Robinhood Markets Joins the S&P 500

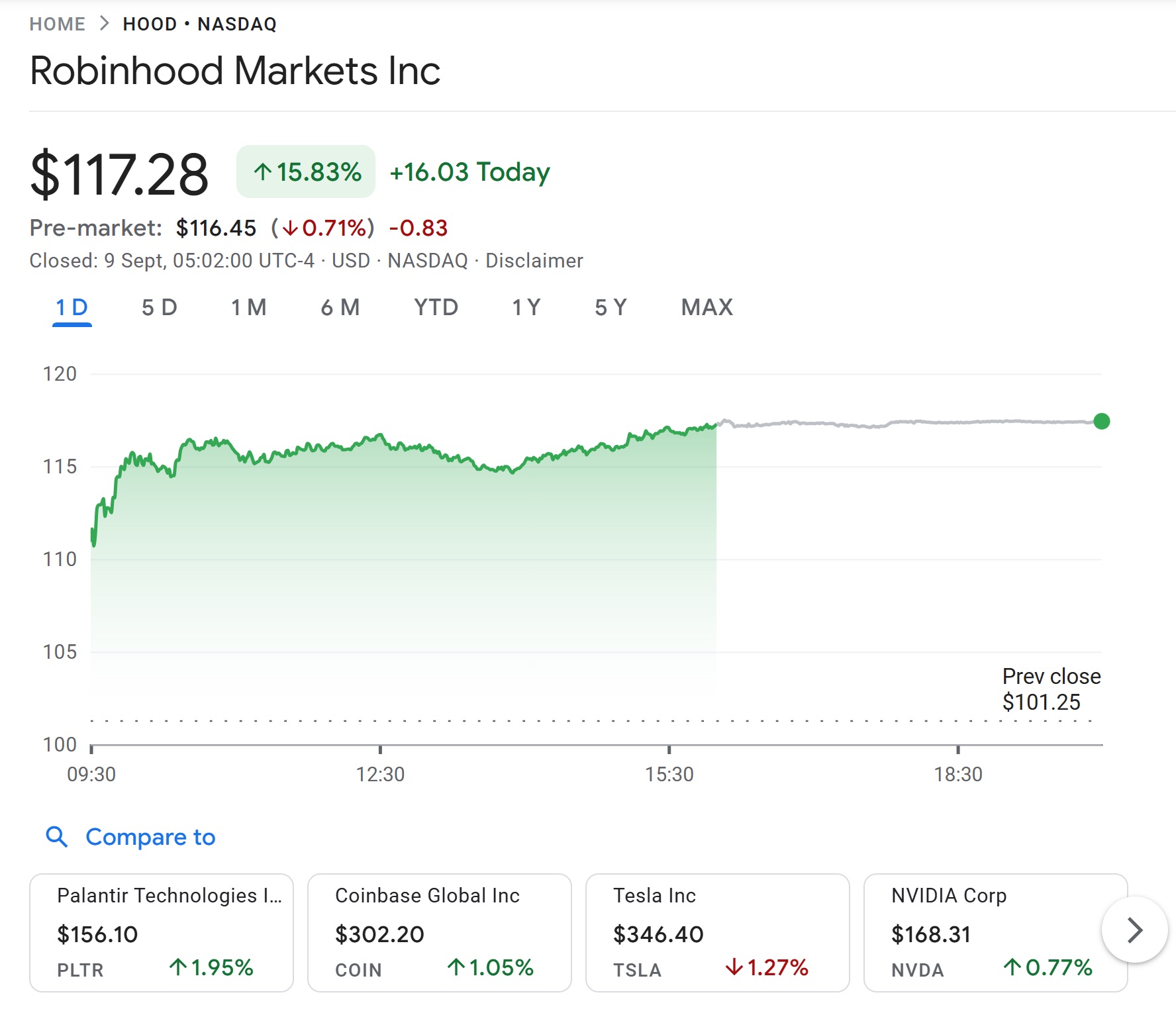

Robinhood Markets will officially enter the S&P 500 on September 22, taking the place of Caesars Entertainment as part of the index’s quarterly rebalancing.

This inclusion, announced by S&P Dow Jones Indices on Friday, adds another crypto-adjacent firm to America’s most closely monitored stock index, broadening the benchmark index’s exposure to the cryptocurrency sector.

“This movement expands the index’s exposure and connection to the digital asset economy,” stated Edwin Mata, co-founder and CEO of tokenization platform Brickken.

“Although the S&P still doesn’t have direct holdings in cryptocurrencies, Robinhood’s role as a retail crypto gateway allows the index to indirectly capture part of the sector’s growth value and liquidity,” Mata further explained.

With Robinhood’s addition, it joins Coinbase, which was included in the S&P 500 in May, as one of the two crypto-facing companies currently within the index. Both serve as essential access points to digital assets, thereby exposing the index and, by extension, passive investors to cryptocurrencies.

“The inclusion of Robinhood in the S&P 500 indicates that crypto-related firms are now seen as important pillars of America’s market,” remarked Agne Linge, head of growth at the decentralized onchain bank WeFi.

After Robinhood joins the S&P 500, all index funds and exchange-traded funds (ETFs) tracking the benchmark will be required to include HOOD in their portfolios, resulting in a significant influx of passive capital into the stock. However, this could also introduce additional volatility to the index.

“The inclusion of both of these stocks, which have exposure to crypto, adds a slight risk— a marginal risk— to the S&P 500, as both have high beta values: 2.89 for Coinbase and 2.36 for Robinhood,” Linge explained.

Beta serves as a measure of an investment’s volatility or systematic risk in relation to the overall market. While higher beta values indicate increased volatility, Linge noted that this tradeoff could be beneficial for long-term index holders.

“It also provides significant exposure to regular investors who have opted for index funds as a safe choice, along with pension funds and, of course, institutions that can now feel more comfortable with crypto exposure through a fundamental investment vehicle like the S&P 500,” Linge continued.

In the meantime, CNBC’s Jim Cramer lauded Robinhood for its inclusion in the S&P 500, referring to it as a “juggernaut” that has transformed the retail brokerage scene.

He also discussed the company’s ongoing expansion, which includes stocks, options, and crypto, as well as extending into retirement accounts and credit cards. Cramer characterized the firm as a rare disruptor that Wall Street initially underestimated but can no longer overlook. “It just came out of nowhere, and it’s killing it,” he said.