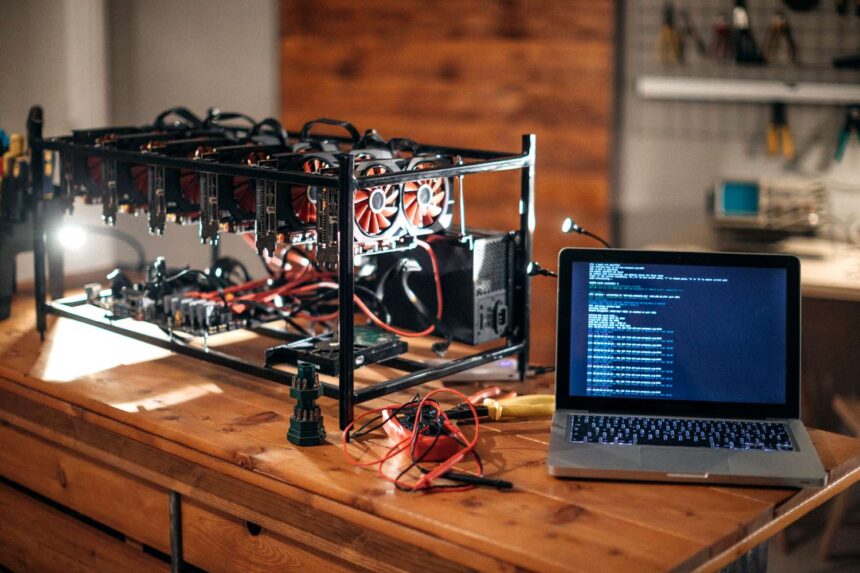

Challenges in the Bitcoin Mining Industry in 2025

Cryptocurrency analyst Joao Wedson has highlighted that the Bitcoin mining industry is confronted with growing difficulties in 2025.

Wedson noted that although BTC prices remain elevated, miners’ revenue is still significantly lower than the highs achieved in 2017 and 2021.

He emphasized that miners have had to allocate more resources toward modern equipment in response to the increasing hash rate, while on-chain transaction volumes have stayed muted since 2022. He indicated that these factors have placed additional strain on the sector.

The analyst introduced a new metric called the Mining Equilibrium Index (MEI) designed to gauge mining profitability. The MEI is computed by contrasting the 30-day average revenue/hash ratio with the 365-day average:

- Below 0.5: linked to stressful situations, capitulation, or adjustments in hash rate.

As per the latest data provided by Wedson, the current index level is at 1.06. Although this figure is comfortably above the critical threshold of 0.5, it remains considerably distant from the 2.5 peaks recorded in 2017 and 2021.

Wedson raised a pivotal question for 2025 regarding whether mining firms will manage to secure the Bitcoin network amidst intensifying competition and rising operational expenses (which include costs for employees, electricity, and infrastructure). He mentioned that miners might need to liquidate a portion of their reserves if their profitability fails to meet their expenditures.

This is not investment advice!