Bitkub Hong Kong IPO: Thai Crypto Exchange Eyes $200M Listing

Background on Bitkub and IPO Plans

Bitkub, Thailand’s leading cryptocurrency exchange, is reportedly considering a $200 million initial public offering (IPO) in Hong Kong. According to Cointelegraph citing a Bloomberg report, Bitkub is exploring this overseas listing option amid continuing volatility in Thailand’s domestic stock market. Founded in 2018, Bitkub facilitates daily cryptocurrency trades worth approximately $66 million, based on data from CoinGecko.

The exchange had originally targeted the Stock Exchange of Thailand (SET) for its IPO, aiming for a public launch in 2025. However, unstable market conditions and uncertainties have delayed these local listing plans, prompting Bitkub to consider international alternatives. As of publication, Bitkub has not issued an official comment regarding the potential Hong Kong listing.

Thai Stock Market Volatility Drives Overseas Move

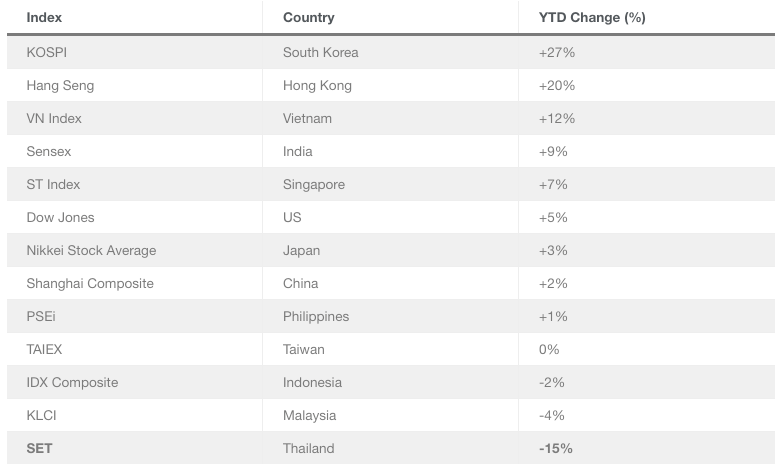

Thailand’s equity market has experienced significant instability in 2025, making it one of Asia’s most volatile. Ongoing political tensions with Cambodia and concerns about global trade have exacerbated market fluctuations. The SET index has dropped 10% this year, reaching a five-year low during the first half and contributing to its ranking as one of Asia’s worst-performing exchanges.

Despite a brief recovery over two consecutive months, foreign investors have continued to divest from Thai equities. Net selling by overseas investors surpassed 100 billion Thai baht (approximately $3 billion) in the first ten months of 2025.

By contrast, regional markets have seen strong performance. South Korea and Hong Kong’s stock exchanges reported growth of 27% and 20% respectively during the same period, further motivating Bitkub’s consideration of the Hong Kong IPO route.

Hong Kong’s Growing Appeal for Crypto Listings

If finalized, the Bitkub Hong Kong IPO would add momentum to the city’s effort to attract international technology and cryptocurrency companies. Hong Kong’s stock market raised HK$216 billion ($27.8 billion) from IPOs in the first ten months of 2025, equating to a 209% rise over the previous year, according to data from the Hong Kong Stock Exchange (HKEX). This surge has coincided with a broader trend of crypto firms, including Bitcoin Depot—the world’s largest Bitcoin ATM operator—establishing a presence in the city.

In a similar move, HashKey Group, the owner of Hong Kong’s top crypto exchange, filed for an IPO in October, seeking to raise $500 million in a listing anticipated for 2026. Should Bitkub’s IPO proceed, it would mark one of the first public listings by a Southeast Asian crypto exchange in Hong Kong, underscoring the city’s expanding role in global digital asset markets.

For more on cryptocurrency industry updates, visit Vizi’s Cryptocurrency section.

What’s Next for Bitkub?

As Bitkub weighs its next steps, the exchange remains positioned as a significant player in the Southeast Asian cryptocurrency landscape. Industry observers are watching closely for official statements and regulatory filings to confirm the potential Hong Kong IPO. Reporting via Cointelegraph.