Satoshi Nakamoto Bitcoin Holdings Drop $20B After Price Crash

Background on Satoshi Nakamoto’s Bitcoin Holdings

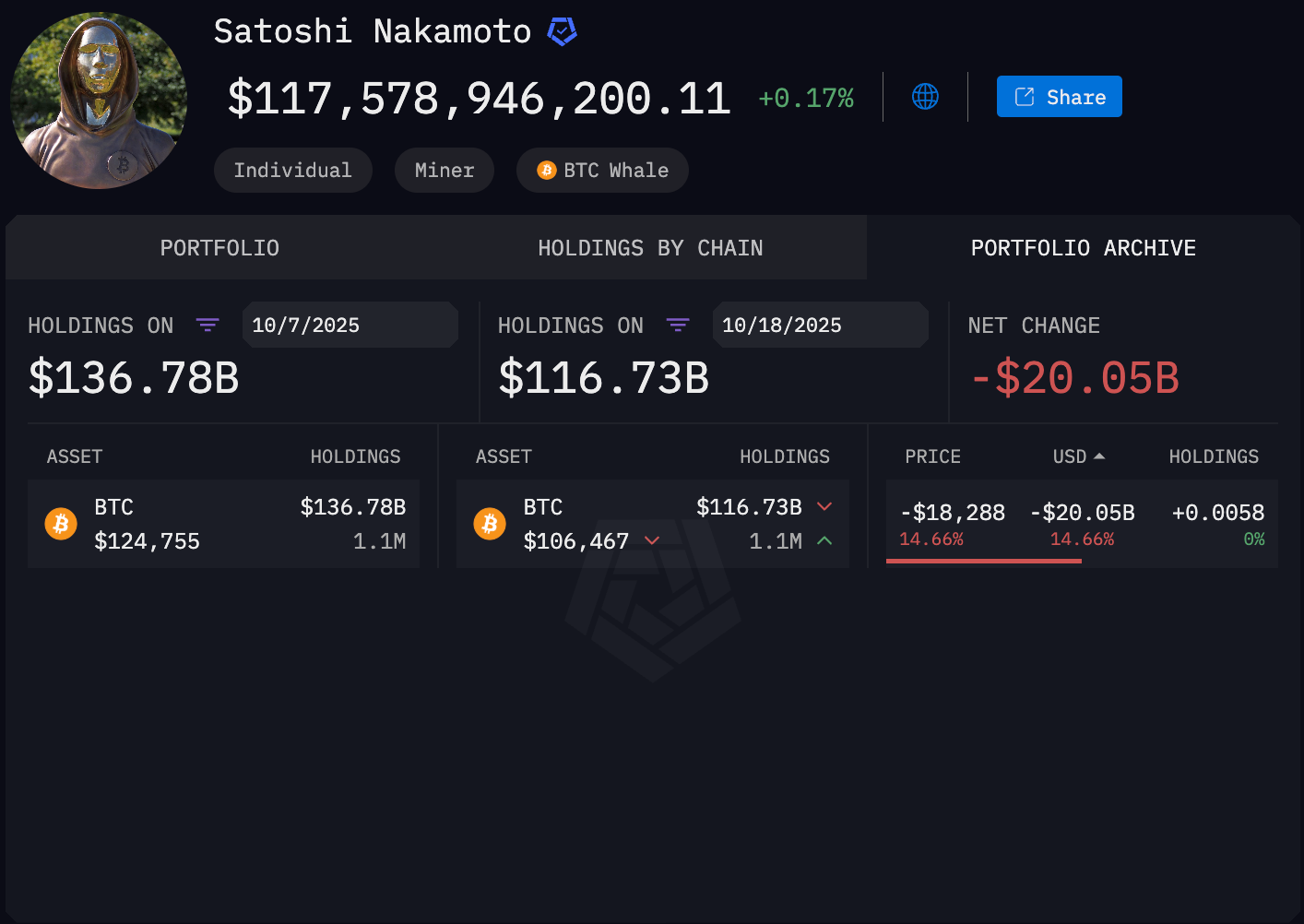

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, remains the largest holder of the cryptocurrency. As of early October, Nakamoto’s wallets reportedly contain over 1 million BTC, with a total value exceeding $117.5 billion according to Arkham Intelligence data. During Bitcoin’s surge to new all-time highs—topping $126,000 in early October—Nakamoto’s Bitcoin holdings briefly soared above $136 billion.

Market Crash Triggers Major Losses

The value of Satoshi Nakamoto’s Bitcoin holdings fell sharply after crypto markets experienced significant volatility on October 8. This downturn was triggered by a post from US President Donald Trump, who announced plans for increased tariffs on China, fueling concerns about a renewed trade war. The resulting uncertainty set off a cascade of liquidations in the perpetual futures market, resulting in the worst 24-hour liquidation event in crypto history with $20 billion wiped out across the market.

While Bitcoin’s price suffered a substantial decline, it managed to stay above the $100,000 mark, demonstrating resilience amid the turbulence. Other cryptocurrencies, particularly altcoins, faced even steeper losses, with some losing over 99% of their value. Reporting via Cointelegraph.

Analyst Perspectives and Market Factors

Investment analysts at The Kobeissi Letter offered their perspective on the recent market events. They attribute the meltdown to several technical factors, including excessive leverage, limited market liquidity, and the influence of major geopolitical headlines, such as Trump’s tariff announcement. “The market crash does not have long-term fundamental implications,” The Kobeissi Letter stated, emphasizing their belief in the strength and resilience of Bitcoin and the broader crypto market.

The Kobeissi Letter also commented that Bitcoin’s all-time high took place during a period when the US dollar was experiencing its weakest performance since 1973, suggesting a broader macroeconomic shift. They noted, “Risk-on asset prices are rising along with store-of-value assets like gold and BTC, which is highly unusual.” This leads them to maintain a bullish outlook for the cryptocurrency sector.

What’s Next for Bitcoin and Crypto Markets

Despite the sharp drop in the value of Satoshi Nakamoto’s Bitcoin holdings, analysts expect the correction to be short-lived. They highlight that structural factors like market liquidity and leverage can amplify movements but do not overwrite the longer-term positive fundamentals underpinning Bitcoin and other cryptocurrencies. Furthermore, expectations of a potential trade agreement between the US and China could ease market anxieties and restore stability.

For ongoing developments in the cryptocurrency sector, see more at Vizi’s Cryptocurrency section.