Crypto Fear & Greed Index Plunges After $230B Market Loss

Market Sentiment Turns to Fear as Sell-Off Hits Crypto Sector

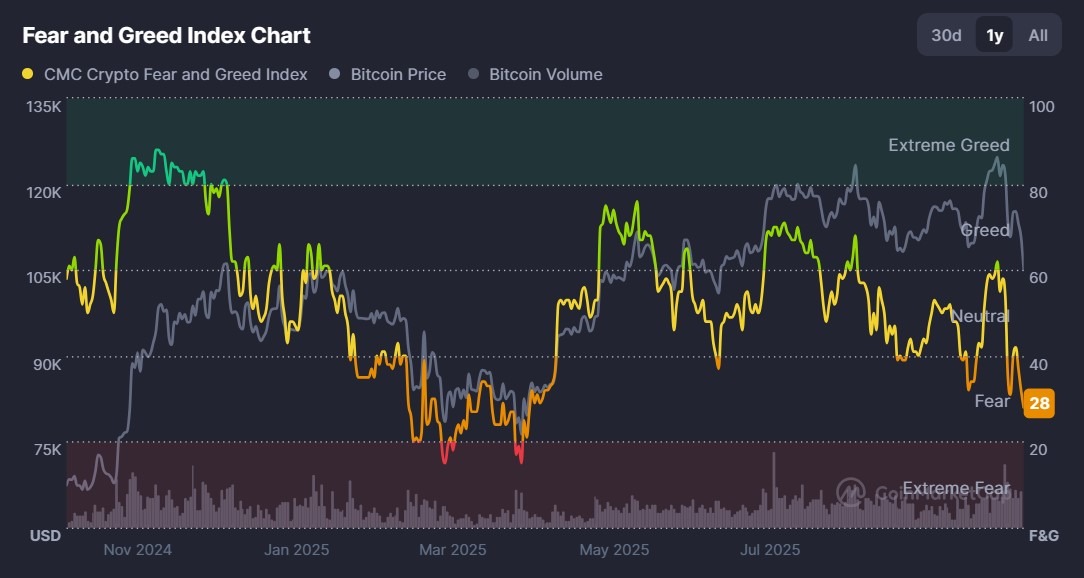

The Crypto Fear & Greed Index plunged to “fear” territory this week, as a sharp market sell-off erased over $230 billion from the overall cryptocurrency market in a single day. According to CoinMarketCap data, the index reached a low of 28 on Friday, marking its lowest level since April and edging closer to “extreme fear.”

On Friday, the total market capitalization dropped to approximately $3.54 trillion, a 6% decline from $3.78 trillion the previous day. This downturn marked one of the most substantial single-day pullbacks in recent months, impacting nearly all major digital assets.

Cryptocurrency Prices Decline Across the Board

The recent crash significantly affected the prices of leading cryptocurrencies. Bitcoin (BTC) fell almost 6% to around $105,000, while Ether (ETH) declined 8% to $3,700. Among large-cap altcoins, BNB registered the steepest loss with a drop of nearly 12%. Chainlink (LINK) and Cardano (ADA) followed, declining by 11% and 9% respectively.

Other major coins, such as Solana (SOL) and XRP, also experienced declines exceeding 7%, extending a week-long downward stretch that reversed earlier gains. On average, top non-stablecoin digital assets fell by approximately 8% to 9% over the last 24 hours. The broader sell-off also affected memecoins, which lost 33% in the past day, and blue-chip non-fungible tokens (NFTs), whose total sector valuation dropped below $5 billion—levels previously seen in July, according to CoinGecko data.

Market Liquidations and ETF Outflows Highlight Downturn

Despite the steep market drop, the rate of liquidations was lower compared to the previous week’s crash. Data from CoinGlass revealed roughly $556 million in leveraged crypto positions were wiped out on Friday; $451 million came from long positions and $105 million from short positions. In comparison, last week’s volatility led to nearly $20 billion in liquidations.

Both spot Bitcoin and Ether exchange-traded funds (ETFs) saw notable outflows. CoinTelegraph reported that spot Bitcoin ETFs recorded over $536 million in withdrawals, while Ether ETFs saw daily net outflows exceeding $56 million.

The ongoing sell-off has also resonated with more traditional markets. The Fear & Greed Index for traditional assets fell to 22, signaling “extreme fear,” after U.S. stocks declined on Thursday amid credit market stress and renewed U.S.–China trade tensions.

What’s Next for Crypto Market Sentiment?

The sharp drop in the Crypto Fear & Greed Index reflects prevailing uncertainty following significant losses across digital asset classes. As volatility persists, market watchers are closely monitoring further reactions across cryptocurrencies, NFTs, and ETFs. Future price recovery or continued downturn may hinge on macroeconomic factors and investor sentiment shifts, as indicated by sentiment indices and trading volumes.

For the latest updates and industry trends, visit Vizi’s cryptocurrency news section.

Sources: