Bitcoin whale short position: $235M leveraged bet signals caution

Background: Whale investor returns with major Bitcoin short

A prominent $11 billion Bitcoin whale has re-entered the spotlight by executing a significant leveraged short position, betting on further declines in the cryptocurrency market. The investor placed a $235 million short position on Bitcoin using 10-times leverage on Monday, at a time when Bitcoin was trading near $111,190, according to a report by Cointelegraph.

This move comes as investors face global uncertainties, including tariff concerns and the ongoing US government shutdown. Blockchain tracking by Hypurrscan revealed that the whale’s position is currently at a $2.6 million unrealized loss and would be liquidated if Bitcoin exceeds a price of $112,368.

Market reaction and previous whale trades

The whale’s activity follows a previous, successful short trade last week that reportedly netted around $200 million in profit after a substantial crypto market downturn. According to data posted by Arkham on X, “The whale who made $200M shorting the Bitcoin crash to $100K has now moved $30M to Hyperliquid and is shorting AGAIN.” The whale also transferred approximately $540 million worth of Bitcoin to fresh wallets in recent days, including $220 million routed to major exchange Coinbase.

Large Bitcoin holders, often called “whales,” have exerted increasing influence over recent price action. Data cited by analyst Willy Woo suggests that extensive selling by previously dormant whales helped cap Bitcoin’s performance in August.

Notably, this whale’s profile rose two months ago when they shifted about $5 billion from BTC into Ether, momentarily becoming the largest non-corporate ETH holder after surpassing Sharplink’s holdings in early September.

Market impact: Losses, leverage, and future outlook

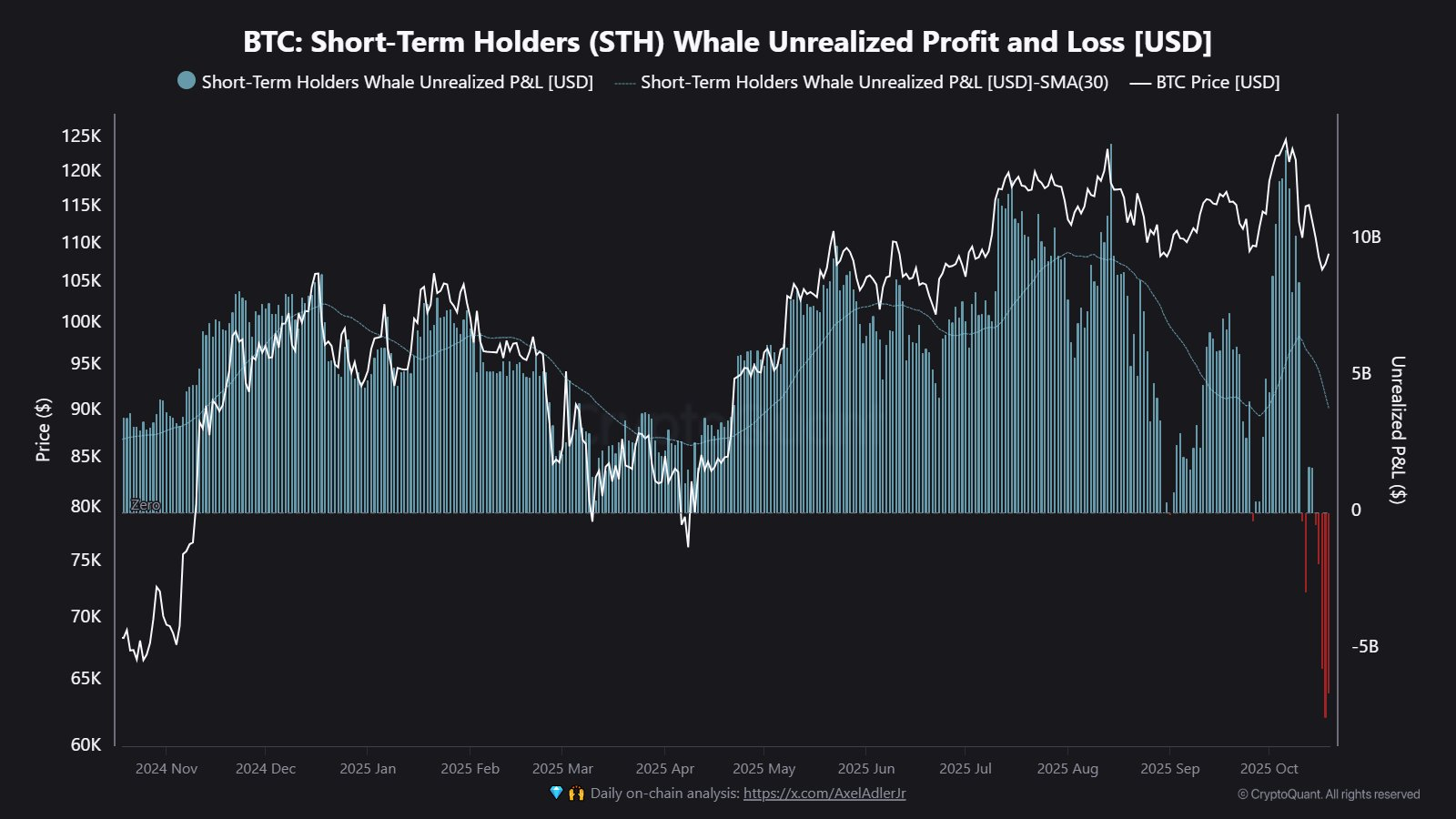

The whale’s short position has amplified concerns about downside risk in cryptocurrency markets. Leveraged trading, while potentially lucrative, increases exposure to rapid losses and volatility. As highlighted in Cointelegraph’s reporting, Bitcoin is now trading below its average cost basis of around $113,000, resulting in unrealized losses of nearly $6.95 billion for large, new Bitcoin holders. CryptoQuant noted that this represents “the largest since Oct 2023,” with whales holding about 45% of overall realized capital.

Despite recent sharp declines that saw Bitcoin fall to $104,000 over a four-day span, some analysts interpret the retreat as a market correction, helping reduce excessive leverage. Glassnode’s Tuesday report observed that the proportion of Bitcoin supply held by short-term holders has risen, signaling increased speculative capital’s influence on price dynamics.

As the current macroeconomic and regulatory climate continues to affect investor confidence, the actions of major Bitcoin whales will likely remain a key factor influencing broader crypto sentiment in the near term.

What’s next for large Bitcoin investors?

Analysts are monitoring whether further large-scale selling or shorting by whales will lead to additional market pressure, or if recent corrections are sufficient to stabilize prices. The movement of substantial crypto holdings into exchange wallets and the continued use of leverage suggest ongoing caution and hedging strategies among institutional participants.

Market watchers will be focused on developments related to both regulatory outlooks and macroeconomic policy shifts as determinants of Bitcoin’s short-term and long-term trajectory.

Sources:

Cointelegraph