SharpLink Ether Treasury Expansion Reaches $3.5B

SharpLink Gaming has significantly expanded its Ether treasury, bringing its total holdings to 859,853 ETH, valued at approximately $3.5 billion. The SharpLink Ether treasury expansion follows a recent capital raise and further cements the company’s position as a leading Ethereum treasury asset holder.

Background: Capital Raise and Strategic Acquisitions

SharpLink completed a $76.5 million capital raise on Friday, which enabled the company to acquire an additional 19,271 ETH at an average price of $3,892 per Ether. These actions were made public in a press release on Tuesday, as reported by Cointelegraph.

The company was the first publicly traded organization to announce a treasury strategy centered on Ethereum’s native token, Ether, initiating its approach on May 27 with an initial $425 million private investment in public equity (PIPE). Since launching its treasury in June, SharpLink has also earned 5,671 ETH in staking rewards, with current values around $23.25 million, leveraging Ethereum’s proof-of-stake network to generate yield for its treasury.

Market Reaction and Competitive Position

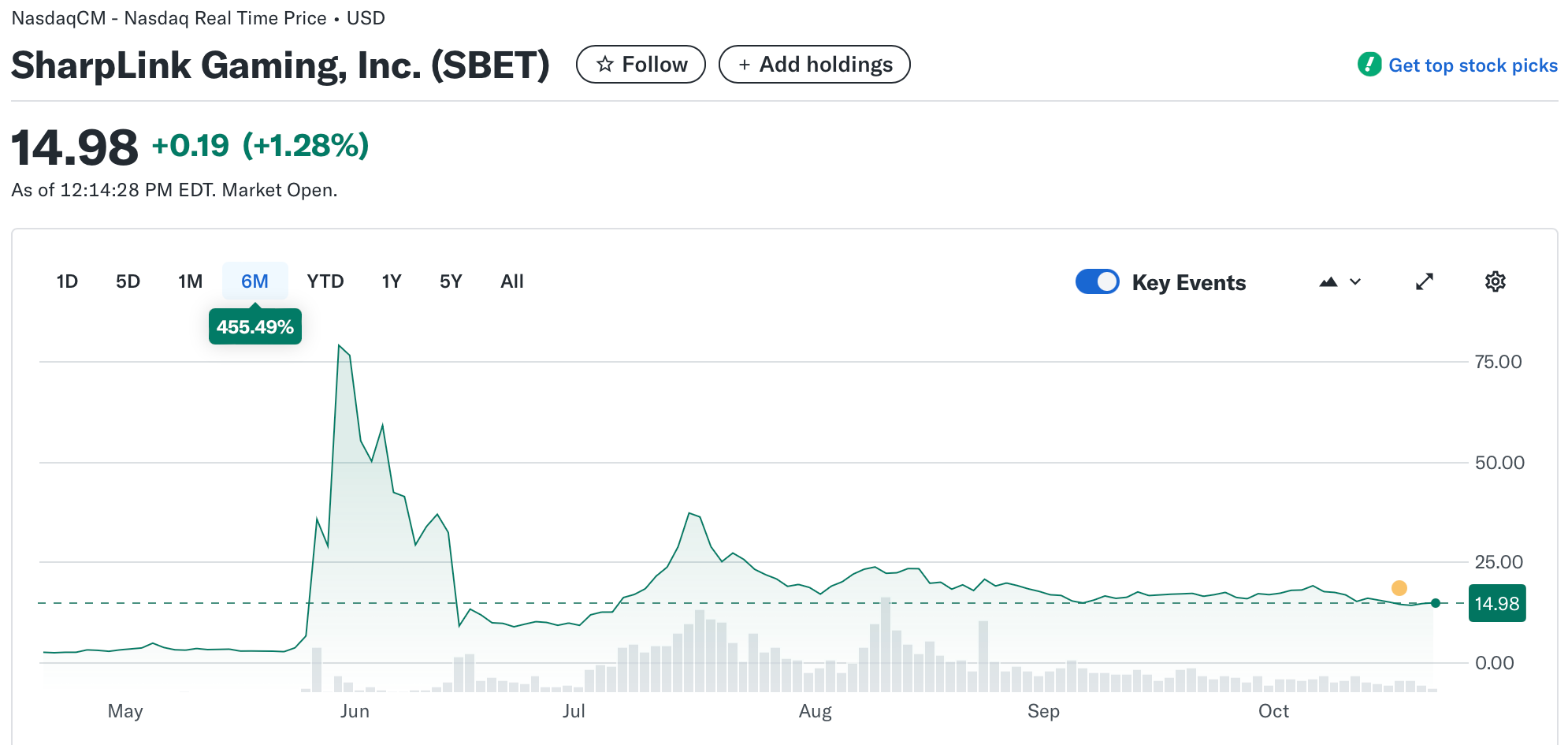

Over the past six months, SharpLink’s stock price has experienced a notable increase of more than 450%, according to Yahoo Finance. This positive market reaction reflects growing investor confidence in the company’s innovative treasury approach and its use of Ethereum staking strategies.

SharpLink now stands as the second-largest Ethereum treasury asset company, following Bitmine Immersion Technologies. Bitmine, which began its ETH treasury operations on June 30 with a $250 million investment, recently purchased another $250 million worth of Ether. As of this report, Bitmine holds around 3.24 million ETH, valued at more than $13 billion, which represents approximately 2.74% of Ether’s total supply. “The current price dislocation represents an attractive risk/reward,” said Bitmine Chairman Tom Lee, according to Cointelegraph.

Ether Machine is also noteworthy in this sector, holding 496,710 ETH as the third-largest treasury and operating as a yield-focused fund for institutional investors.

Ethereum Staking and Broader Market Context

Ethereum’s proof-of-stake protocol enables companies like SharpLink and others to use their ETH holdings as validators, creating a yield-generating asset through staking rewards for their treasury. This approach to Ether treasury management has gained traction among publicly traded companies and institutional investors seeking new ways to generate passive income from crypto holdings.

As reported by Strategicethreserve.xyz, 69 Ethereum treasury companies currently hold a combined total of 5.74 million ETH. Over the past 14 days, however, Ether’s price has decreased by around 14%, and close to 9.6% over the month, based on CoinGecko data. Despite recent price declines, companies continue to view ETH accumulation and staking as a long-term strategic opportunity.

For further information on the evolution of corporate Ethereum treasuries, visit Vizi’s cryptocurrency section.

What’s Next for SharpLink and Ethereum Treasuries?

SharpLink Gaming’s Ether treasury expansion illustrates the growing interest among corporate entities in using ETH as a strategic asset. With ongoing ETH acquisitions and the addition of staking rewards, SharpLink remains at the forefront of Ethereum-based treasury strategies. The broader trend, led by companies like Bitmine Immersion Technologies and Ether Machine, highlights the institutional adoption of proof-of-stake assets for yield generation and balance sheet diversification.

Industry experts will continue to monitor Ether price movements, treasury strategies, and regulatory developments that could affect the adoption of ETH and staking as central components of corporate treasuries.

Sources

Cointelegraph

Yahoo Finance

CoinGecko

Strategicethreserve.xyz