Crypto Liquidations: Regulatory Investigation Called by Crypto.com CEO

Background to the Record Crypto Liquidations

Crypto.com CEO Kris Marszalek has urged regulators to conduct a regulatory investigation following a surge of $20 billion in crypto liquidations over the past 24 hours, according to Cointelegraph. In a statement posted Saturday on X, Marszalek asked authorities to “conduct a thorough review of fairness of practices,” particularly questioning whether trading platforms had “slowed down to a halt… not allowing people to trade” and if all trades were “priced correctly and in line with indexes.”

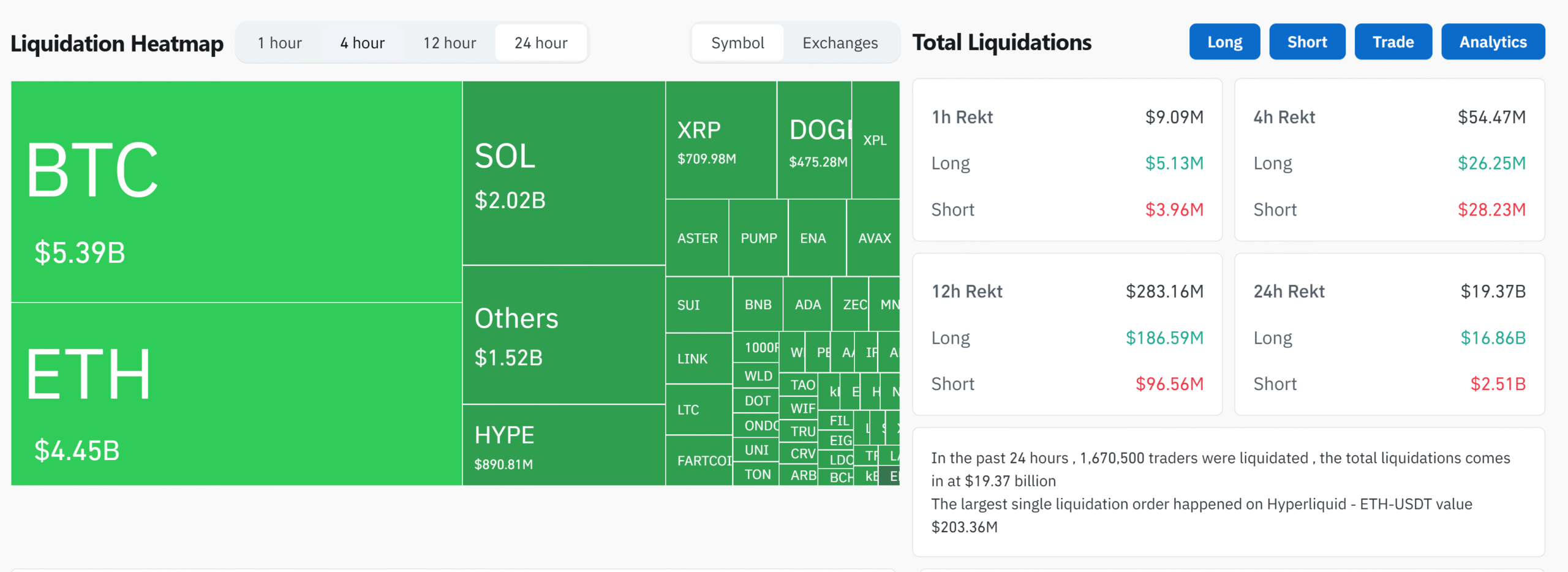

The unprecedented scale of crypto liquidations became apparent after rapid price movements across digital asset markets. Data from CoinGlass revealed Hyperliquid led all exchanges with $10.31 billion in wiped-out positions, followed by Bybit with $4.65 billion and Binance with $2.41 billion. Other exchanges, such as OKX ($1.21 billion), HTX ($362.5 million), and Gate ($264.5 million), recorded comparatively lower amounts.

Market Reactions and Exchange Responses

The event’s impact reached major exchanges, particularly Binance, which confirmed a price depeg incident involving tokens like Ethena’s USDe (USDE), BNSOL, and WBETH. This led to forced liquidations for certain users. Binance stated it is “reviewing the affected accounts and appropriate compensation measures.”

Some users reported financial losses allegedly caused by system errors on Binance. One trader wrote that their short position was automatically closed while their long remained open, resulting in a full loss—an issue they claimed did not occur on rival platforms. Binance co-founder Yi He acknowledged the complaints, apologizing publicly for “significant market fluctuations and a substantial influx of users” and promising compensation for “verified cases where platform errors caused losses.” However, she clarified that, “Losses resulting from market fluctuations and unrealized profits are not eligible.”

Crypto analyst Quinten François noted the scale of this wipeout eclipses previous record events. The estimated $19.31 billion in liquidations surpasses those from both the COVID-19 market crash ($1.2 billion) and the FTX collapse ($1.6 billion).

Broader Economic Drivers and What’s Next

The crypto market volatility that led to the crypto liquidations regulatory investigation follows recent geopolitical developments. U.S. President Donald Trump announced a 100% tariff on all Chinese imports starting November 1, in response to China’s newly introduced restrictions on rare earth mineral exports. These minerals, vital for technology manufacturing, are an area where China dominates supply.

China’s move means any product containing more than 0.1% Chinese rare earths will require an export license effective December 1. Trump criticized this as “a moral disgrace,” and suggested he may cancel a scheduled meeting with President Xi Jinping at the upcoming APEC summit.

As exchanges investigate liquidation practices and users await outcomes on compensation, regulatory scrutiny may intensify. Market participants and analysts will be watching for possible inquiries by global regulators into potential market manipulation or compliance lapses during periods of extreme turbulence.

For further insights on cryptocurrency markets and regulatory developments, visit the cryptocurrency section on Vizi.com.