American Bitcoin Adds $163M in BTC, Lifting Treasury Above $445M

Background: American Bitcoin Expands Holdings

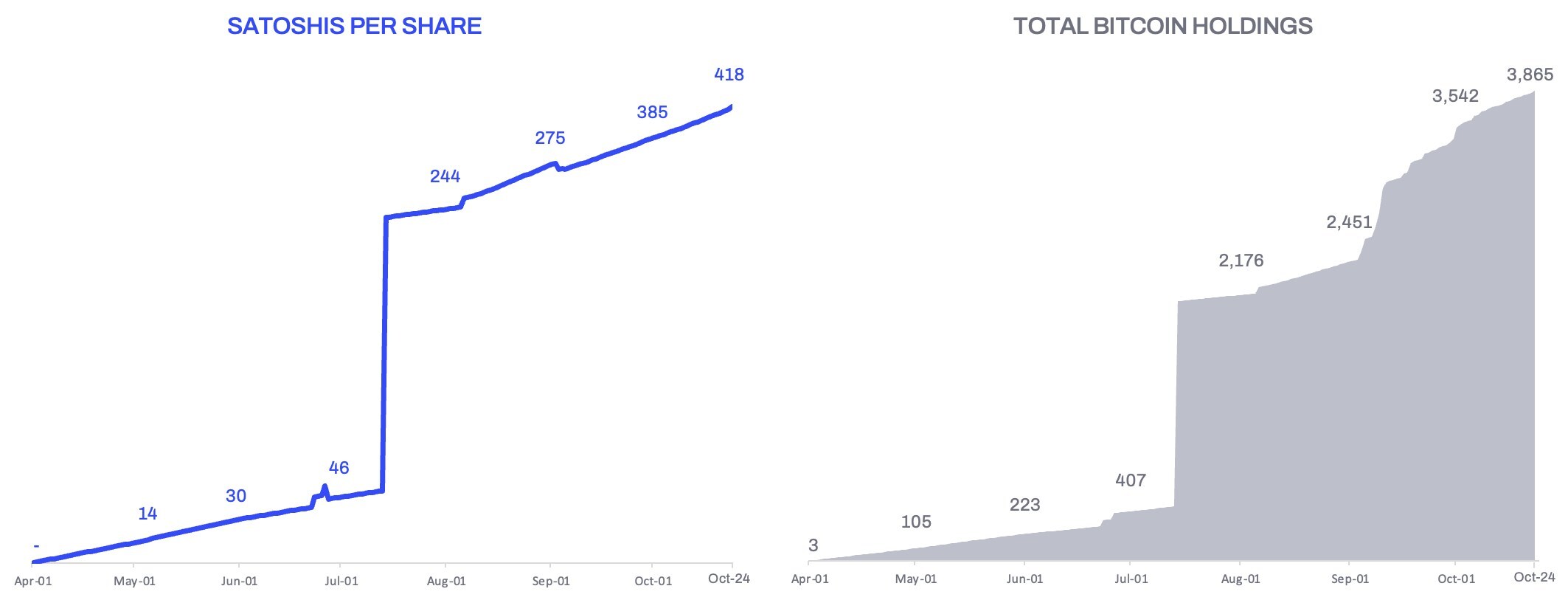

American Bitcoin, a mining and treasury company co-founded by Eric Trump and Donald Trump Jr., has increased its cryptocurrency reserves by acquiring 1,414 Bitcoin (BTC) for approximately $163 million. This transaction, announced Monday, raises the firm’s total Bitcoin holdings to 3,865 BTC, valued at almost $445 million, according to reporting via Cointelegraph.

Eric Trump, serving as chief strategy officer, emphasized the company’s strategy to grow its Bitcoin-per-share ratio. “We believe one of the most important measures of success for a Bitcoin accumulation platform is how much Bitcoin backs each share,” he said, as cited by Cointelegraph.

Company Developments and Public Listing

American Bitcoin emerged in March after mining firm Hut 8 secured a majority stake by exchanging its Bitcoin mining hardware. The company subsequently merged with Gryphon Digital Mining, a move approved by shareholders in late August, which facilitated American Bitcoin’s entrance on the Nasdaq stock exchange. The company trades under the ticker symbol “ABTC” while maintaining its brand name.

American Bitcoin’s Nasdaq debut in early September witnessed significant trading activity, closing up over 16% following volatile intraday performance. Trading in American Bitcoin shares was halted five times due to heightened price swings, including an 85% spike at one point during the first day. The listing came after Gryphon’s stock surged 230% in anticipation of the merger’s completion.

For more on cryptocurrency-listed companies, see the Vizi.com Cryptocurrency section.

Political Context and Market Scrutiny

American Bitcoin’s rapid expansion has drawn increased attention, partly because of the Trump family’s involvement in digital assets. The company’s latest Bitcoin purchase follows a period of public and political scrutiny centered around former President Trump’s broader engagement with cryptocurrencies both as an investor and policymaker.

Notably, Trump’s recent pardon of Binance founder Changpeng “CZ” Zhao, who had pleaded guilty to breaching U.S. Anti-Money Laundering laws, further fueled criticism. Democratic Representative Maxine Waters labeled the pardon as “an appalling but unsurprising reflection of his presidency,” and alleged that Trump was “doing massive favors for crypto criminals,” with additional charges of corruption and profit-seeking from the presidency, according to Cointelegraph.

Reports indicate Trump’s personal wealth has seen substantial growth in his recent term, with the Trump family openly discussing substantial gains from digital asset ventures. Eric Trump recently told supporters that family profits from digital asset investments were likely “more” than the reported $1 billion.

What’s Next for American Bitcoin?

With the acquisition of over $163 million in Bitcoin, American Bitcoin continues to reinforce its presence among publicly traded cryptocurrency companies. The company’s emphasis on BTC-per-share as a primary metric, the successful Nasdaq listing, and further scrutiny highlight a period of significant transition and opportunity for both the business and the broader crypto market.

The impact of political engagement and regulatory scrutiny on American Bitcoin’s future operations remains to be seen, as the intersection of politics and digital assets grows increasingly complex.