Bybit Pauses New User Registrations in Japan Amid FSA Crypto Regulations

Background: Bybit Responds to Japan’s Regulatory Changes

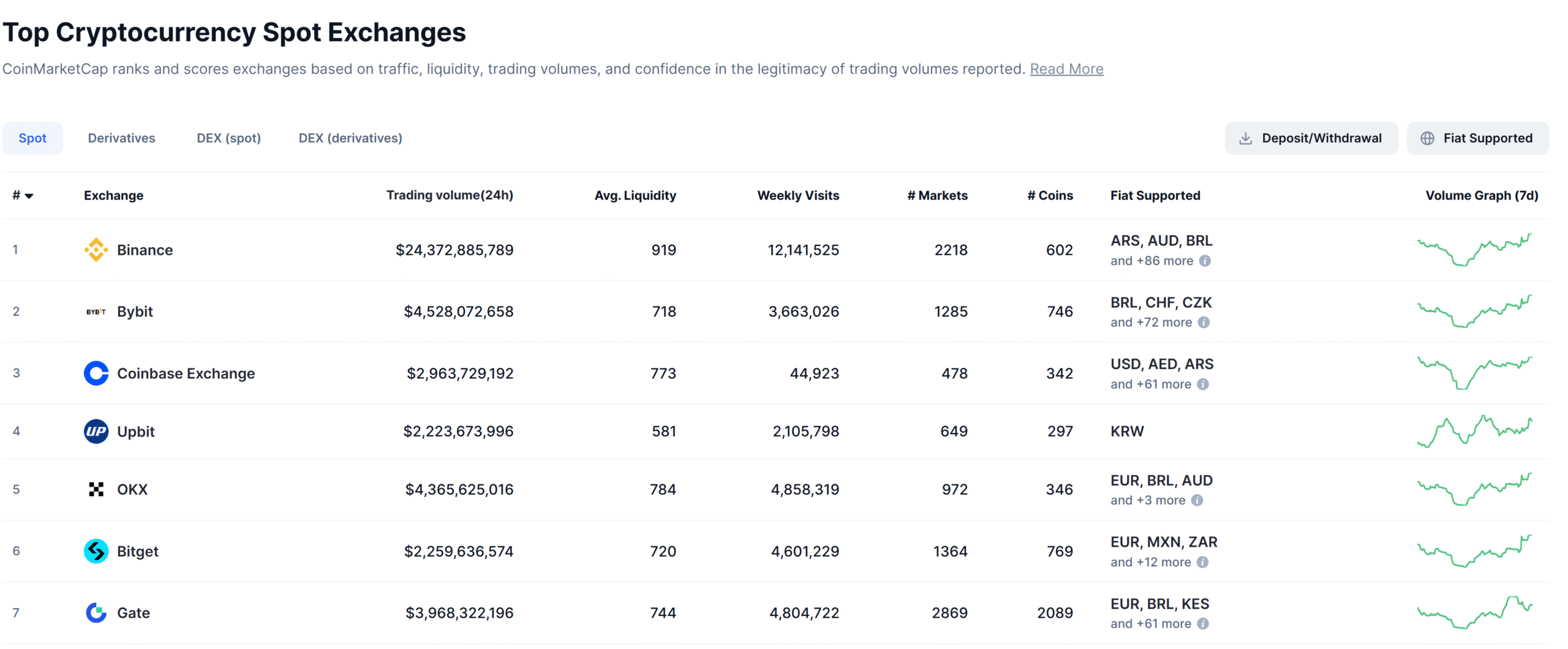

Bybit, currently the world’s second-largest crypto exchange by trading volume, has announced it will halt new user registrations in Japan beginning October 31. The pause is a direct response to evolving digital asset regulations from Japan’s Financial Services Agency (FSA), according to an official statement from the company.

The crypto exchange stated that the decision is part of its “proactive approach” to align with the country’s newly developing regulatory framework for digital assets. “It has always been Bybit’s commitment to operate responsibly and in compliance with local laws and regulatory expectations,” the company noted in its announcement (Cointelegraph).

Market Reaction: Banks May Enter Crypto Sector

Current Japanese customers will not be impacted by this decision, as all existing Bybit services are set to remain operational for them. The exchange said it will provide further updates as it continues discussions with regulators about future compliance steps. This move by Bybit comes as Japan considers wider regulatory reforms in its banking and financial sectors.

Last week, it was reported that the FSA is reviewing proposals to allow banks in Japan to acquire, hold, and trade cryptocurrencies like Bitcoin (BTC), as well as operate licensed crypto exchanges. These reforms, under review at an upcoming Financial Services Council meeting, are designed to bring digital assets into closer alignment with traditional financial instruments such as stocks and government bonds. The FSA also seeks to address the risks associated with crypto market volatility, which could lead to new capital and risk-management requirements for banks before they are permitted to hold digital assets.

Such policy changes may pave the way for broader institutional adoption of cryptocurrencies within Japan’s regulated banking environment.

Industry Implications and Startup Challenges

Industry experts say these developments reflect ongoing challenges and opportunities for crypto startups in Japan. In July, Maksym Sakharov, co-founder and CEO of the decentralized onchain bank WeFi, suggested to Cointelegraph that regulatory barriers, rather than taxation, are driving crypto innovation out of the country. He argued that even if a proposed 20% flat tax on crypto gains is introduced, Japan’s “slow, prescriptive, and risk-averse” approach to regulatory approvals may continue to push startups and liquidity offshore. This highlights the delicate balance between market growth and regulatory oversight now at play in Japan’s crypto sector.

What’s Next for Bybit and the Japanese Crypto Market?

Bybit is expected to maintain all existing services for current users in Japan while awaiting further guidance from regulators. The FSA’s ongoing review could potentially lead to significant changes in the nation’s crypto landscape, with the possibility of banks entering the crypto market if new policies are enacted. Bybit’s continued cooperation with regulators is likely to influence both the exchange’s local operations and Japan’s broader digital asset industry.

For ongoing coverage of cryptocurrency regulations and market developments in Japan and beyond, visit the cryptocurrency news section on Vizi.

Sources

Reporting via Cointelegraph.