US Government Crypto ETF Approvals May Surge in 2026

Background: US Government and Crypto ETF Regulation

The reopening of the US government and resumption of the normal legislative session may lead to a surge in new crypto exchange-traded fund (ETF) approvals by the Securities and Exchange Commission (SEC) in 2026, according to analysts. This comes after periods of uncertainty caused by government shutdowns and regulatory delays, which have impacted markets and investor sentiment.

Matt Hougan, chief investment officer at Bitwise, told CNBC that demand for crypto ETFs and exchange-traded products (ETPs) is “huge,” driven by investors seeking passive exposure to cryptocurrencies. Hougan noted that crypto index ETFs, in particular, could see significant growth as more investors look for smaller crypto allocations within diversified portfolios.

Market Reaction: New ETF Launches and Trading Activity

Recent market activity demonstrates robust investor interest in new crypto ETF offerings, despite broader market declines. For instance, Canary Capital’s XRP ETF (XRPC) debuted on Thursday and recorded $58 million in first-day trading volume, marking the most successful ETF launch of 2025 to date. However, the price of XRP fell approximately 13% over the last week based on data from CoinMarketCap.

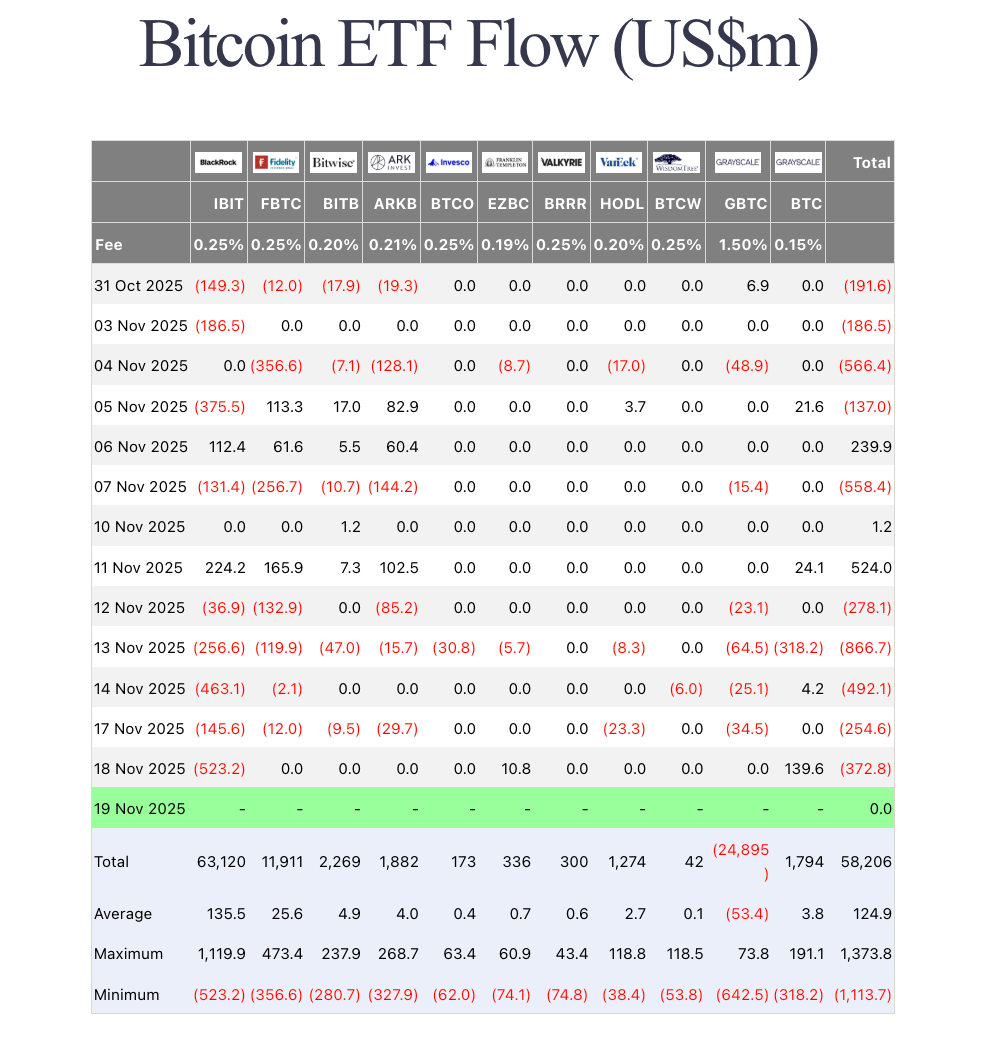

Bitcoin (BTC) ETFs have faced similar volatility. November has seen roughly $1.1 billion in outflows from Bitcoin ETFs, according to Farside Investors, making it the worst month on record for these investment vehicles. The average cost basis for Bitcoin ETFs is about $89,600, and Bitcoin prices dipped below this level on Tuesday, putting the majority of ETF investors at a loss, said Glassnode analyst Sean Rose.

Despite significant outflows—about $1 billion in the month following October’s market crash—many Bitcoin ETF investors have held their positions, Bloomberg ETF analyst Eric Balchunas reported. Balchunas also confirmed that long-term Bitcoin holders, or “whales,” were chiefly responsible for most of the BTC sold in October and November.

What’s Next for US Government Crypto ETF Approvals?

With the US government now operating and expectations growing for regulatory progress, industry experts predict a renewed push for crypto ETF approvals in 2026. The SEC is expected to address the “huge” demand identified by investment professionals, possibly setting the stage for diverse crypto ETFs—including index products—aimed at traditional investors.

Heavy capital outflows continue to put downward pressure on digital asset prices, but future approvals could help revive optimism within the market and enhance investor access to cryptocurrency investment vehicles. As regulatory clarity improves and new products launch, market observers will closely monitor trends in ETF flows and price performance.

For more on cryptocurrency market dynamics, visit our cryptocurrency section.

Sources

Reporting via Cointelegraph.