Bitcoin Price Prediction: Hoskinson Sees $250K by 2026

Background

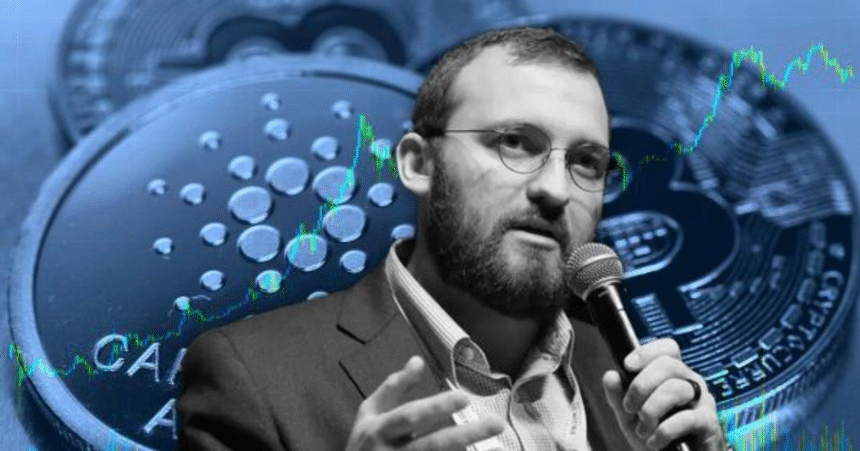

Bitcoin price prediction 2026 is gaining attention following recent statements from industry leaders. Despite lingering uncertainty in the U.S. regulatory environment, Bitcoin (BTC) began October with upward momentum and continues to attract bullish forecasts from market participants. Among the notable voices is Charles Hoskinson, founder of Cardano (ADA), who shared his outlook in an interview with Bloomberg.

Hoskinson predicts that Bitcoin could surge to $250,000 by June or July of 2026. At Bitcoin’s current price near $120,000, this represents an approximate 108% increase. His forecast joins a range of speculative targets, with other projections for $150,000 and $200,000 circulating within the crypto community. Reporting via Crypto News.

Factors Behind the Bitcoin Price Prediction

According to Hoskinson, one key driver behind his Bitcoin price prediction for 2026 is the prospect of greater regulatory clarity in the U.S. crypto market. He specifically referenced the proposed CLARITY Act, which aims to define regulatory responsibilities and establish a clearer framework for cryptocurrency oversight. Hoskinson stated, “If the CLARITY Act were to pass, it would lead to a larger wave of institutional adoption and boost the price of Bitcoin” (Bloomberg interview via Crypto News).

The CLARITY Act is designed to address uncertainties and provide a defined structure for market participants, specifying which bodies will regulate different aspects of the industry. Hoskinson believes this clarity will attract increased demand for Bitcoin and digital assets. He further remarked that, following such legal developments, “more and more companies will add Bitcoin to their balance sheets as part of their digital asset treasury (DAT) strategy.”

Market Reaction and Outlook

Hoskinson’s forecast aligns with broader market sentiments anticipating increased institutional adoption of cryptocurrencies. He noted that new legislation, combined with corporate engagement through bitcoin holdings, would likely contribute to reaching the $250,000 target by mid-2026. While the actual price trajectory will depend on evolving regulatory decisions and institutional behavior, the conversation itself underscores ongoing optimism around Bitcoin’s role in the financial system.

As Bitcoin continues to draw attention from both retail and professional investors, forecasts such as Hoskinson’s highlight the potential impacts of legal and corporate developments on long-term price movements. Stakeholders in the cryptocurrency sector continue to monitor both regulatory proposals and the adoption trends of major companies for signs that could support these bullish outlooks.

What’s Next?

The future of Bitcoin’s price will depend on various factors, including the fate of the CLARITY Act and ongoing institutional interest. Market observers are likely to follow legislative progress in Washington and assess how potential regulatory clarity influences investment activity and corporate participation in the crypto space. For the latest updates on major trends in digital assets, visit our cryptocurrency news section.

Note: This article does not constitute investment advice!