Kazakhstan CBDC and Stablecoin Strategy Advances

Background: Piloting CBDC and Stablecoins

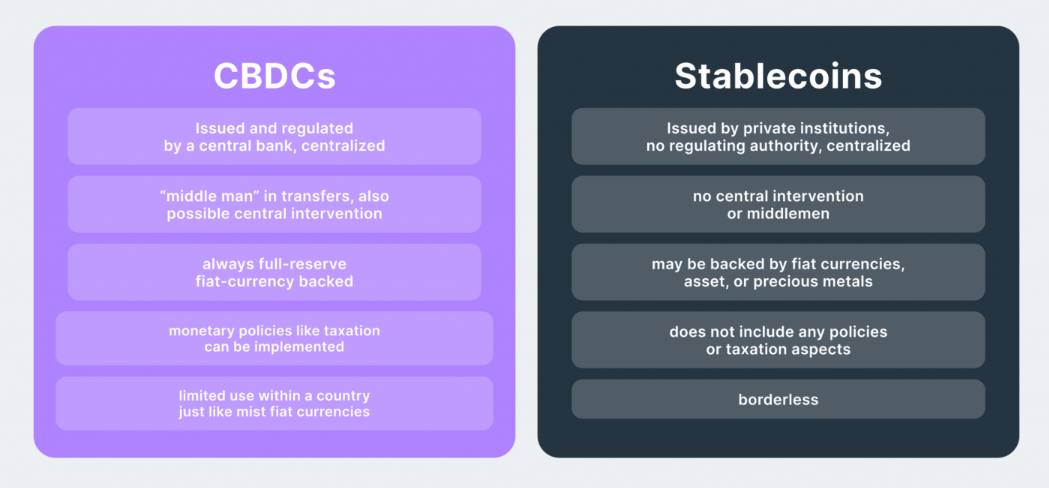

Kazakhstan has taken significant steps in the rapidly growing digital assets sector, piloting both a central bank digital currency (CBDC) and a state-backed stablecoin. The National Bank of Kazakhstan introduced the Evo stablecoin in September 2023 through a partnership with blockchain network Solana and Mastercard, creating one of the first cases of a state-supported stablecoin. Alongside this, the digital tenge, the country’s CBDC, continues its pilot phase following its launch in 2023, with ongoing integration of new participants and platform projects.

Berik Sholpankulov, deputy governor of the National Bank, stated that the initiatives—the Evo stablecoin and the digital tenge—are viewed not as competitive but as complementary. “We see not competition, but rather opportunities for integration and interoperability,” Sholpankulov told Cointelegraph. Lawmakers are active in efforts to designate the digital tenge as legal tender, offering it the same legal status as the fiat currency.

Different Roles: Evo Stablecoin and Digital Tenge

Sholpankulov emphasized the distinct purposes of Kazakhstan’s CBDC and its stablecoin. The digital tenge, issued by the central bank, is positioned to become legal tender for public and interbank transactions. In contrast, the privately-issued Evo stablecoin is designed for specific ecosystems, with usage based on participant networks.

The regulatory framework for the digital tenge is being finalized. Once completed, the CBDC will enter wider circulation as an official payment method, also serving as a platform for fintech and tech companies to build new solutions outside traditional banking institutions. According to Sholpankulov, “The digital tenge will enter circulation as a means of payment and as a guarantor on behalf of the national bank” (Cointelegraph).

Talgat Dossanov, Intebix exchange founder and issuer of the Evo stablecoin with Eurasian Bank, agreed that the digital tenge and Evo stablecoin are complementary. He noted, “The digital tenge strengthens the role of the central bank and the country’s financial sovereignty, while the stablecoin accelerates integration into the global crypto market,” reporting via Cointelegraph.

Market Reactions and Regional Impact

Kazakhstan’s strategy for CBDC and stablecoin development aligns with its efforts to become Central Asia’s primary cryptocurrency hub. The country has allowed regulatory fees in stablecoins such as USDT and pioneered one of the region’s first spot Bitcoin funds. Kazakhstan also maintains close connections with international exchanges like Binance, and in September 2023, it approved a fund giving investors exposure to Binance Coin (BNB).

High-level meetings reinforce these ambitions. On Thursday, central bank chairman Timur Suleimenov met with former Binance CEO Changpeng Zhao to discuss the launch of a new KZTx stablecoin and future blockchain projects. Meanwhile, Telegram co-founder Pavel Durov met with President Kassym-Jomart Tokayev to announce the development of an artificial intelligence research lab in Astana.

What’s Next for Kazakhstan’s Digital Asset Policy?

Kazakhstan continues to strengthen its digital asset policies, focusing both on retaining control of the national payments system and fostering innovation through state-backed and private initiatives. Officials maintain that CBDCs are vital tools for emerging markets to protect financial sovereignty and reduce foreign currency dependence. “For Kazakhstan, the main objective of the digital tenge as a CBDC is ensuring the independence and sovereignty of the national payment infrastructure,” Sholpankulov stated.

Looking ahead, full legislative backing for the digital tenge and further collaboration on stablecoin initiatives could position Kazakhstan as a leader in regional cryptocurrency adoption and regulatory innovation. For more on digital assets, visit the cryptocurrency section on Vizi.com.