Bitcoin Purchasing Power: Natalie Brunell on Inflation Solutions

Background: Economic Challenges and Bitcoin’s Appeal

Bitcoin purchasing power has become a central topic for individuals seeking protection from the negative effects of inflation and currency depreciation. Natalie Brunell, journalist and author of “Bitcoin is for Everyone,” has been vocal about Bitcoin’s potential to safeguard savings and address social mobility concerns. Speaking in an interview with Cointelegraph, Brunell shared her personal journey as a first-generation immigrant to the United States whose family experienced hardship during the 2008 financial crisis.

Brunell explained that understanding the “root economic issues” such as inflation and a weakening monetary system is essential to fully appreciating Bitcoin’s value as a savings vehicle. She remarked that it took her over a decade to recognize how currency inflation and policy decisions “eat away at the value of money,” directly impacting long-term prosperity and social mobility (Reporting via Cointelegraph).

Bitcoin as a Hedge Against Inflation

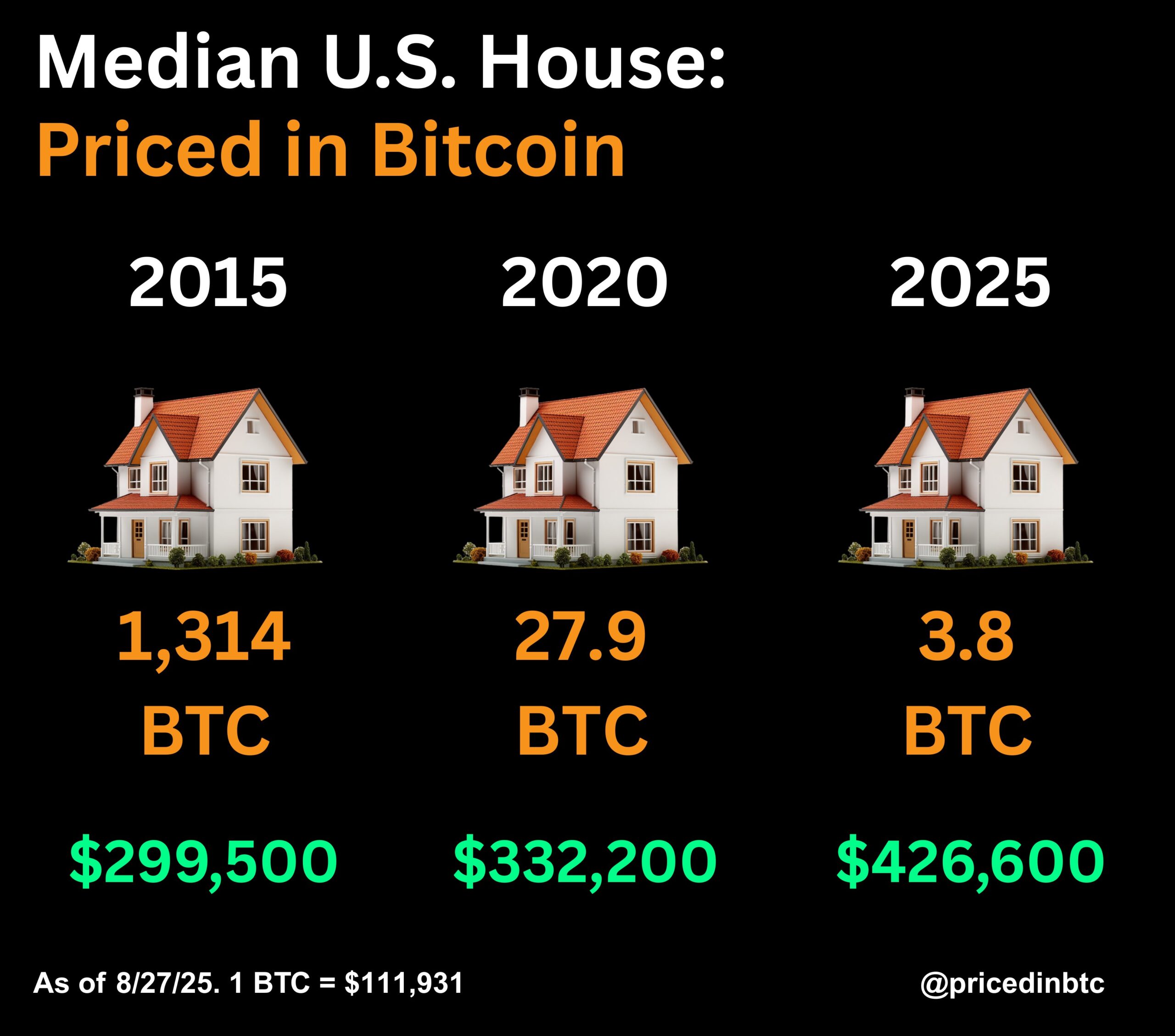

According to Brunell, fiat currency inflation not only leads to increased consumer prices but also diminishes future purchasing power. She argued that this dynamic incentivizes short-term thinking and consumption, undermining the ability to build wealth or invest in long-term projects. Brunell emphasized that Bitcoin’s supply is capped at 21 million coins and operates on a decentralized, proof-of-work system. This scarcity, she said, “stores economic energy” and offers individuals “a hard monetary standard.”

Brunell explained, “You don’t appreciate what will potentially solve it, which, I believe, is Bitcoin,” pointing to the currency’s role in encouraging individuals to save rather than spend impulsively. Saving in Bitcoin, she argues, empowers individuals to prioritize the future, family, health, creativity, and community-building, all of which are disadvantaged under constantly depreciating fiat systems.

Portability and Security for Those in Crisis

Another dimension of Bitcoin purchasing power highlighted by Brunell is its utility for emigrants, refugees, and people in crisis situations. Unlike fiat currencies, which often rely on physical notes or centralized banking, Bitcoin’s digital nature grants owners the ability to transfer wealth globally with minimal risk of confiscation or loss, simply by retaining a private key or “seed phrase.” In Brunell’s words, “If you needed to flee in an emergency, you can literally memorize a 12-word or 24-word seed phrase and take your whole net worth with you.”

Brunell described how Bitcoin’s portability becomes indispensable for those facing war, persecution, or natural disasters. This feature sets Bitcoin apart from fiat currencies, which frequently fail to offer such protection or resilience in times of instability.

Since the United States’ departure from a hard money standard, Brunell connected the rise of fiat money with trends of “declining mental health, increased levels of crime, and the lack of affordability for people to own a home.” She suggests that these issues are symptoms of a broken monetary standard and sees Bitcoin as a potential solution for restoring purchasing power and social stability.

What’s Next for Bitcoin and Financial Education?

Brunell and others continue to advocate for greater financial education so individuals can better understand the benefits and trade-offs of Bitcoin versus traditional fiat savings. As inflation remains a concern globally, Bitcoin’s fixed supply and decentralized security may gain further attention as mechanisms to counter loss of purchasing power and downward social mobility.

For further insights into how cryptocurrency is transforming savings behaviors and financial systems, visit Vizi’s cryptocurrency coverage.