Bitcoin White Paper 17th Anniversary: Impact and Market Trends

Background: 17 Years of Bitcoin Since the White Paper

The Bitcoin white paper 17th anniversary was celebrated on October 31, 2023, marking 17 years since Satoshi Nakamoto released the founding document, “Bitcoin: A Peer-to-Peer Electronic Cash System.” The white paper, published on October 31, 2008, proposed a decentralized, peer-to-peer financial network secured by proof-of-work (PoW) consensus. Nakamoto introduced Bitcoin in response to the 2008 global financial crisis, emphasizing a system that eliminates the need for traditional intermediaries and solves the double-spending problem without central control.

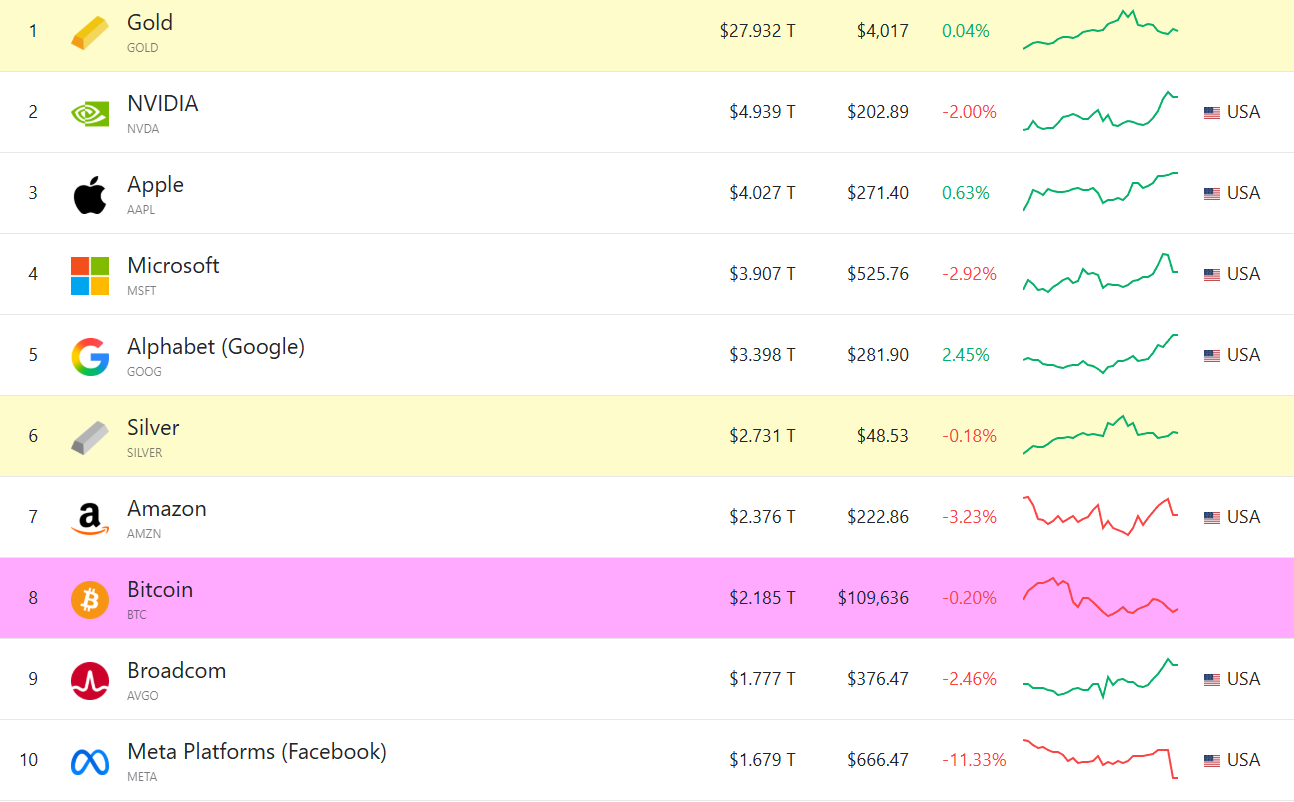

Just three months after sharing the white paper, Nakamoto launched the Bitcoin network by mining the genesis block, which came with a reward of 50 BTC. This event laid the foundation for the first global decentralized digital currency. Since then, Bitcoin has transitioned from a niche project to a widely recognized digital asset now valued at approximately $2 trillion. According to CompaniesMarketCap rankings, Bitcoin stands as the eighth-most-valuable asset worldwide, following silver and Amazon.

Market Reaction and October Downturn

This anniversary arrives during a challenging market period for Bitcoin. Data from CoinGlass shows that October 2023 broke Bitcoin’s six-year streak of positive “Uptober” performances. Historically, October has been the second-strongest month for Bitcoin, delivering average returns of 19.9%. However, Bitcoin’s price declined by over 3.5% this October, marking its first monthly loss for the month since 2018, when it dropped 3.8%.

On October 17, 2023, the crypto market experienced a sharp correction with Bitcoin reaching a four-month low, briefly dipping below $105,000 amid a $19 billion market-wide downturn. Crypto analysts described this correction as a “controlled deleveraging,” intended to remove excess leverage and establish a more sustainable market basis for future growth.

Industry Reflections and Future Outlook

Narek Gevorgyan, founder and CEO of CoinStats, commented on Bitcoin’s evolution since the white paper’s publication. “Since then, we’ve witnessed remarkable growth: institutional adoption, regulatory clarity, and millions of users discovering financial freedom through digital assets,” Gevorgyan told Cointelegraph.

Despite the recent setback, Bitcoin continues to attract institutional and government-level attention, reinforcing its standing as a transformative financial technology. The rapid ascent of Bitcoin over the past 17 years demonstrates its role in advancing digital assets and transforming how value is stored and transferred globally.

For broader insights into the cryptocurrency market, explore related coverage on Vizi’s cryptocurrency section.

What’s Next for Bitcoin?

As it heads into its eighteenth year, Bitcoin remains a subject of close observation by investors, institutions, and regulators. Future trends may be shaped by further regulatory developments, increasing financial institution engagement, and technological upgrades. The recent downturn has not diminished long-term optimism, with many analysts citing Bitcoin’s previous recoveries as an indication of underlying resilience.

Bitcoin’s journey from the publication of the white paper to its current status underlines the digital asset’s significant transformation and expected trajectory for continued innovation and influence in global finance.

Sources:

Cointelegraph