US government shutdown: Crypto bill talks and ETF delays

Background: Shutdown enters fourth week as Senate preps key vote

The US government shutdown is approaching its fourth week, marking the third-longest closure in American history. Since October 1, federal operations have been halted due to a deadlock in Congress on funding legislation. The Senate is scheduled to vote at 5:30 p.m. ET on Monday, marking the eleventh attempt to end the impasse. If the Senate passes the proposed funding measure and the president signs it, the government would reopen. A failure in the vote, however, would prolong the shutdown. (Cointelegraph)

Crypto bill discussions continue despite funding deadlock

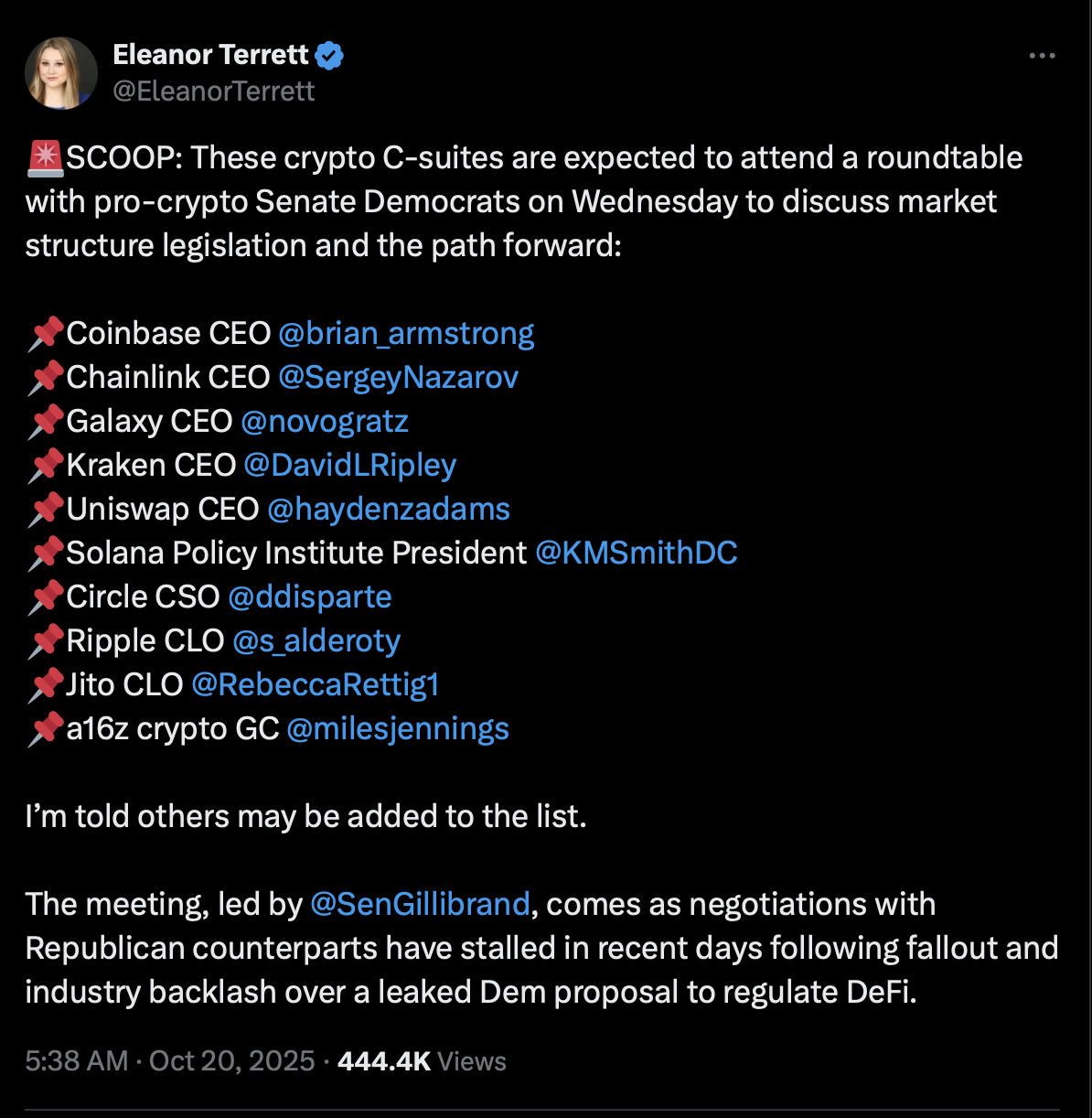

Despite the ongoing US government shutdown, lawmakers are pressing ahead with key policy discussions, including cryptocurrency market regulation. On Wednesday, Senate Democrats will host a roundtable with top crypto industry executives from firms such as Coinbase, Kraken, Circle, and Ripple. The meeting, led by Senator Kirsten Gillibrand, aims to address the long-stalled crypto market structure bill. Journalist Eleanor Terrett reported via X that the session will discuss a recent counter-proposal by Senate Democrats that critics say would “kill DeFi” and counter the bipartisan CLARITY Act passed by the House in July.

The Senate’s proposed market-structure bill is intended as a counterpart to the CLARITY Act, seeking to establish a comprehensive federal framework for digital assets regulation. Lawmakers hope these talks will break the legislative deadlock and move key crypto regulations forward, even as the broader government remains shuttered.

Market impact: Crypto ETF approvals face shutdown delays

The prolonged US government shutdown has also affected the cryptocurrency market, particularly exchange-traded funds (ETFs). The Securities and Exchange Commission (SEC), with staff limited by the shutdown, missed key deadlines for ETF approvals. Notably, the first missed deadline was for Canary’s proposed Litecoin ETF on October 2. Bloomberg analyst Eric Balchunas noted via social media that both this ETF and Canary’s HBAR ETF appear ready but are delayed by the federal shutdown.

Cointelegraph reports that up to 16 crypto ETFs, including those tracking Solana, XRP, Dogecoin, and Litecoin, were slated for decision in October, with another 21 applications submitted in early October. The approvals are on hold pending the return of full SEC operations. Major issuers such as Bitwise, Fidelity, Franklin Templeton, CoinShares, Grayscale, Canary Capital, and VanEck have provided updated filings reflecting new staking provisions for some ETFs, but all final decisions are pending the resolution of the government shutdown.

What’s next: Awaiting Senate vote and crypto discussions

The upcoming Senate vote on funding and Wednesday’s roundtable on the crypto market structure bill are critical next steps for both the US government shutdown and digital asset regulation efforts. Resolution of the funding crisis would likely accelerate pending government actions, including long-delayed ETF reviews by the SEC. Lawmakers and industry executives will continue to negotiate over the future US crypto regulation landscape, amid hopes for bipartisan progress when the government reopens.

For further information on cryptocurrency policies and regulations, visit the Cryptocurrency section of Vizi.