Euro-Denominated Stablecoins Urged by EU Officials

Background: EU Emphasizes Digital Currency Sovereignty

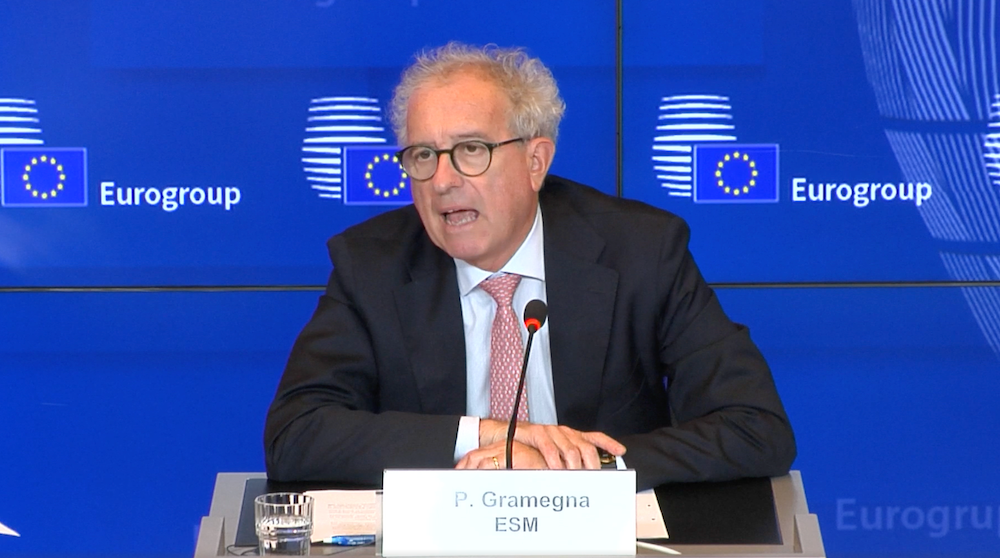

Senior European Union officials are pressing for the accelerated development of euro-denominated stablecoins, aiming to reduce dependence on US dollar-denominated tokens. This was stated during an economic health hearing focused on the eurozone, held on Thursday. The call was led by Pierre Gramegna, managing director of the European Stability Mechanism (ESM), who emphasized the strategic need for the EU to nurture its own stablecoins.

“Europe should not be dependent on US dollar-denominated stablecoins, which are currently dominating markets,” Gramegna told lawmakers at the hearing, as reported by Cointelegraph. He addressed concerns that the dominance of dollar tokens could pose a risk to the EU’s financial autonomy and stability.

Paschal Donohoe, president of the Eurogroup, echoed the need for financial innovation. He noted that while stablecoins represent an important frontier, the upcoming digital euro—planned as a central bank digital currency (CBDC)—could still offer substantial commercial advantages within the bloc.

Market Reaction and Strategic Importance

The renewed focus on euro-denominated stablecoins follows a noticeable surge in US dollar-backed tokens, particularly after the introduction of the GENIUS regulatory framework in the United States. This shift has prompted EU officials to reconsider earlier warnings about the systemic risks of stablecoins, instead viewing them as essential instruments for the region’s financial future.

Stablecoins now carry geostrategic weight as major governments seek to boost international demand for their fiat currencies through digital innovation. Within the EU, central figures such as European Central Bank (ECB) board member Piero Cipollone have voiced strong backing for the digital euro, although Cipollone cautioned that its launch may not occur before 2029 due to legislative delays.

Christine Lagarde, president of the ECB, has previously warned against the risks posed by foreign stablecoins, stating that regulatory gaps must be closed to prevent external issuers from draining liquidity from the EU’s monetary system.

What’s Next for the Euro and Stablecoins

With the digital euro facing a potentially prolonged timeline, the push for privately-developed euro-denominated stablecoins grows more pressing. Regulatory bodies and policymakers acknowledge that financial and technological innovation must be paired with robust oversight.

Internationally, US Federal Reserve officials have asserted the pivotal role of dollar-denominated stablecoins. Christopher Waller, a Fed governor, stated in 2024 that “crypto-assets are de facto traded in US dollars. So, it is likely that any expansion of trading in the DeFi world will simply strengthen the dominant role of the dollar,” highlighting the competition the euro faces in the digital asset domain.

As the EU weighs its regulatory and strategic options, stablecoins remain central to debates over the future of cross-border payments and currency sovereignty.

For further insights on the evolution of digital assets in Europe, visit the cryptocurrency section on Vizi.

Sources

Reporting via Cointelegraph.