Holds the Majority of ETH?

Approximately 70% of all ETH is concentrated in just 10 addresses; however, the majority of these belong to staking contracts, exchanges, or funds rather than individual whales.

Almost half of all ETH is held in a single smart contract: the Beacon Deposit Contract, which supports Ethereum’s proof-of-stake system.

Major institutions like BlackRock, Fidelity, and publicly listed companies now possess millions of ETH, transforming Ether into a significant treasury asset.

ETH ownership has evolved since the days of early adopters. Today, the focus is on the platforms and services constructed on top of it.

As of August 2025, on-chain data reveals that the top 10 Ether (ETH) holders control roughly 83.9 million ETH (around 70% of the overall circulating supply).

Consequently, the community has raised the question: who truly possesses the majority of ETH? The answer indicates that protocol-level smart contracts, major exchanges, exchange-traded fund (ETF) trusts, and even public companies play a significant role.

This article delves into the Ether rich list of 2025, covering entities from the Beacon staking contract and Coinbase’s hot wallets to BlackRock’s ETHA trust and Vitalik Buterin’s notable holdings.

As of mid‑2025, Ether’s circulating supply is approximately 120.71 million ETH. Following the Pectra upgrade in May, issuance has stabilized around net zero, providing context for understanding Ether ownership distribution.

The top 10 Ether addresses have been shown to hold 83.9 million ETH as of August 4, 2025, which is roughly 70% of the total supply.

Expanding the lens, the top 200 wallets comprise over 52%, holding more than 62.76 million ETH (most of these assets are linked to staking contracts, exchange liquidity, token bridges, or custodial funds). Unlike dormant Bitcoin whale addresses, these Ether whale addresses are actively utilized infrastructure, showcasing ETH’s capability to effectively fuel staking, decentralized finance (DeFi), and institutional functions.

As of August 4, 2025, the Beacon Deposit Contract is reported to hold roughly 65.88 million ETH, which accounts for about 54.58% of the total circulating supply of 120.71 million ETH.

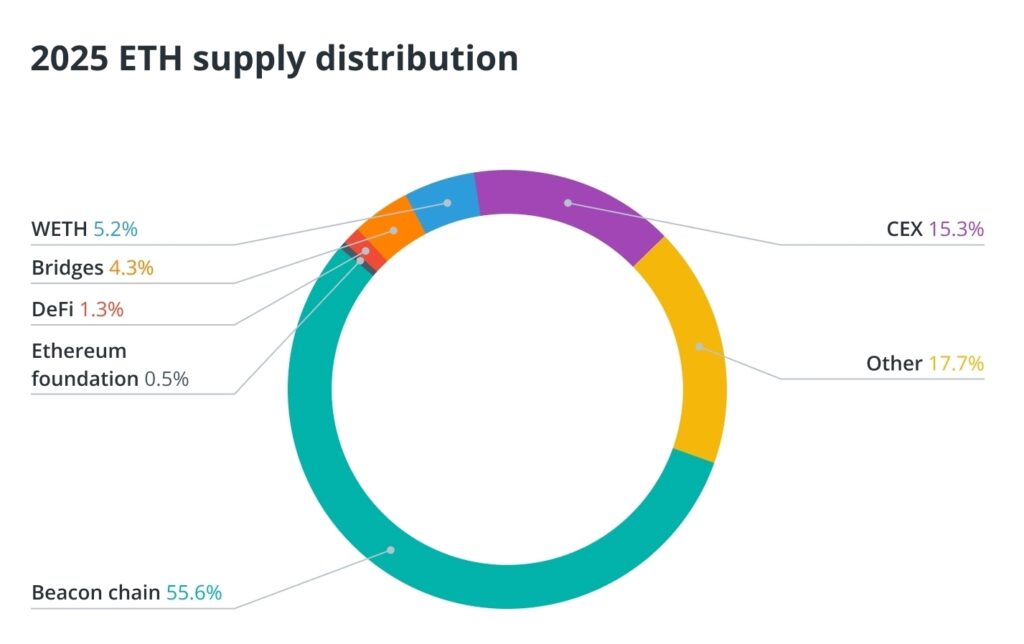

These statistics are generally aligned with reports from March 2025, which estimated the share to be around 55.6% (see figure below).

This smart contract serves as the entry point for Ethereum validators, each of whom must deposit a minimum of 32 ETH to engage in securing the network.

Even after withdrawal functionality was introduced in 2023, funds are not instantly liquid. Validators must exit the active set, wait approximately 27 hours for the unbonding period, and then depend on a protocol-controlled sweep to release ETH.

This makes the Beacon contract the largest ETH holder—not an individual, but the network itself. With slashing penalties and structured exits, it guarantees validator accountability. Nevertheless, some critics argue that concentrating a significant portion of the supply in one contract poses systemic risks in the case of coordinated exits or protocol-level issues.

The Wrapped Ether (WETH) Smart Contract

Did you know? The Wrapped Ether (WETH) smart contract also ranks as one of the largest ETH holders, currently holding over 2.26 million ETH (around 1.87% of the circulating supply).

Top Exchanges and Custodians

As of August 22, 2025, the following exchanges and custodians are among the largest ETH holders:

- These addresses represent a crucial layer of active infrastructure where Ether is utilized to support exchange liquidity, staking derivatives like cbETH, and asset bridging across chains.

As of late July 2025, BlackRock’s iShares Ethereum Trust (ETHA) has facilitated a significant shift in institutional ETH ownership. With $9.74 billion in net inflows, ETHA now (August 2025) holds over 3 million ETH (approximately 2.5% of the total supply), positioning it as one of the largest ETH wallets of 2025.

Grayscale’s ETHE continues to be a significant factor, managing 1.13 million ETH. Fidelity’s Ethereum Fund (FETH), launched in 2024, has gathered $1.4 billion in inflows, while Bitwise is transitioning from Bitcoin-only strategies to ETH-based mandates with staking features.

Together, these institutions now command over 5 million ETH (4.4% of supply), thereby reshaping the landscape of ETH holding patterns. They symbolize a new class of DeFi millionaires who are regulated, ETF-oriented, and staking-savvy.

Public Companies Treating ETH as Treasury Asset

A growing number of public companies are adopting a strategy akin to Strategy’s Bitcoin (BTC) plan (but with staking) to treat ETH as a treasury asset. Examples include, but are not limited to:

- Bitmine Immersion Technologies (NYSE: BMNR) holds over 776,000 ETH (approximately $2 billion), funded by a $250-million PIPE round.

- SharpLink Gaming (Nasdaq: SBET) has amassed roughly 480,000 ETH ($1.65 billion) since June.

- Bit Digital (Nasdaq: BTBT) holds around 120,000 ETH, having shifted from Bitcoin following an equity raise.

- BTCS (Nasdaq: BTCS) reports approximately 70,028 ETH (around $275 million), financed by convertible notes.

Most of this ETH is actively staked, earning around 3%-5% APY. These firms cite Ethereum’s programmability, stablecoin ecosystem, and regulatory clarity (like the GENIUS Act) as the foundation for their ETH strategies.

This new list of ETH billionaires comprises not only individuals but also corporate treasuries betting on Ether’s long-term value.

Notable Individual ETH Holders

While smart contracts and institutions prevail in the Ethereum rich list of 2025, a few individuals remain prominent as major ETH holders.

Vitalik Buterin, co-founder of Ethereum, is broadly believed to possess between 250,000 and 280,000 ETH (around $950 million), mostly distributed across a select few non-custodial wallets, including the notable VB3 address.

Rain Lõhmus, co-founder of LHV Bank, acquired 250,000 ETH during the 2014 initial coin offering (ICO) but lost access to the private key. His coins remain untouched, now valued at nearly $900 million.

Cameron and Tyler Winklevoss, early investors and founders of Gemini, are estimated to personally control between 150,000 and 200,000 ETH, separate from Gemini’s exchange treasury of over 360,000 ETH.

Joseph Lubin, co-founder of Ethereum and head of ConsenSys, is estimated to hold roughly 500,000 ETH (around $1.2 billion), though this information has never been officially confirmed.

Did you know? As of early 2025, Etherscan data indicated over 130 million unique addresses, yet fewer than 1.3 million hold at least 1 ETH, representing less than 1% of the total. Holding a single ETH puts you in a rare category on the Ether rich list of 2025.

Tools for Identifying Top Ether Holders

Determining the top Ether holders in 2025 relies on tools such as Nansen’s Token God Mode, Dune Analytics, and Etherscan. These platforms categorize wallets by behavior and associate them with exchanges, funds, smart contracts, or individuals.

- Token God Mode clusters wallet groups to recognized entities, tracks inflows and outflows, and ranks the largest ETH wallets in 2025.

- Dune dashboards utilize schema tables like “labels.addresses” to distinguish externally owned accounts (EOAs) from smart contracts and exchanges, providing insights into public Ethereum addresses and ETH holding patterns.

- Etherscan categorizes wallets based on transaction history, attribution, or user-submitted evidence, enhancing transparency around crypto wallets. Together, these resources assist in mapping Ether ownership distribution.

However, limitations persist. Reused deposit addresses can inflate figures, cold wallets may escape clustering, and privacy techniques can obscure real control. Even the top 200 Ethereum addresses by balance are likely to include fragmented or inaccurately labeled entities. ETH address rankings provide a blend of certainty and statistical inference, lacking complete visibility.

Did you know? One of the oldest untouched ETH wallets, likely from the 2014 ICO, still retains around 250,000 ETH (around 0.2% of supply) and has not moved even a gwei in nearly a decade.

This article does not constitute investment advice or recommendations. Every investment and trading action carries risks, and readers should perform their own research before making decisions.