Aave Labs MiCA Authorization: Zero-Fee Stablecoin Ramps in Ireland

Background: Aave Labs Secures MiCA Authorization for Stablecoin Ramps

Aave Labs has become one of the first major decentralized finance (DeFi) organizations to obtain authorization under the European Union’s Markets in Crypto-Assets (MiCA) regulation. This approval, granted by the Central Bank of Ireland, allows the company to provide regulated stablecoin ramps across the European Economic Area (EEA) via its fiat-to-crypto service, Push.

The MiCA authorization was awarded to Push Virtual Assets Ireland Limited, a subsidiary wholly owned by Aave Labs. This regulatory milestone positions Aave Labs at the forefront of compliant DeFi infrastructure in Europe. According to Cointelegraph, Aave’s selection of Ireland for its European operations aligns with a growing trend of crypto firms choosing Ireland as a strategic hub for regulatory clarity under MiCA. Notably, the crypto exchange Kraken also received MiCA authorization in Ireland on June 25, 2024.

Market Reaction and Impact on DeFi

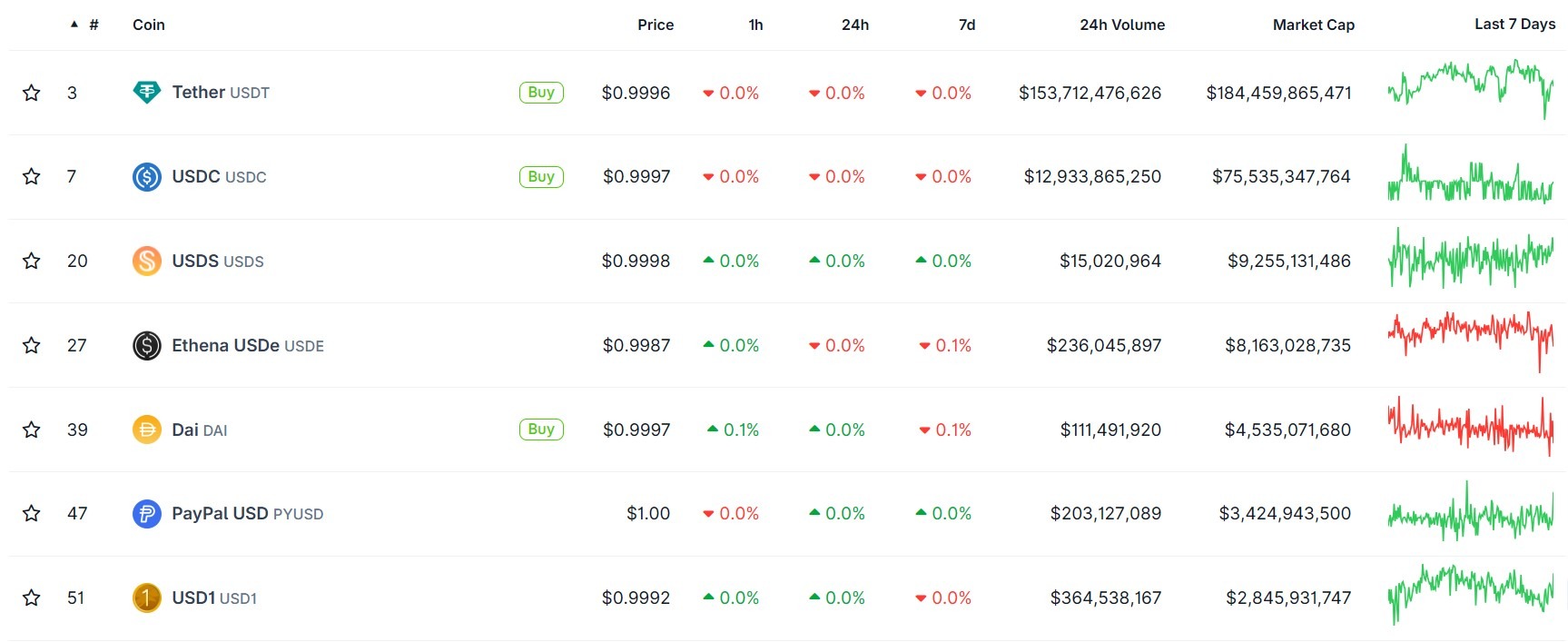

The launch of Aave’s Push service enables users to convert between the euro and cryptocurrencies, including GHO, Aave’s native stablecoin. This development comes as global stablecoin supply has surpassed $300 billion, with CoinGecko data reporting a sector-wide market capitalization of $312 billion at the time of writing. The growing demand for fiat-pegged crypto assets highlights the increasing utility and adoption of stablecoins worldwide.

Aave Labs is promoting Push as a “zero-fee” solution for crypto on-ramps and off-ramps, making it competitive compared to legacy fintech providers and centralized exchanges (CEXs). While the current fee structure is set to zero, the company has not confirmed if this arrangement will remain permanent or if it is an introductory offer. “The company introduced the product as a ‘zero-fee’ solution,” according to Cointelegraph.

By offering a compliant and streamlined method for euro-to-crypto conversions, Push addresses a key friction point in DeFi adoption: the need for users to rely on external CEXs for fiat transfers. This initiative could simplify entry into DeFi for mainstream users and offer a predictable, audited payment solution for developers and end-users alike.

What’s Next for Aave and Compliant DeFi Infrastructure

The ability for a DeFi-native platform like Aave to operate a regulated fiat bridge marks a significant step for the broader DeFi sector. This move may set a precedent as stablecoin liquidity, compliant services, and user trust become critical components of mainstream adoption. Aave currently manages tens of billions in stablecoin liquidity, and recent DefiLlama data shows it processed $542 million in volume in a single day, with the total value borrowed from its lending pools exceeding $22.8 billion.

Aave Labs stated that compliance with regulated payment infrastructure is crucial to support developers and users entering DeFi. By bridging the euro and stablecoins through a regulated, audited service, Push aims to reduce barriers and create a seamless entry point for the EEA market.

As MiCA regulations roll out, other DeFi and crypto platforms may follow Aave’s example, further strengthening the role of compliant stablecoin services in Europe’s crypto ecosystem. For ongoing updates and insights, visit our cryptocurrency news section.