Hyperliquid Whale Linked to Ex-BitForex CEO Garrett Jin

Onchain Investigator Connects Hyperliquid Whale to Garrett Jin

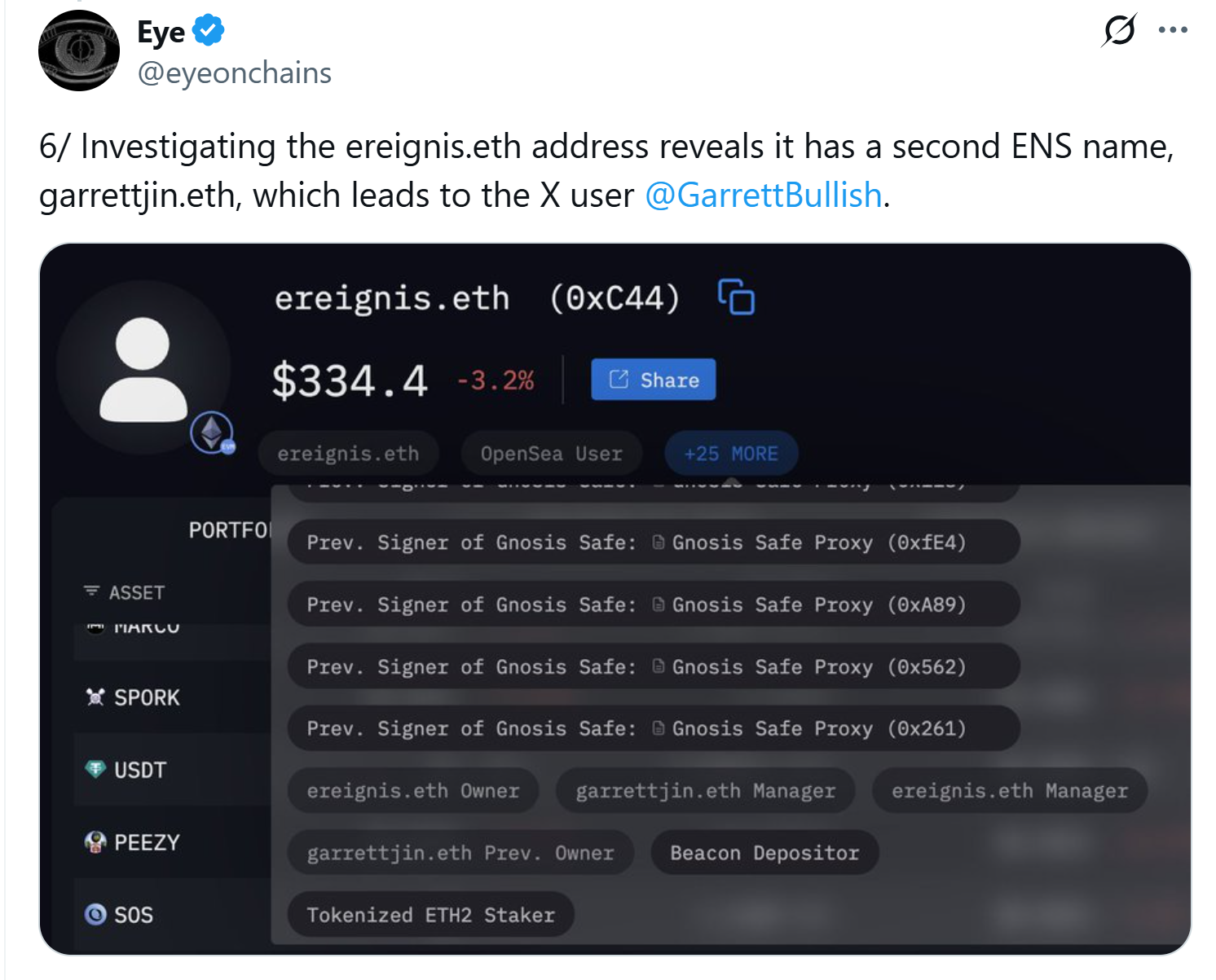

An onchain investigation by crypto researcher Eye has linked the mysterious Hyperliquid whale, who controls over 100,000 BTC, to Garrett Jin, former CEO of BitForex. BitForex is a now-defunct cryptocurrency exchange implicated in a major fraud scandal. Reporting via Cointelegraph, the onchain research outlined how the whale’s main wallet, known as ereignis.eth, was connected to another Ethereum Name Service (ENS) name, garrettjin.eth. This ENS is directly associated with Jin’s verified X (formerly Twitter) account, @GarrettBullish.

Wallet Analysis Uncovers Significant Links

According to Eye’s findings, the ereignis.eth wallet’s activities matched Garrett Jin’s known business transactions, including transfers to staking contracts and addresses that had been funded by exchanges Jin previously worked with, such as Huobi (renamed HTX). Investigator Eye stated, “The ENS name ereignis.eth (‘event’ in German) confirms his link to this wallet, identifying him as the actor behind the large-scale operations on Hyperliquid/Hyperunit,” via X.

Further analysis showed the wallet received and sent funds traced back to BitForex-related addresses as well as to Binance accounts. These transactions detailed substantial market operations, including a notable $735 million Bitcoin (BTC) short position. The pattern of wallet activity reflects significant connections with Jin’s business dealings and former exchange associations, amplifying the scrutiny around the Hyperliquid whale’s market activity.

Background: BitForex Collapse and Subsequent Ventures

Garrett Jin led BitForex from 2017 to 2020, during which the exchange faced accusations of falsifying trading volumes. Additionally, Japan’s Financial Services Agency flagged BitForex for operating without registration. In 2024, BitForex suffered a loss of $57 million from its hot wallets, leading to frozen withdrawals and a complete shutdown, following the detention of its team in China. The Hong Kong Securities and Futures Commission later issued a warning for suspected fraud, and many users claimed millions in unrecovered funds.

After the closure of BitForex, Jin launched further ventures like WaveLabs VC (2020), TanglePay (2021), IotaBee (2022), and GroupFi (2023), most of which became inactive. In 2024, Jin established XHash.com, an institutional Ethereum staking platform. Investigators allege that XHash.com may have been used to onboard questionable funds. Following these allegations, Jin reportedly removed references to XHash from his social media, although mentions remained on his Telegram account.

For broader context on digital asset security and market practices, visit the Vizi cryptocurrency section.

Market Reaction and Ongoing Investigation

The claims linking the Hyperliquid whale to the former BitForex CEO have generated skepticism in the crypto community. Analyst Quinten François questioned the straightforwardness of the evidence, stating on X, “Why would you have an .eth name leading to your X handle in a wallet that directly connects to market manipulation wallets and wallets for other crime?…sounds way too simple to be true.” While speculation continues, the onchain ties and wallet activities remain under examination as authorities and analysts seek further clarity on the Hyperliquid whale BitForex CEO connection.

As of now, no formal charges have been publicly announced regarding Jin’s alleged involvement with the Hyperliquid whale’s operations.

What’s Next for Crypto Oversight?

This high-profile linkage between the Hyperliquid whale and a prominent exchange executive underscores ongoing concerns over transparency and accountability in the crypto market. Regulatory agencies across multiple jurisdictions continue to increase their scrutiny of major digital asset players. The evolving situation emphasizes the importance of enhanced due diligence and onchain analytics in safeguarding crypto markets from fraudulent practices.

For updated news and further developments on crypto investigations, monitor reputable industry sources and regulatory bulletins.

Sources: