Amina Bank Launches Polygon Staking for Institutions

Background: Amina Bank Leads with Polygon Staking Service

Swiss-based Amina Bank has announced the launch of Polygon (POL) staking services for its institutional clients, becoming the first financial institution to provide regulated access to this offering. This development positions Amina Bank, regulated by the Swiss Financial Market Supervisory Authority (FINMA), at the forefront of institutional crypto adoption. The move was revealed on Thursday as the bank introduced partnerships with the Polygon Foundation to enable up to 15% staking rewards for clients.

Details of the Amina Bank Polygon Staking Offer

Through its new service, Amina Bank aims to deliver a secure, regulated pathway for asset managers, family offices, and corporate treasuries to participate in the Polygon network. By staking POL tokens, clients contribute to the stability and security of a blockchain platform that is already adopted by major global financial institutions, including BlackRock, JPMorgan, Franklin Templeton, and Stripe. “Our expansion of POL services provides institutional clients with regulated access to the blockchain, enabling our clients to be rewarded for providing stability and security to a blockchain network used by some of the biggest financial institutions,” said Chief Product Officer Myles Harrison, as reported by Cointelegraph.

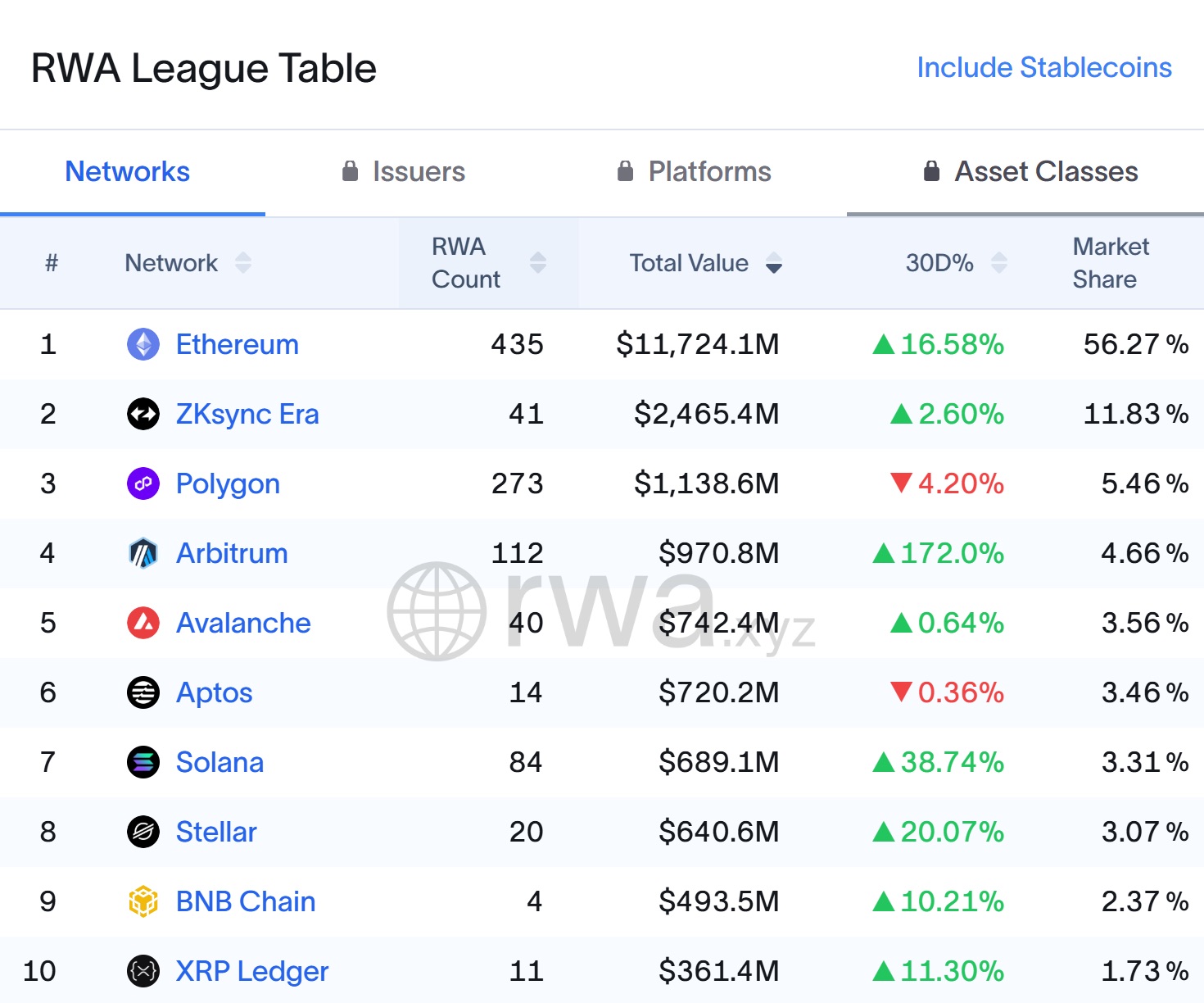

Polygon (POL) has become a prominent base for Web3 projects and onchain financial applications. Data from RWA.xyz shows Polygon ranks third in the real-world asset (RWA) tokenization space, with over $1.13 billion in total value across 273 tokenized assets, while Ethereum continues to lead with a 56% market share.

Institutional Demand and Wider Market Reaction

Amina Bank’s decision to offer Polygon staking follows notable growth in its business performance. In May 2024, the bank, formerly known as Seba Bank, reported a 69% year-over-year increase in revenue to $40.4 million and a 136% rise in assets under management to $4.2 billion. These gains were attributed to surging institutional demand and international expansion.

The launch comes amid rising interest in digital asset staking services worldwide. On Wednesday, Coinbase received regulatory approval in New York to provide staking services, enabling customers to earn rewards on assets like Ether (ETH) and Solana (SOL). Earlier this week, Grayscale became the first U.S.-based crypto fund issuer to add staking options to its exchange-traded products, starting with ETPs for Ethereum and Solana. These moves underscore the growing momentum for institutional and retail staking opportunities across major blockchain networks.

What’s Next for Institutional Crypto Adoption?

Amina Bank’s regulated Polygon staking offer sets a new benchmark for financial institutions exploring blockchain integration. By allowing clients to earn staking rewards in a compliant manner, Amina is meeting institutional requirements for security and transparency. The institutional embrace of Polygon and other major blockchains is expected to continue, fostering further growth in tokenization and decentralized finance products.

For more information on institutional blockchain trends and cryptocurrency innovation, visit the Vizi cryptocurrency section.

Sources

Reporting via Cointelegraph.