Digital euro launch timeline: ECB targets 2029 rollout

ECB advances digital euro plans pending legal framework

The European Central Bank (ECB) has announced progression to the next phase in the digital euro project, building on groundwork that started in late 2023. The central bank revealed that, if the legislative framework is in place by 2026, the Eurosystem could pilot the digital euro in 2027, with a potential full launch as early as 2029. “If legislation in place in the course of 2026, a pilot exercise could start in 2027 and the Eurosystem should be ready for a potential first issuance of the digital euro during 2029,” the ECB stated.

Background: Project development and legislative challenges

The ECB began examining the digital euro in 2020, initiating a preparation phase in late 2023. The digital euro project, however, has encountered skepticism from banks, lawmakers, member states, and consumers—primarily due to privacy concerns and broader risks. A legislative proposal that would establish the necessary legal foundation for the digital euro has been under review in the European Parliament since 2023. Progress has been delayed by political debates and the 2024 European elections, pushing back consensus on the way forward.

ECB Board member Piero Cipollone projected in September that a consensus could be achieved by May 2026, clearing the way for the digital euro launch timeline to keep pace with the ECB’s objectives. Cipollone emphasized that a digital euro could guarantee “all Europeans have access to free, universally accepted digital means of payment, even in the event of major disruptions such as war or cyberattacks,” according to reporting by Cointelegraph.

Global context and market reactions

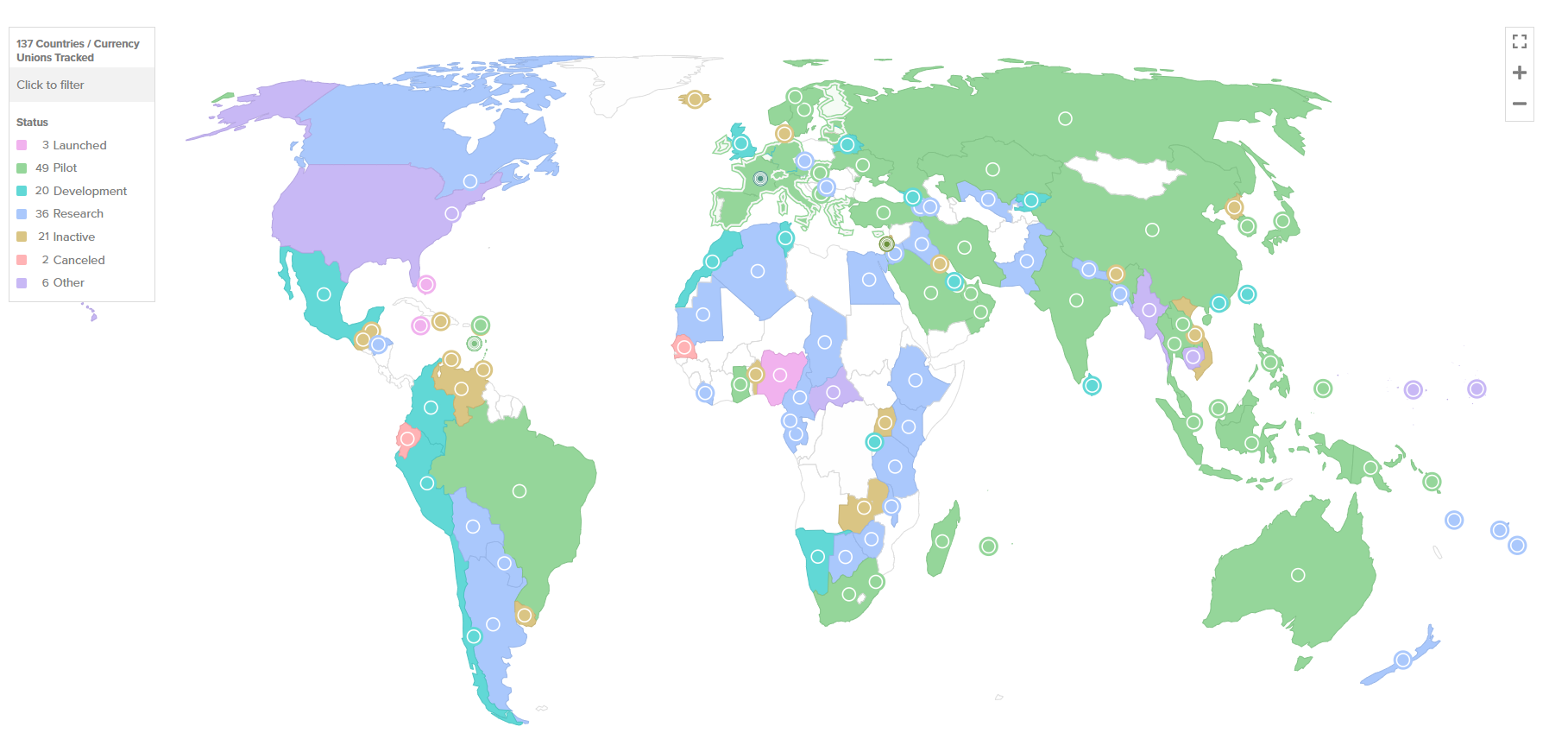

Globally, official central bank digital currency (CBDC) launches remain limited. The Atlantic Council’s CBDC tracker lists only Nigeria, the Bahamas, and Jamaica as having fully implemented digital tokens, despite 49 other jurisdictions currently piloting such projects. These digital innovations are generally assessed for their ability to boost payment efficiency and broaden financial inclusion, as noted by the Human Rights Foundation when it launched its own CBDC tracker in late 2023. Nevertheless, concerns persist over privacy and potential government overreach, which continue to fuel debate in Europe and elsewhere.

What comes next for the digital euro?

The ECB will press on with its development efforts, focusing on establishing the groundwork pending a finalized legal framework. If European legislators reach consensus by 2026, pilot trials of the digital euro could commence in 2027, and the currency might become available for public use by 2029. Ongoing stakeholder feedback and public consultation are expected to influence both the design and implementation of the digital euro. For broader news and updates on cryptocurrencies and CBDCs, see Vizi’s cryptocurrency section.

Sources

Reporting via Cointelegraph.