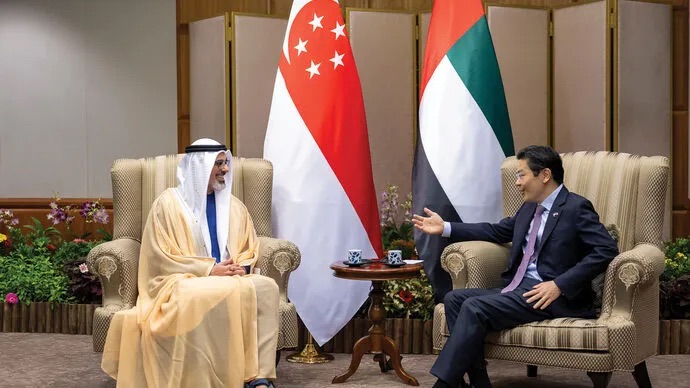

Singapore and UAE Lead Global Rankings in Crypto Obsession

Singapore Tops Global Crypto-Obsession Report

Singapore has been named the world’s most “crypto-obsessed” country, according to a recent report from ApeX Protocol. The ranking, which positions Singapore at the top with a perfect composite score of 100, is driven by several key metrics: 24.4% of Singapore’s population now own cryptocurrencies, and the country leads globally in crypto-related search activity, recording 2,000 queries per 100,000 people. Growth has been rapid, with the proportion of Singaporeans holding digital assets doubling from 11% in 2021 to over 24% in the following year.

UAE and United States Trail Close Behind

The United Arab Emirates (UAE) ranks just behind Singapore with a composite score of 99.7. The Gulf nation leads the world in crypto ownership, with 25.3% of its population reported as cryptocurrency holders. The UAE experienced a 210% increase in adoption since 2019, notably peaking in 2022 when over a third of the population stated they held crypto assets.

In third place, the United States achieved a score of 98.5, largely due to its expansive infrastructure. The U.S. boasts more than 30,000 cryptocurrency ATMs—ten times the amount present in any other country—and has seen a 220% climb in crypto usage since 2019. “Crypto is no longer on the fringe,” a spokesperson from ApeX Protocol said. “It’s becoming part of how countries define their financial future… not just as an investment, but as a reflection of how people engage with technology, money, and trust in the digital age” (Reporting via Cointelegraph).

Global Perspective: Other Leading Crypto Markets

Canada secured fourth place, posting the highest growth rate in the report—an increase of 225% in crypto asset adoption. With 10.1% of Canadians owning crypto and 3,500 ATMs spread across the country, Canada’s composite score reached 64.7. Turkey rounds out the top five at 57.6, driven by 19.3% of its population holding crypto and nearly 1,000 monthly crypto-related searches per 100,000 people.

European and other global economies also made strong showings, with Germany (48.4), Switzerland (46.2), and Australia (45.1) following in the rankings. Argentina (37.6) and Indonesia (37.1) demonstrated that emerging markets are increasingly active in digital asset adoption. ApeX Protocol’s methodology for calculating crypto-obsession includes ownership rate, growth in adoption, search activity, and ATM availability.

Broader Trends in Global Crypto Adoption

The updated ApeX Protocol report supports other recent findings about rising global crypto usage. As noted by Cointelegraph, the United States recently jumped to second place in the Chainalysis 2025 Global Crypto Adoption Index, attributed to increased spot Bitcoin ETF flows and a clearer regulatory climate.

India has maintained its status as the top country for crypto adoption for three consecutive years, propelling the Asia-Pacific region to a 69% year-on-year explosion in crypto transaction value. Other prominent countries in the top ranks include Pakistan, Vietnam, Brazil, and Nigeria, despite shifts prompted by evolving regulations.

What’s Next for Crypto-Obsessed Nations?

Analysts expect ongoing growth in both crypto adoption and technological infrastructure, especially in nations already demonstrating high ownership rates or rapid adoption. Singapore and UAE’s leading positions indicate a deep integration of digital assets into financial systems and consumer behavior. Meanwhile, established financial hubs like the United States and Canada continue to enhance their accessibility and regulatory clarity, potentially supporting further mainstream adoption.

For more updates and analyses on digital asset trends, see cryptocurrency news on Vizi.