Bitcoin and Ether ETF Outflows Deepen, Solana Inflows Rise

Background on Bitcoin and Ether ETF Outflows

Spot Bitcoin and Ether exchange-traded funds (ETFs) continued their streak of net capital outflows on Tuesday. According to Farside Investors, spot Bitcoin (BTC) ETFs experienced net outflows of $578 million in a single day, marking the steepest decline since mid-October. Leading the withdrawals were BlackRock’s iShares Bitcoin Trust and Fidelity’s FBTC product. Similarly, spot Ether (ETH) ETFs registered $219 million in net redemptions, with Fidelity’s FETH and BlackRock’s ETHA contributing most to the losses. This marks the fifth consecutive day of outflows for both Bitcoin and Ether ETFs, with Ether-linked products alone shedding nearly $1 billion since late October.

Solana ETF Inflows Buck the Trend

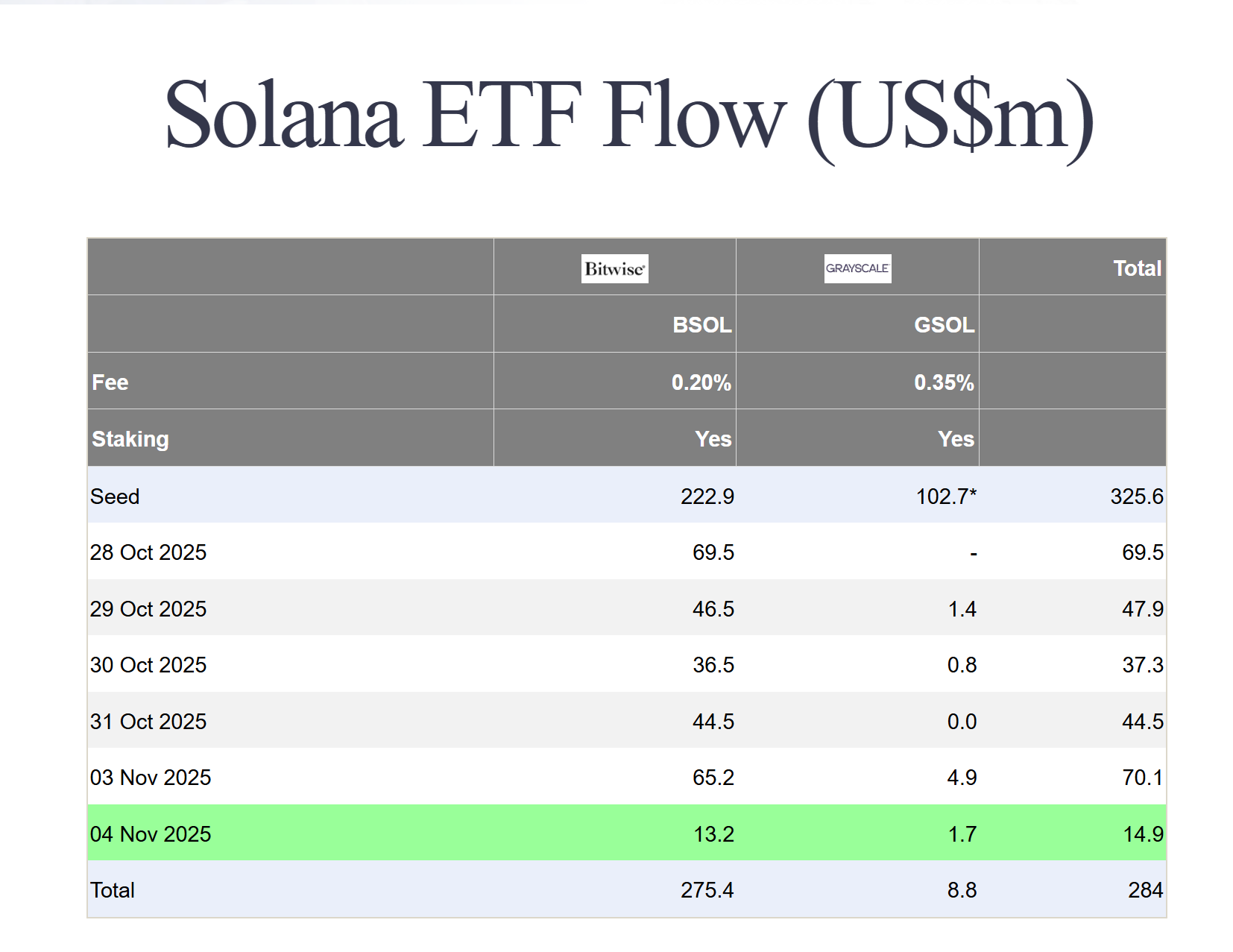

While Bitcoin and Ether ETF outflows dominated headlines, spot Solana (SOL) funds experienced a contrasting trend. Solana ETFs attracted $14.83 million in net inflows, continuing a six-day streak of gains. Bitwise’s BSOL and Grayscale’s GSOL were notable beneficiaries, suggesting a rotation of institutional capital into Solana’s newer, yield-oriented offerings. This influx highlights a shift in trader sentiment, with investors showing increased interest in alternative digital assets even as the broader cryptocurrency ETF market faces challenges.

Market Context and Expert Insights

Vincent Liu, chief investment officer at Kronos Research, commented on the ongoing Bitcoin and Ether ETF outflows, attributing the trend to broader market jitters. In a statement to Cointelegraph, Liu said, “Straight days of redemptions show institutions are trimming risk as leverage unwinds and macro jitters rise.” He explained that the ETF outflows are driven mainly by a risk-off environment caused by a strengthening US dollar and tighter liquidity conditions.

Liu noted that Solana’s ETFs are benefiting from a strong narrative and yield potential as new products attract fresh capital: “It’s a narrative-driven move by early adopters chasing yield and growth.” Despite the positive inflows, Liu cautioned that Solana’s growth remains limited in scope compared to more established crypto ETFs. He emphasized that broader market risk sentiment continues to be cautious, with most institutions reducing exposure until conditions improve.

What’s Next for Cryptocurrency ETFs?

The persistence of Bitcoin and Ether ETF outflows suggests that global economic factors are influencing institutional investment in digital assets. Until liquidity stabilizes, further capital rotation and risk reduction may continue to pressure ETF markets. Meanwhile, Solana’s continued ETF inflows indicate investor appetite for new products with yield and growth prospects, though this segment remains relatively niche. As macroeconomic trends evolve, ETF flows across cryptocurrencies may undergo further shifts, reflecting ongoing adaptation in institutional crypto strategies.

For more news and analysis on cryptocurrency markets, visit the Cryptocurrency section at Vizi.

Sources

Reporting via Cointelegraph