Crypto Dispensers $100 Million Sale Considered Amid CEO Indictment

Background: Strategic Review Follows Serious Charges

Crypto Dispensers, a Chicago-based operator known for its Bitcoin ATMs, is evaluating a potential $100 million sale. The decision comes shortly after its founder and CEO, Firas Isa, was indicted on federal money laundering charges. The company announced on Friday that advisors have been hired to conduct a “strategic review,” with the aim of exploring potential buyers and business directions (Cointelegraph).

According to the firm, the review may result in a sale or other alternatives, including continuing operations independently. Crypto Dispensers emphasized that there is no guarantee any transaction will be completed.

The move follows the company’s 2020 shift from physical Bitcoin ATMs to a software-driven model. This transition, as stated in a company press release, was intended to address increasing concerns about fraud, compliance requirements, and regulatory oversight. CEO Firas Isa framed the review as a natural step for scaling the business, noting: “Hardware showed us the ceiling. Software showed us the scale.”

Federal Indictment and Compliance Issues

The potential $100 million sale was announced days after the U.S. Department of Justice unsealed an indictment alleging Crypto Dispensers and Isa facilitated a $10 million money laundering scheme. Prosecutors contend that between 2018 and 2025, the company knowingly accepted funds from wire fraud and narcotics trafficking operations using its ATM network.

Despite having Know Your Customer (KYC) procedures in place, authorities allege Isa converted these funds into cryptocurrency and transferred them to wallets designed to obscure source origins. Both Isa and the company have pleaded not guilty to a conspiracy charge, which carries a potential 20-year federal prison sentence. If a conviction occurs, assets related to the alleged activities could be subject to government seizure. Reporting via Cointelegraph.

Regulatory Scrutiny and Market Reaction

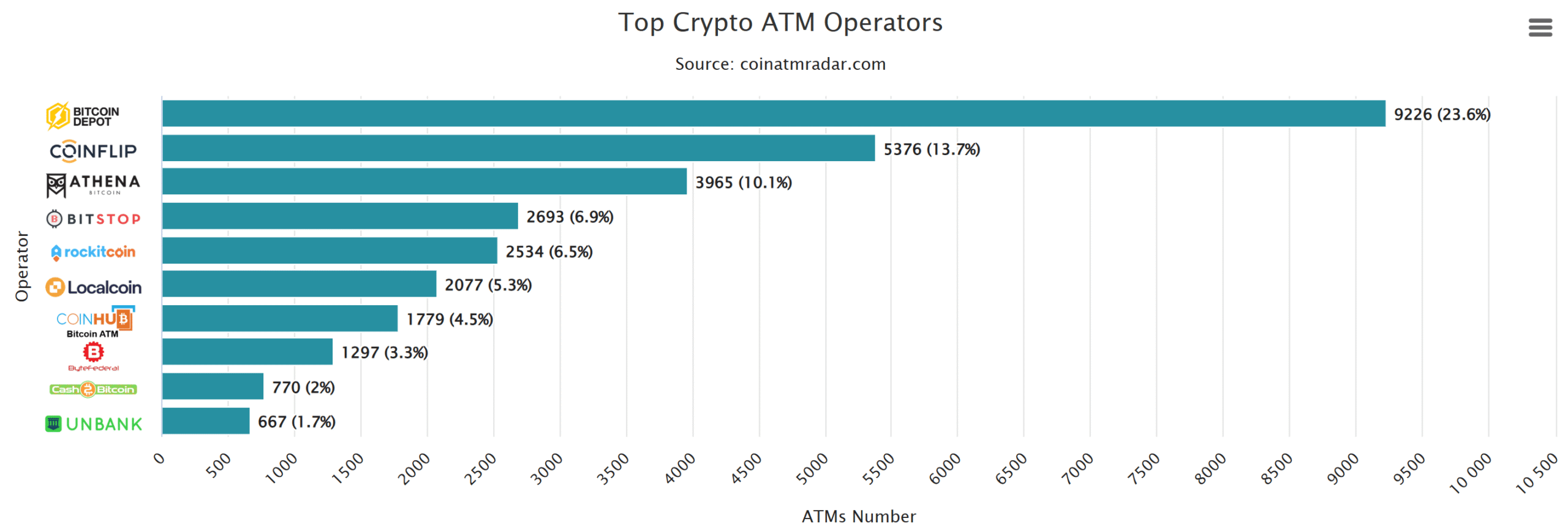

Crypto ATMs face mounting pressure from U.S. regulators and law enforcement due to their vulnerability to fraud and use in illicit financial activities. In 2024, the Federal Bureau of Investigation recorded nearly 11,000 scam complaints involving crypto kiosks, amounting to more than $246 million in losses. This rise in fraudulent activity has prompted lawmakers and local governments to scrutinize the sector further.

Some cities, such as Stillwater, Minnesota, and Spokane, Washington, have enacted bans on crypto ATMs after residents suffered significant financial losses from scams involving the machines. Other jurisdictions, like Grosse Pointe Farms in Michigan, have set transaction limits to curb potential abuse, imposing a $1,000 daily cap and a $5,000 two-week ceiling on future kiosk transactions.

The regulatory outlook remains complex, with additional federal and local rules likely as the industry evolves. For broader context on cryptocurrency regulations and market adjustments, visit our cryptocurrency section.

What’s Next for Crypto Dispensers?

As Crypto Dispensers undertakes its strategic review, the outcome is uncertain. The company could pursue a sale, restructure its business, or maintain its independence. The legal proceedings against CEO Firas Isa and the company will also play a significant role in shaping its future direction. Continued developments in the regulatory landscape for crypto ATMs could further influence business operations and compliance practices.

Market participants and users of crypto ATMs are advised to monitor updates closely, as the intersection of regulatory scrutiny and evolving business strategies will likely impact both service availability and security standards in the sector.

Sources: Cointelegraph