Trump Crypto Project Freezes User Funds After Attack

Background: Security Breach Impacts User Wallets

The Trump family-backed crypto initiative, World Liberty Financial (WLFI), has drawn renewed scrutiny over its ability to freeze and reassign user funds. The platform, which markets itself as “community governed,” confirmed on Wednesday that it will reallocate assets affected by a recent pre-launch phishing attack. According to WLFI, the breach exposed the seed phrases of a “relatively small subset” of user wallets, with attackers exploiting vulnerabilities stemming from “third-party security lapses,” rather than any issue with WLFI’s own platform or smart contracts.

In an official post on the X platform, WLFI stated, “This was not a WLFI platform or smart contract issue. Attackers gained access to user wallets through third-party security lapses” (via Cointelegraph).

Freezing and Reallocating User Funds

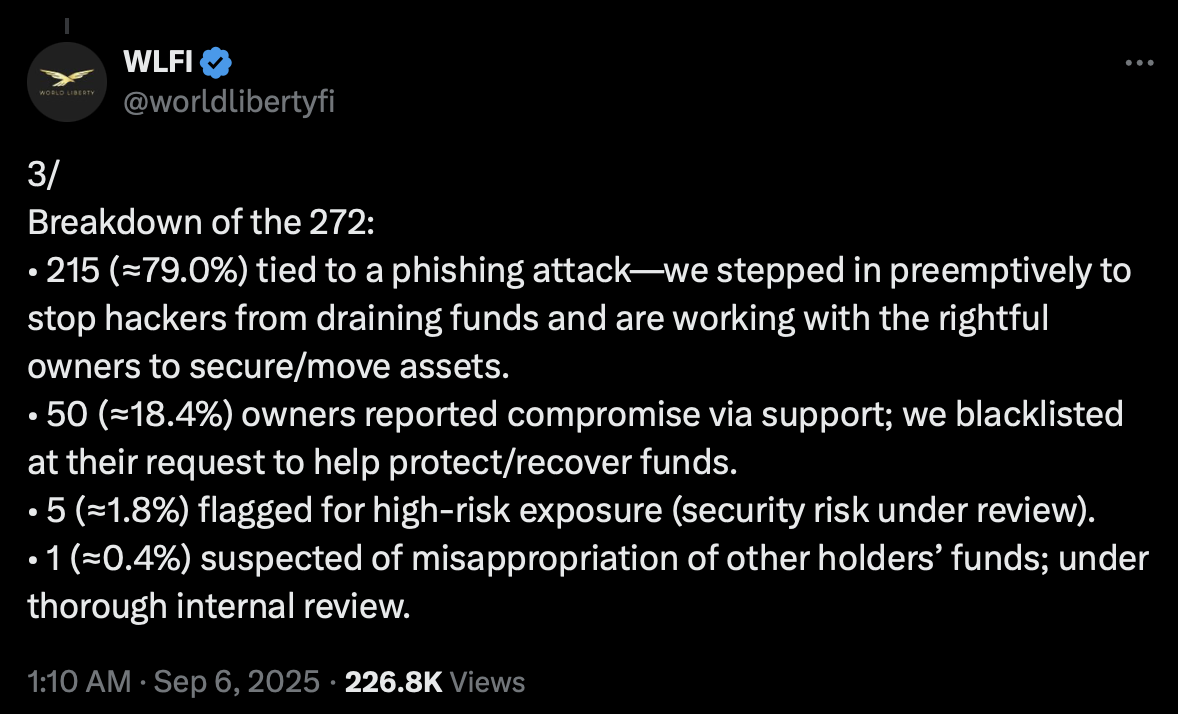

As part of its response, the Trump crypto project blacklisted 272 wallets—215 of which were connected to the phishing attack. Of these, 50 wallets were directly reported by users as compromised. WLFI initially froze all affected accounts in September to investigate the attack and prevent further losses. The platform says only those users who have completed Know Your Customer (KYC) verification will be eligible for the asset reallocation. Accounts lacking verified KYC status remain frozen for the time being.

WLFI indicated it had “stepped in preemptively to stop hackers from draining funds and are working with the rightful owners to secure/move assets,” as stated in a Sept. 6 X post. The project has not publicly disclosed the full value of assets impacted by the incident, and inquiries by reporters remain unanswered as of this publication.

Market Reaction and Centralization Concerns

The Trump crypto project’s approach has reignited debate regarding platform centralization and control over user assets. Some users on X criticized WLFI’s power to freeze or move funds without broader decentralized governance mechanisms. One pseudonymous blockchain developer, flick, commented, “The entire ecosystem is dependent on your security. Everyone will get phucked in the end,” highlighting concerns over central oversight.

Others, however, viewed the Trump crypto project’s action as a sign of accountability, applauding WLFI’s attempt to make affected users whole following the phishing attack. “Good to see a project actually taking responsibility instead of hiding behind ‘not our fault’. User safety > everything,” wrote crypto trader DefiBagira in a public X response.

What’s Next for Users and the Project?

With the asset reallocation process underway, only users who complete KYC verification are able to regain access to their funds. Those who have not yet verified their identities remain locked out. WLFI’s team continues to work with affected wallet owners to secure and potentially return assets, though questions remain regarding the future management of user funds and decentralized governance. The platform’s recent actions are likely to sustain debate within the broader cryptocurrency community over centralization versus user control.

Sources

Reporting via Cointelegraph.