High: Network Growth Drives Surge

Background: BNB Surges Past $1,300, Marking New Milestone

BNB recently reached an all-time high above $1,300, signaling a significant moment in its market history. According to David Namdar, CEO of Nasdaq-listed CEA Industries, this upward movement is not an isolated event but a reflection of the BNB network’s long-term credibility and growth. In an interview with Cointelegraph, Namdar described BNB as “the most overlooked blue-chip in the market.” He attributed the recent rise to years of underappreciated fundamentals finding fresh recognition within the broader cryptocurrency ecosystem.

Namdar highlighted BNB’s growing throughput, its surge in active users, and consistent traction in decentralized finance (DeFi) and blockchain gaming as indicators of the network’s strong foundation and practical utility.

Market Reaction: Activity and Ecosystem Expansion Fuel Gains

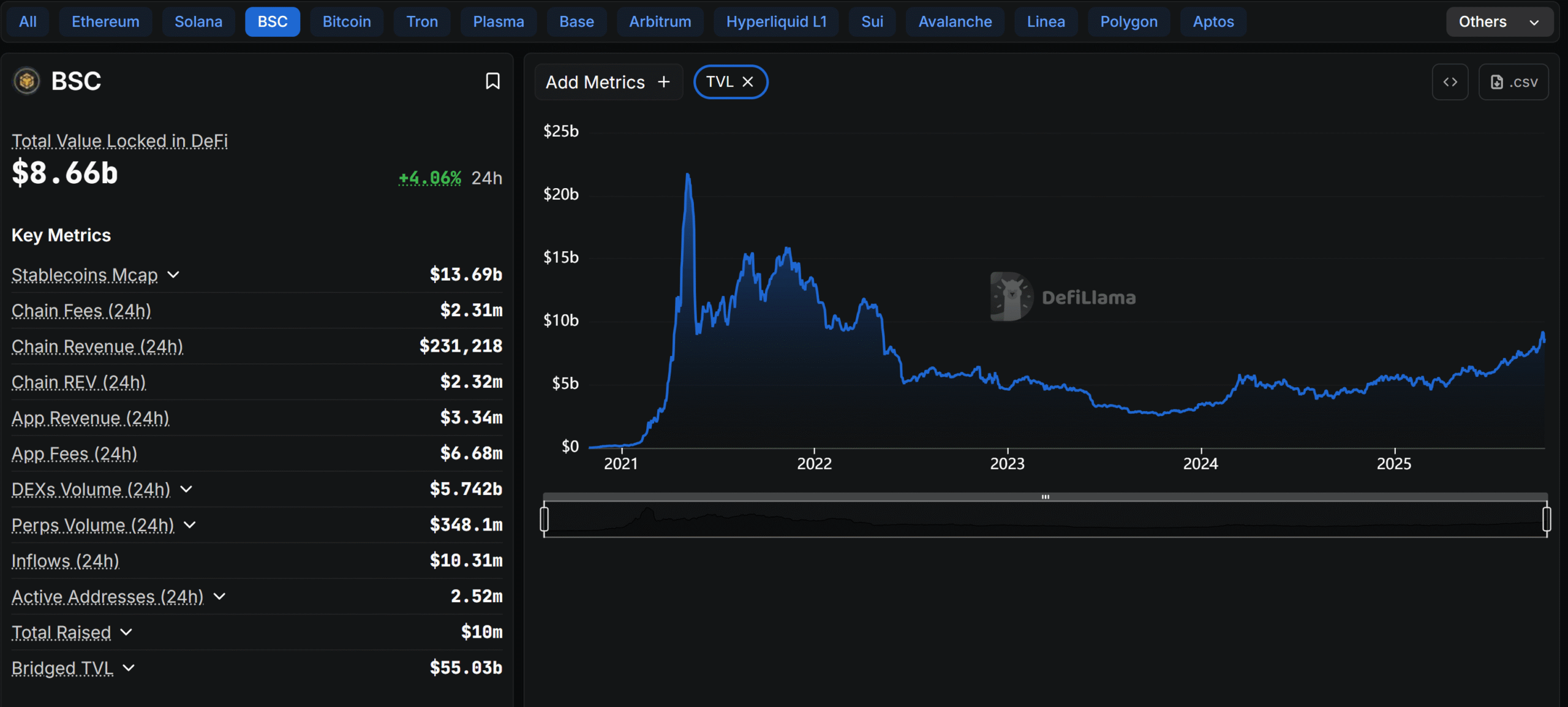

Recent data from analytics firm DefiLlama shows that the BNB Smart Chain (BSC) currently has a total value locked (TVL) of $8.66 billion, ranking it as the third-largest blockchain globally. Over just one day, BSC recorded 2.52 million active users and more than 20.7 million transactions, emphasizing the platform’s robust onchain activity.

Namdar noted that this performance supports a “scale + utility” thesis, pointing to increasing network usage and fee generation. Reports from Messari and internal BNB Chain updates show persistently high activity across both BSC and opBNB, along with consistent product innovation.

While Namdar acknowledged that broader macro factors, such as renewed liquidity and the influx of Exchange-Traded Fund (ETF) flows, have contributed to BNB’s rally, he stressed that the primary driver has been the strength and unique ecosystem surrounding the token. He cited high PancakeSwap volumes, rising daily active users on opBNB, and a growing diversity of decentralized apps as evidence of this trend.

Binance, the exchange supporting BNB, has expanded its global presence through infrastructure, wallet services, payments, and Web3 applications. Recent regulatory licenses and partnerships in Europe, the Middle East, and Asia have boosted confidence among investors and users alike.

What’s Next: Institutional Growth and Onchain Trading Booms

Institutional adoption is also playing a role in BNB’s momentum. CEA Industries, listed on Nasdaq under the ticker BNC, announced last week that it holds 480,000 BNB tokens, while its collective crypto and cash holdings now total $663 million, reportedly making it the world’s largest corporate BNB treasury.

In addition, Binance’s reach in Japan has grown, with local fintech company PayPay, backed by SoftBank, acquiring a 40% stake in Binance’s Japanese subsidiary. As of September 2025, Binance Japan will become an equity-method affiliate of PayPay, further strengthening BNB’s regional presence.

Meanwhile, the BNB Chain has also seen a notable surge in memecoin trading, referred to as “BNB meme szn” by Binance founder Changpeng Zhao. According to Bubblemaps analytics, more than 100,000 traders recently engaged in BNB memecoin trading, with roughly 70% reporting profits. Several traders have posted significant gains, with one exceeding $10 million in returns.

Marwan Kawadri, BNB Chain’s DeFi lead, described the network as “the heartbeat of onchain trading,” given its record levels of active users and decentralized exchange volumes.

For more insights and analysis on cryptocurrency developments, visit the Vizi Cryptocurrency channel.