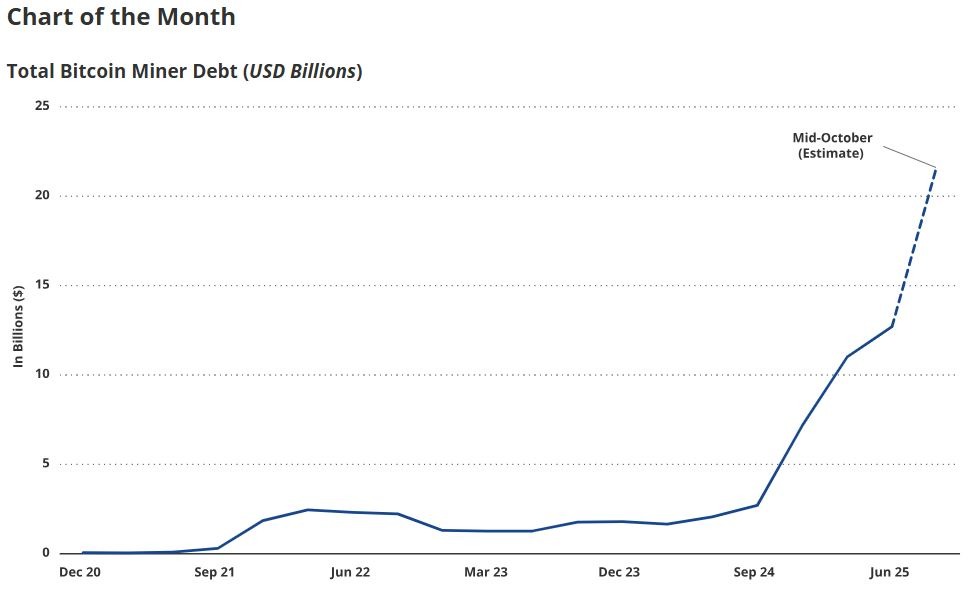

Bitcoin miner debt growth hits $12.7B amid AI expansion

Background: Rising Bitcoin miner debt and industry transformation

Bitcoin miner debt has increased sharply, reaching $12.7 billion over the past year, according to investment firm VanEck. This jump from $2.1 billion comes as miners seek to upgrade equipment and position themselves within emerging markets for artificial intelligence (AI) and high-performance computing (HPC). VanEck’s Nathan Frankovitz and Matthew Sigel noted that continued investments are required to maintain or improve a miner’s share of the global hashrate, crucial for securing daily Bitcoin (BTC) rewards.

“Miners’ revenues are difficult to underwrite as they rely almost entirely on the price of Bitcoin, which is speculative. Importantly, equity tends to be a more expensive form of capital than debt,” said Frankovitz and Sigel in VanEck’s October Bitcoin ChainCheck report, Reporting via Cointelegraph.

Market reaction: Funding strategies and AI shift

The drive to secure advanced mining machines and diversify income streams is leading miners to expand into AI and HPC hosting. Following the April 2024 halving event, which reduced mining rewards to 3.125 Bitcoin per block, miners have faced compressed profitability. Industry data from The Miner Mag showed combined debt and convertible-note deals from 15 public miners reached $4.6 billion in Q4 2024, dropped to $200 million at the start of 2025, and rose to $1.5 billion in Q2 2025.

Several major mining firms have secured significant funding for expansion. In October, Bitfarms finalized a $588 million convertible note offering for HPC and AI infrastructure projects in North America. Similarly, TeraWulf launched a $3.2 billion senior secured notes offering to facilitate data center growth in New York. IREN also closed a $1 billion convertible note deal in October for general corporate purposes and working capital.

Many miners now utilize excess energy to host AI and HPC operations, locking in “more predictable cash flows backed by multi-year contracts,” Frankovitz and Sigel stated. This approach allows companies to balance volatile mining income with the stability of tech service contracts.

What’s next: Diversification and network security

As competition increases and mining rewards fall, diversifying revenue is becoming essential for sustainability. Despite this strategic pivot, industry analysts believe the Bitcoin network’s security remains robust. “AI’s priority for electrons is a net benefit to Bitcoin,” Frankovitz and Sigel wrote, suggesting that energy demand from AI and HPC will not undermine Bitcoin’s network strength.

Miners are also seeking ways to monetize surplus electrical capacity during low AI demand periods. This could reduce or eliminate the need for costly backup power generation, such as diesel generators, improving operational efficiency. The shift shows that miners are adapting to the post-halving landscape and leveraging emerging tech markets to maintain financial stability.

As the sector evolves, ongoing investment and innovation are likely, with Bitcoin miner debt growth underpinning these transformations.

For more on cryptocurrency industry trends, visit Vizi’s cryptocurrency section.