Bitcoin Golden Cross Retest Signals Potential Rally

Background: Understanding the Bitcoin Golden Cross

Bitcoin is retesting the “golden cross,” a technical indicator viewed as a bullish signal in financial markets. The golden cross forms when a short-term moving average, typically the 50-day, crosses above a long-term moving average, usually the 200-day. Historically, this pattern has signaled a shift in momentum from bearish to bullish and is often followed by significant price increases.

According to a recent analysis shared by Mister Crypto on X (formerly Twitter), Bitcoin’s previous golden crosses in 2017 and 2020 preceded rallies of 2,200% and 1,190% respectively. As of the latest data, Bitcoin (BTC) is trading close to the $110,000 mark. The analyst noted that maintaining this price level could trigger another strong rally. “The setup looks incredibly strong,” he stated, adding that a confirmed breakout “could absolutely explode” Bitcoin’s price in the near future (reporting via Cointelegraph).

Market Reactions and Analyst Insights

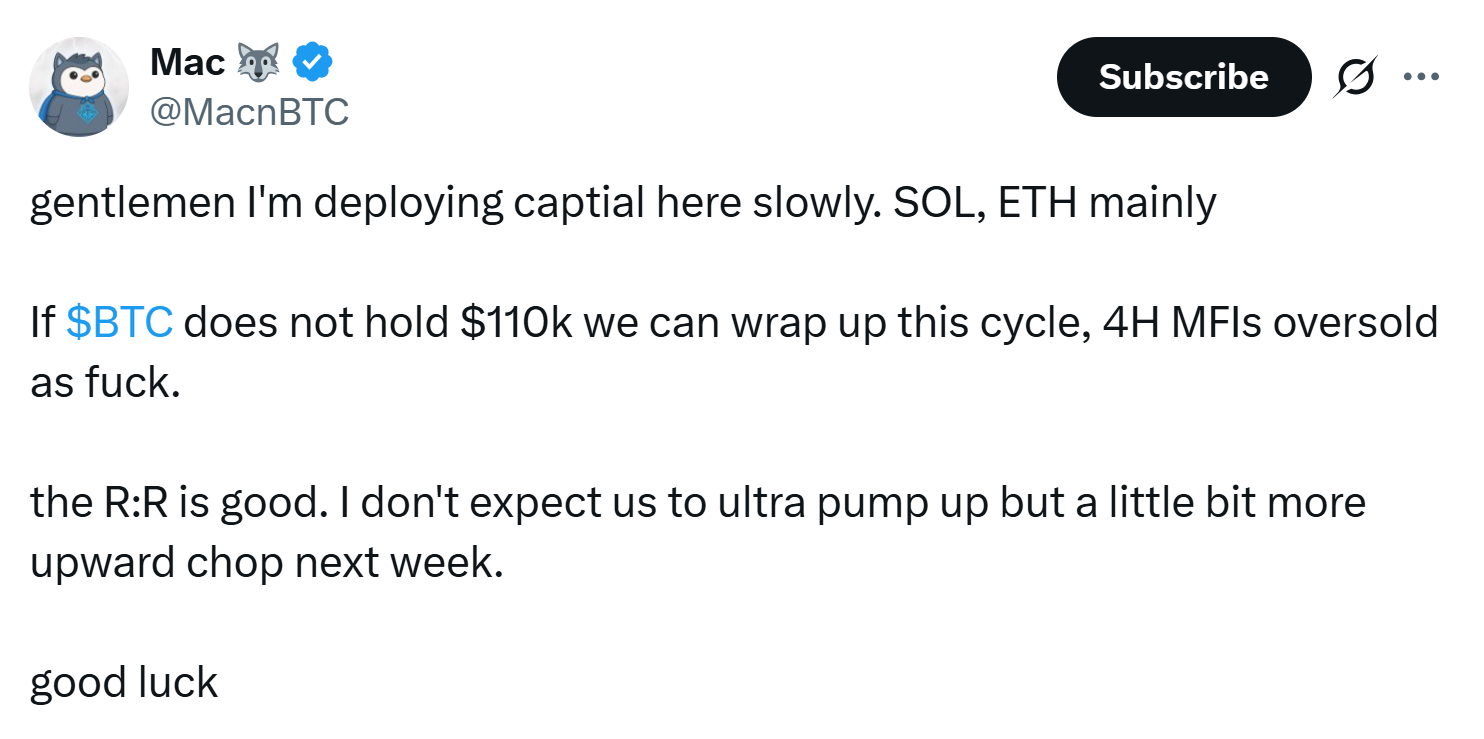

Other market analysts have emphasized the significance of the $110,000 range for Bitcoin. Another crypto strategist known as Mac observed that Bitcoin’s four-hour Money Flow Index (MFI) is “deeply oversold,” which could indicate that the asset is poised for a short-term rebound. He cautioned, however, that failing to remain above the $110,000 threshold could mark the end of the current bullish cycle. While Mac does not foresee an immediate surge, he anticipates a period of “upward chop” in the coming week.

Broader market sentiment is also affected by equity volatility. Tom Lee, co-founder of Fundstrat, pointed out that last Friday’s stock market drop was the largest in six months. He highlighted a 1.29% spike in the VIX—an index that measures market volatility—describing it as “the 51st largest ever spike in the VIX.” Lee suggested this uptick in volatility typically signals a short-term market bottom, stating, “If someone says, ‘Are we higher a week from today?’ I’m going to say the odds are actually really good,” according to Cointelegraph.

Macroeconomic Factors and Future Outlook

The recent turbulence in both cryptocurrency and stock markets follows an announcement by U.S. President Donald Trump that the United States will impose 100% tariffs on all Chinese imports, starting November 1. This move comes in response to new export restrictions by Beijing on rare earth minerals—materials essential for a range of high-tech applications and the green energy sector. China recently implemented rules requiring an export license for any product containing more than 0.1% Chinese-sourced rare earths, with these controls set to begin on December 1.

Given that China provides about 70% of the world’s rare earth supply, these geopolitical tensions could impact both the technology sector and digital assets such as Bitcoin.

Crypto analysts and investors will closely monitor Bitcoin’s price action around the golden cross and the $110,000 support level. The resolution of this technical and macroeconomic uncertainty is likely to determine whether the cryptocurrency resumes its historical pattern of post-golden cross rallies.

For more on cryptocurrency market trends, visit our cryptocurrency analysis section.

What’s Next for Bitcoin?

Market participants are now focused on whether Bitcoin can sustain its position above the $110,000 level following the golden cross formation. Technical indicators, such as the Money Flow Index and moving averages, along with broader economic developments like global trade tensions, will be key factors shaping the next phase of Bitcoin’s trajectory.

Analysts will continue to watch for confirmation of a breakout, which in previous cycles has announced a period of accelerated upward movement for the digital asset.

Sources: Cointelegraph