UK Crypto Tax Warning Letters Double as HMRC Ramps Up Scrutiny

Background: Surge in Crypto Warning Letters

The UK tax authority, HM Revenue & Customs (HMRC), has significantly increased its enforcement efforts against crypto tax non-compliance. Nearly 65,000 UK crypto tax warning letters were sent to investors believed to have underreported or evaded taxes on digital assets in the 2024–25 tax year, according to data obtained by the Financial Times. This figure marks a sharp rise from the 27,700 letters sent in the previous year, reflecting mounting concern over undeclared crypto gains.

Known as “nudge letters,” these communications prompt investors to voluntarily update their tax filings before a formal investigation is initiated. Over the past four years, HMRC has dispatched more than 100,000 such letters as both crypto adoption and asset values have surged in the UK.

Crypto Adoption and HMRC Enforcement

The push for tax compliance comes as crypto ownership climbs steadily in the United Kingdom. According to the Financial Conduct Authority, approximately seven million UK adults now own crypto. This represents a notable increase compared to around 10% of the population, or five million people, in 2022 and just 4.4% (2.2 million) in 2021.

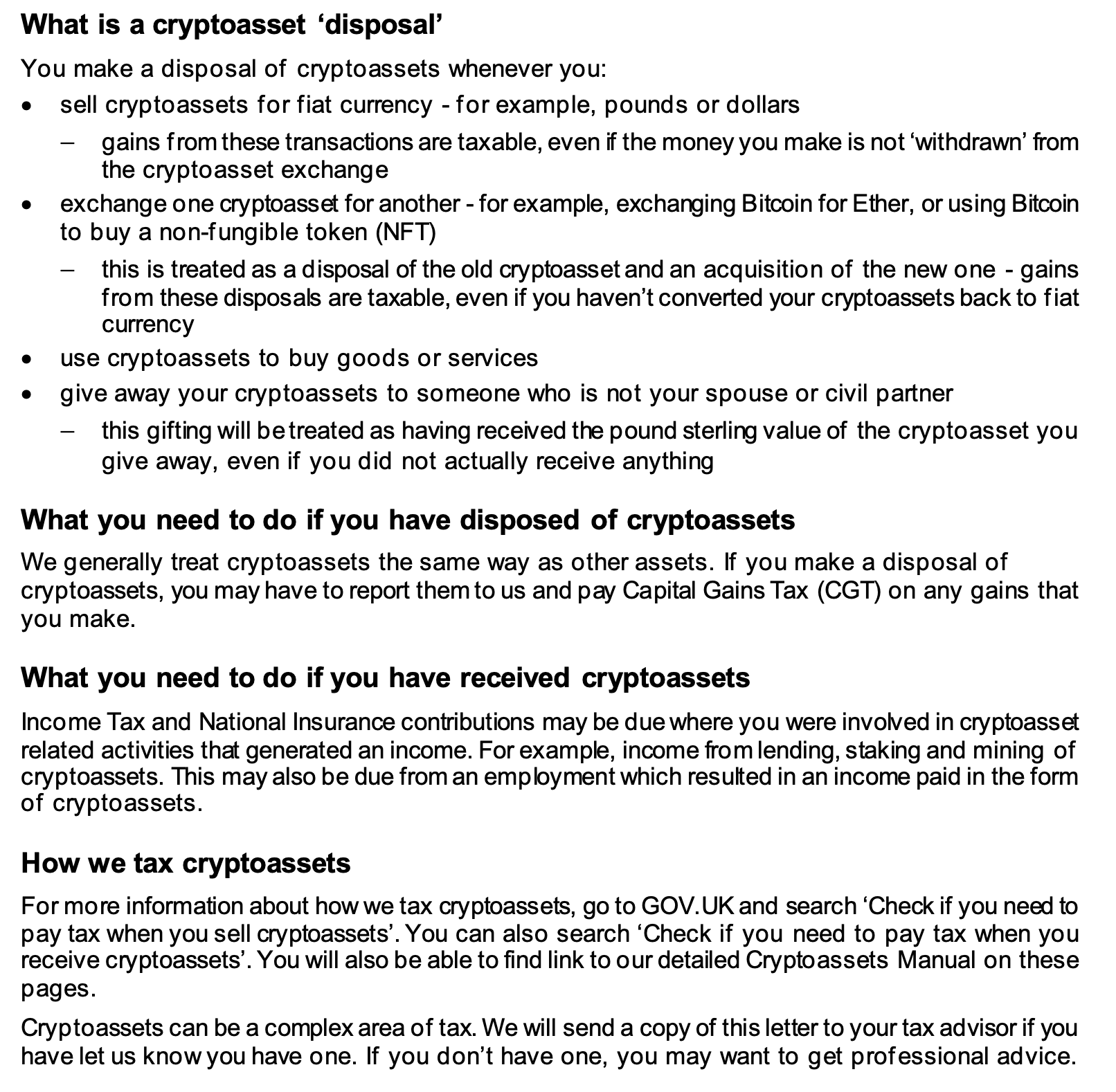

Neela Chauhan, a partner at UHY Hacker Young, told the Financial Times that tax rules around cryptocurrencies are “quite complex and there’s now a volume of people who are trading in crypto and not understanding that even if they move from one coin to another it triggers capital gains tax.” She added that the increased scrutiny is likely tied to a rise in individuals unaware of their tax obligations when transacting in digital assets.

HMRC’s access to crypto data has expanded. The agency now receives transaction data directly from major crypto exchanges. From 2026, as part of the OECD’s Crypto-Assets Reporting Framework (CARF), HMRC will gain automatic access to global exchange data, further boosting its oversight.

Global Tax Compliance Efforts and Market Reaction

The UK is not alone in intensifying its approach to crypto tax enforcement. South Korea’s National Tax Service (NTS) has also stepped up efforts, warning that even cryptocurrency assets stored in cold wallets may be subject to seizure if linked to unpaid taxes.

In the United States, lawmakers are considering updates to crypto tax policies. Senate Finance Committee discussions in June explored whether routine crypto payments should be taxed as capital gains and debated classification of staking rewards. Coinbase tax executive Lawrence Zlatkin advocated for a de minimis exemption for transactions under $300, stating during the hearing, “Small crypto transactions should not be taxed, to encourage practical use” (Cointelegraph).

These regulatory actions across multiple jurisdictions indicate a worldwide trend towards stricter oversight and reporting of cryptocurrency transactions.

What’s Next for Crypto Investors in the UK?

With the number of UK crypto tax warning letters on the rise and more transparent data-sharing mechanisms on the horizon, UK crypto investors should expect continued scrutiny. Experts recommend reviewing tax returns for undeclared crypto gains and maintaining thorough records of digital asset transactions.

Those receiving a “nudge letter” from HMRC are encouraged to respond promptly and seek advice to ensure full compliance. The evolving regulatory environment signals that individuals and businesses dealing in crypto should stay informed to avoid penalties.

For more updates and news about cryptocurrencies and compliance, visit Vizi Cryptocurrency News.

Sources: Cointelegraph, Financial Times