Germany Bitcoin Recognition Motion Urges MiCA Exemptions

Background on Germany’s Bitcoin Recognition Motion

The German parliament is preparing to review a parliamentary motion that highlights the distinct role of Bitcoin. Submitted by the main opposition party, Alternative for Germany (AfD), the motion calls for Bitcoin to be recognized as a unique, decentralized digital asset and urges the government to adopt a strategic approach to its regulation.

The motion was filed with the Bundestag on Thursday and challenges the inclusion of Bitcoin under the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework. The AfD contends that Bitcoin, due to its decentralized structure, is fundamentally different from other digital assets and should not be subject to the same overregulation.

Arguments Against MiCA Overreach

According to the parliamentary motion, the overregulation of Bitcoin via national MiCA implementation “jeopardizes Germany’s innovative capacity, financial freedom, and digital sovereignty,” citing concerns that excessive regulatory measures could stifle technological advancement and economic opportunity for German citizens and businesses.

The AfD further stated that while the current tax policy for Bitcoin in Germany is “fundamentally positive,” ongoing legal uncertainties continue to deter private, long-term investments in the asset. The party advocates for maintaining the 12-month holding period for tax-exempt gains and preserving Bitcoin’s VAT exemption. Additionally, the motion emphasizes the importance of protecting the right to self-custody, allowing individuals greater control over their holdings.

European Context and Market Reaction

If adopted, the motion would position Germany alongside other EU nations considering the recognition of Bitcoin as a strategic reserve asset while relaxing MiCA regulations. Recently, Éric Ciotti of France’s Union of the Right for the Republic proposed a similar measure aimed at easing MiCA rules for Bitcoin and stablecoins while opposing central bank digital currencies.

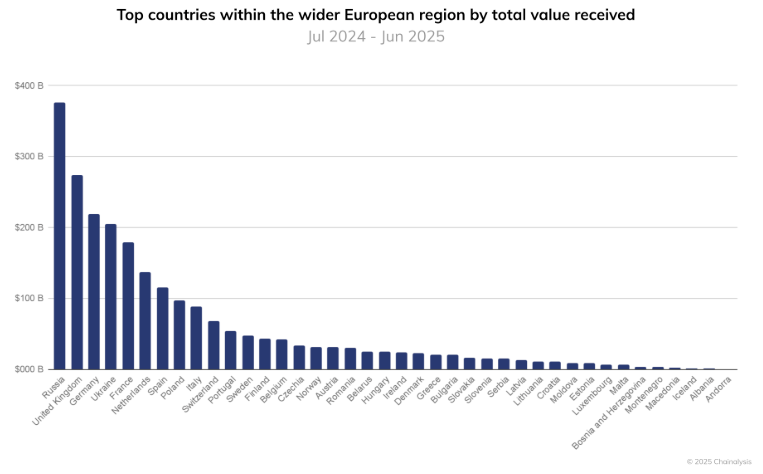

Despite concerns about overregulation, industry reports provide a nuanced perspective. The Europe crypto adoption report by Chainalysis ranked Germany as the third-largest recipient of crypto value in Europe, indicating robust activity and interest, while also suggesting that the MiCA framework—complete by the end of 2024—may help Germany remain attractive for crypto-focused companies. “Reporting via Cointelegraph.”

What’s Next for Bitcoin Regulation in Germany?

The motion’s review in parliament will determine whether Germany opts for a differentiated regulatory stance on Bitcoin, possibly influencing its tax treatment, user rights, and broader role as a potential national reserve asset. The discussion highlights ongoing debates among policymakers regarding the optimal balance between innovation, security, and regulatory oversight in the evolving cryptocurrency landscape.

For further coverage on cryptocurrency policy and regulation, visit Vizi Cryptocurrency News.

Sources: Cointelegraph