BitMine Acquires Ether: 2.5% of ETH Supply in Aggressive Buy

Background: BitMine’s Major Ether Acquisition Amid Market Crash

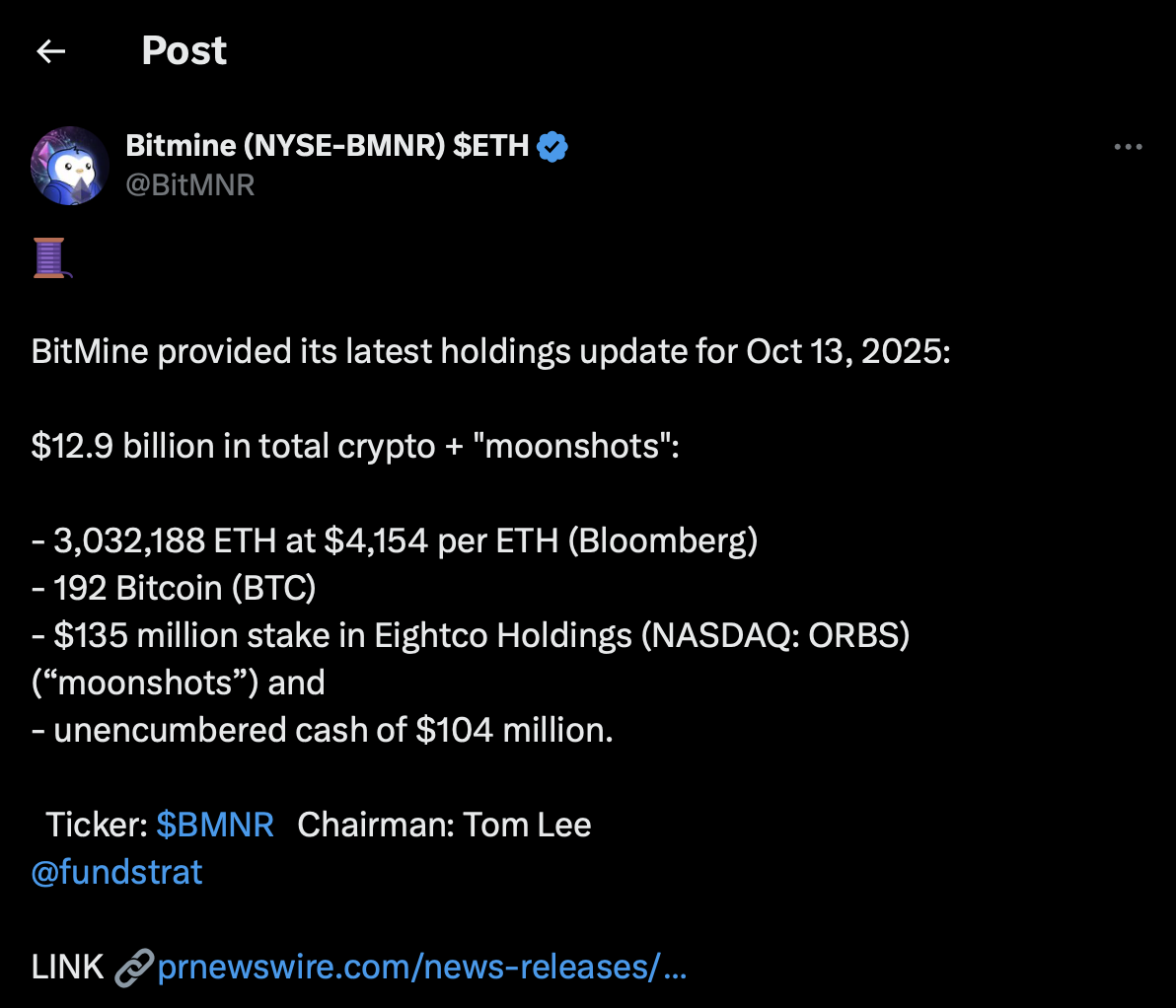

BitMine, recognized as the world’s largest corporate Ether holder, increased its position in Ethereum (ETH) significantly during the recent cryptocurrency market downturn. Over the course of the past weekend, BitMine purchased 202,037 ETH—valued at approximately $827 million—according to a statement posted Monday on X (formerly Twitter). This purchase brings BitMine’s total Ether holdings to more than 3 million ETH, accounting for roughly 2.5% of the total circulating supply of Ethereum.

The company disclosed that its average purchase price for ETH during this acquisition was $4,154 per token. BitMine’s latest move was prompted by a major market correction on Friday, which triggered a rapid $19 billion liquidation event across the cryptocurrency sector.

Market Reaction and Institutional Confidence

The timing of BitMine’s aggressive purchases signals increased institutional confidence in Ether’s long-term prospects. Tom Lee, chairman of BitMine and head of research at Fundstrat, commented, “The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of.” According to Lee, “Volatility creates deleveraging, and this can cause assets to trade at substantial discounts to fundamentals, or as we say, ‘substantial discount to the future,’ and this creates advantages for investors, at the expense of traders,” he added.

BitMine’s buying activity reportedly brings the company “halfway” to its stated treasury goals for cryptocurrency holdings. The firm’s total balance sheet now includes $13.4 billion in assets, with $12.9 billion in diverse crypto and so-called “moonshot” investments, 192 BTC, $104 million in cash reserves, and a $135 million equity stake in Nasdaq-listed Eightco Holdings.

The acquisition strategy may influence other corporations to adopt similar long-term accumulation tactics for crypto assets.

Stock Performance and Broader Impact

While BitMine’s activity in the crypto market has attracted attention, its listed stock, BMNR, experienced an 11% decline over the last five days, based on Google Finance data. This downturn followed a short position taken by Kerrisdale Capital, which criticized BitMine’s business operations. Despite the recent stock drop, BMNR ranked as the 22nd most-traded stock in the US by average five-day trading volume, exceeding $3.5 billion as of last Friday.

The growing interest from traditional market investors, coupled with BitMine’s assertive stance in Ether accumulation, could shape future trends in both the cryptocurrency and equity markets. Analysts continue to watch whether other institutional players will increase their exposure to Ethereum and related digital assets in response to such moves.

For more insights into industry shifts, visit our cryptocurrency coverage.

What’s Next for Ether and BitMine?

BitMine’s actions have sparked discussion about the influence of corporate entities on Ethereum’s price stability and long-term growth. As volatility continues in the digital asset market, further acquisitions by large holders like BitMine may impact both short- and long-term valuations of Ether. Market participants are monitoring whether BitMine will accelerate its treasury targets in coming quarters and how this will affect broader institutional sentiment around cryptocurrency investments.

Sources:

Cointelegraph