Blockchain Networks Fund Freezing: Bybit Reveals Capabilities

Bybit Research Uncovers Fund Freezing in 16 Blockchain Networks

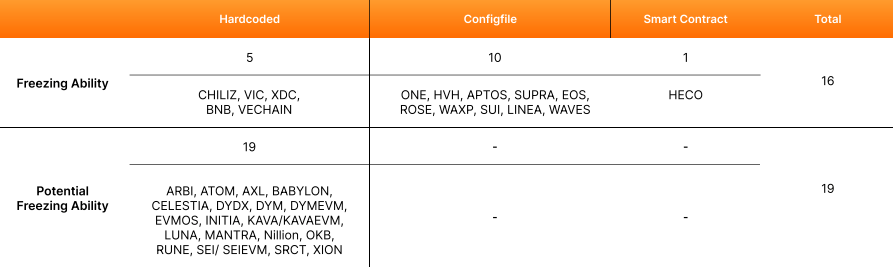

A recent report by Bybit’s Lazarus Security Lab has revealed that 16 blockchain networks have built-in capabilities to freeze or restrict user funds. The research, released on Tuesday, was based on the analysis of 166 blockchain networks using both AI-driven techniques and manual review. The main keyword, blockchain networks fund freezing, highlights concerns around decentralization and user autonomy in these digital ecosystems.

Background: Protocol-Level Freezing Mechanisms Identified

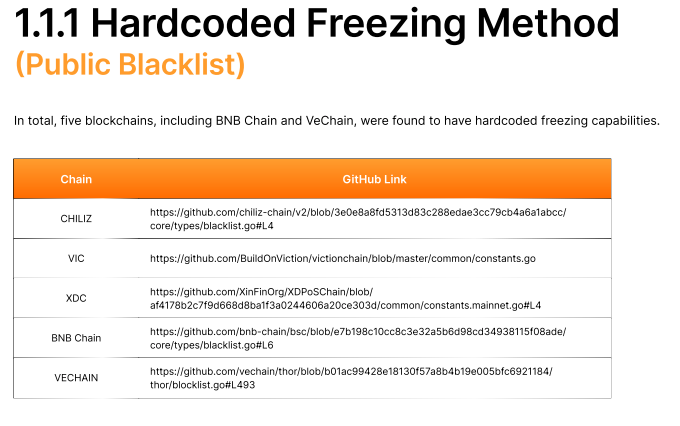

The Bybit research team found three primary mechanisms through which these blockchain networks fund freezing can occur. First, some networks employ a hardcoded freezing method or public blacklist, allowing direct intervention at the code level. Second, certain blockchains utilize a configuration file-based system—referred to as a private blacklist—managed through files like YAML, ENV, or TOML. These are typically accessible only to validators and core developers. Third, freezing can be implemented via onchain smart contract mechanisms.

For example, BNB Chain, VeChain, Chiliz, Viction, and the XDC Network were found to have freezing functions directly within their source code, based on reviews of their public GitHub repositories. On the other hand, Aptos, Eos, and Sui employ config-based systems. The report noted that the Heco chain (Huobi Eco Chain) is unique for managing a blacklist through an onchain smart contract.

Potential for Future Expansion: Cosmos Ecosystem and Related Networks

Alongside the 16 networks already capable of freezing, Bybit’s analysts also identified 19 blockchains where freezing features could be added with “relatively minor protocol changes.” This includes the Cosmos chain, where module accounts—controlled by program logic rather than private keys—could theoretically be adapted for future freezing functions. According to the report, “this function could, in theory, be modified in the future to add a hacker’s address, but so far none of the blockchains in the Cosmos ecosystem have used it in this way,” as stated in the report via Cointelegraph.

Market Reaction and Concerns About Decentralization

The findings add fuel to ongoing debates about the true level of decentralization in blockchain platforms. As more networks incorporate admin-level controls, compliance modules, and emergency intervention capabilities, some experts warn that these steps, even if intended for safety, may centralize power and introduce potential censorship risks. Bybit researchers highlighted that while these mechanisms help combat hacks or thefts, they also “raise deeper concerns about censorship and centralized control in blockchain systems,” according to Bybit’s Lazarus Security Lab.

These revelations come in the wake of a significant security incident in which Bybit suffered a $1.5 billion cold wallet hack. Through quick action and cooperation with partners such as Circle, Tether, THORchain, and Bitget, $42.9 million in stolen funds were frozen, while the mETH Protocol managed to recover approximately $43 million in cmETH tokens.

What’s Next for Blockchain Networks and User Protection?

The increasing ability of blockchain networks to freeze funds is likely to prompt further industry discussion regarding user protections and oversight mechanisms. As networks evolve and face greater security and regulatory scrutiny, transparency about administrative controls and freezing processes will become more important for users and developers alike. For more coverage on the crypto industry’s latest trends, visit Vizi’s cryptocurrency resources.

Sources

Reporting via Cointelegraph