Chainlink Tokenized Finance Integration: Grayscale Report

Background: Grayscale Identifies Chainlink’s Central Role

Digital asset manager Grayscale has emphasized Chainlink’s significance in the evolving landscape of tokenized finance, describing the project as a “critical connective tissue” for linking the cryptocurrency sector with traditional finance. The comments were made in a recent research report, which detailed Chainlink’s expanding ecosystem and pivotal contributions to blockchain infrastructure (Cointelegraph).

Chainlink’s Expanding Infrastructure for Tokenized Assets

According to Grayscale, Chainlink’s suite of software solutions, particularly its modular middleware, enables on-chain applications to securely access off-chain data, facilitate crosschain transactions, and meet enterprise compliance standards. The report noted, “A more accurate description of Chainlink today would be modular middleware that lets on-chain applications safely use off-chain data, interact across blockchains, and meet enterprise-grade compliance needs.” This capacity has established LINK as the leading non–layer 1 cryptocurrency by market capitalization (excluding stablecoins), offering investors exposure across various blockchain networks.

The research points to asset tokenization as the most promising pathway for Chainlink’s contribution to the industry. Most traditional financial instruments, such as securities and real estate, remain on off-chain records. For these to harness blockchain benefits including efficiency and programmability, tokenization combined with integration to real-world data is essential. “We expect Chainlink to play a central role orchestrating the process of tokenization, and it has announced a variety of partnerships, including with S&P Global and FTSE/Russel, that should help it do so,” Grayscale stated via Cointelegraph.

Market Activity and Chainlink Tokenized Finance Applications

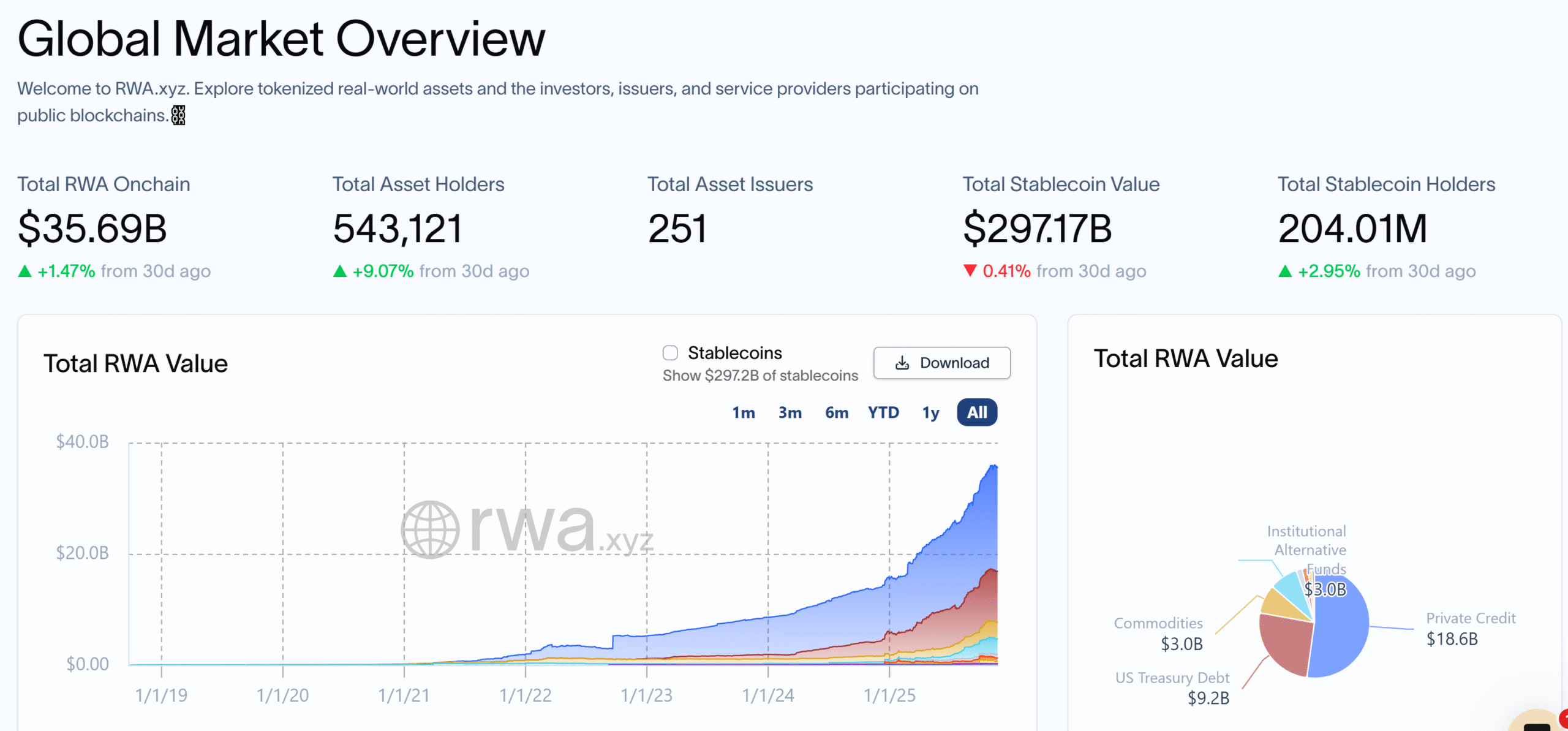

The tokenized asset market has surged from $5 billion to $35.6 billion since early 2023, according to data from RWA.xyz. Chainlink has been active in enabling foundational infrastructure for this growth. In June, Chainlink collaborated with JPMorgan’s Kinexys network and Ondo Finance in a pilot crosschain delivery-versus-payment (DvP) settlement. The project connected JPMorgan’s Kinexys Digital Payments system with Ondo Chain’s testnet, which is focused on tokenized real-world assets. Utilizing Chainlink’s Runtime Environment (CRE), the settlement exchanged Ondo’s tokenized US Treasurys fund, OUSG, for fiat payment without transferring assets between chains.

This demonstration marks a significant advancement in cross-system blockchain finance, as it allowed traditional payment systems to interact with public blockchain networks smoothly and securely.

What’s Next for Chainlink and Tokenized Finance

With the increasing adoption of tokenized assets and real-world asset integration, Grayscale expects Chainlink to solidify its role as a bridge between legacy financial markets and the blockchain ecosystem. Partnerships with notable industry benchmarks such as S&P Global and FTSE/Russel further expand its reach, supporting broader use of blockchain in asset settlement, compliance, and crosschain applications.

Experts believe that sustained growth in the tokenized asset market, along with continued collaboration between blockchain projects and traditional finance, could reinforce Chainlink’s status as an infrastructural pillar for decentralized and tokenized financial systems.

For more on cryptocurrency market trends, visit our cryptocurrency news section.